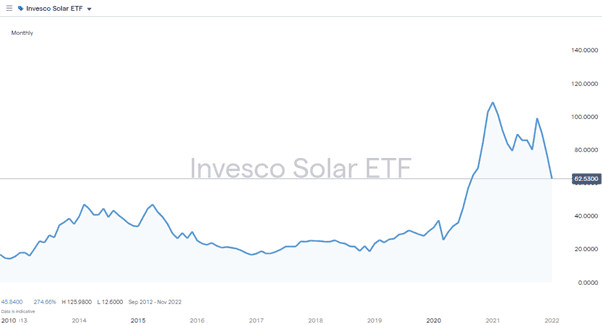

Ethical investing, backing companies and sectors which make the world a better place, has gathered so much momentum that it’s now one of the hot topics in the financial markets. One of the main reasons is that making decisions based on core principles is also good for the trading bottom line. Prices of assets in the solar, electric vehicles, carbon-free energy, and meat-free-food sectors have sky-rocketed, but as with other areas of the markets, increased returns have led to increased amounts of market abuse.

Source: IG

Regulators Clamp Down on Greenwashing

The malpractice that regulators are targeting is “Greenwashing”; which means presenting investment opportunities as being greener than they are. This results in investors being mis-sold an investment. It also diverts capital from the legitimate companies with a genuine chance of improving global welfare if they are provided with the cash to fund their investments.

The International Organization of Securities Commissions (IOSCO), which coordinates securities watchdogs from the US, Europe, Asia, and Latin America, has recently published ten recommendations for its large institutional investors to apply in day-to-day work. It’s an important step in what has to date been a largely unregulated business but one which is growing by 20% a year.

When implemented, the new regulations will ensure asset managers provide greater transparency on their decision-making process and the due diligence they carry out to ensure their investments are as ethical as they claim.

Investors should ultimately benefit from greater clarity, but it’s also almost guaranteed that the extra costs incurred by prominent money managers will be passed on to clients. The clearing up of the ethical investment sector is also not an easy task to complete. As it has grown, a range of different standards has been drawn up in an effort to provide transparency. However, it is already full of buzzwords such as ESG and CSR. There is also Fairtrade, ISO standards and Impact Investing to consider.

How to Ensure Ethical Investments Make a Difference

One way for smaller investors to swerve the confusion surrounding the sector and having to place trust in fund managers to make the best ethical stock pick is to build their own portfolio using an online broker. The increasing popularity of ethical investments means trusted brokers who are well-regulated are offering more and more markets in the sector. Whether the decision is to buy ethical stocks or sustainable ETFs, online brokers offer a cost-effective way to gain exposure to the market and keep more control of the investment process.

Crowdsourcing information about scam brokers can help others avoid falling into the traps set by disreputable brokers, and you can share your experiences here. If you want to know more about this particular topic or have been scammed by a fraudulent broker, you can also contact us at [email protected]

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2025

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #2 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #3 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #4 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #5 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #6 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox