Inflation is supposed to be bad for stocks, but despite signs that price rises could be on the way, equity indices keep rallying. As with most market divergences, there comes the point when a correction kicks in, and as inflation is the harder of the two to control, it’s often equity prices that adjust. Historical prices show that it’s just easier for investors to click ‘sell’ than it is for central banks to wrestle with getting the inflation genie back in the bottle.

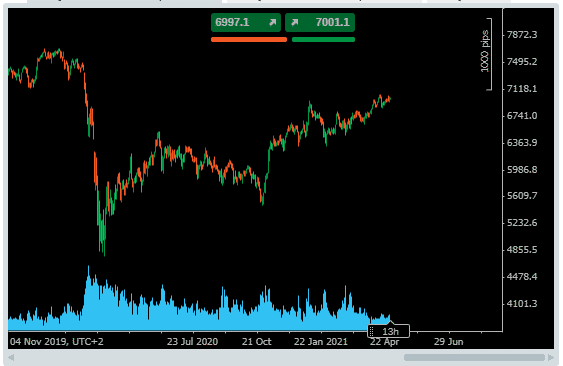

UK100 Index – Daily Chart

Source: Pepperstone

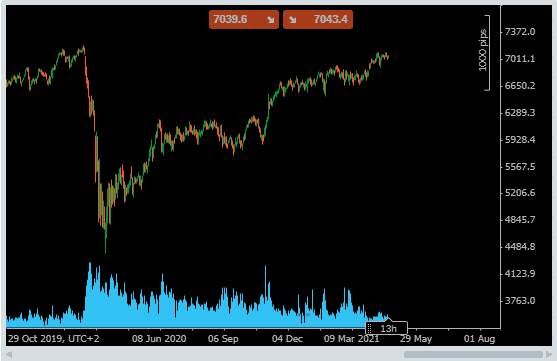

AUS200 Index – Daily Chart

Source: Pepperstone

Timing is everything, and the global stock indices have started the week showing little concern about the threat of price uncertainty and lower revenues. As the realignment could be weeks or months away, many of the bulls will still show a positive return on recent long positions, but news events later this week could offer an insight into what’s coming down the road.

Tuesday the 4th of May Market News – Reserve Bank of Australia Interest Rate Decision

Australia’s economy continues to have economic hotspots, especially the residential property market. Many eyes will be on the Trade Balance report due on the same day. An interest rate hike looks highly unlikely, but the accompanying statement may provide clues to which direction policy is heading and when.

Thursday the 6th of May Market News – Bank of England Interest Rate Decision

The Bank of England’s suggestions that negative interest rates could be on the way are firmly behind it. After sounding out market participants about them in 2020, the UK economy has defied expectations and burst out of its most recent lockdown.

UK annual growth for 2021 is now forecast to be 7%, a significant upgrade from the 5.5% prediction made in February. The Q1 data is also due to be massively adjusted.

The most likely direction for interest rate moves now appears to be upwards, and while the consensus is that this might take 12 months to occur, there are other tools open to the Bank of England, which might be discussed on Thursday.

The key data point to look out for relates to the Bank-backed open market purchases of Gilts. The Bank has bought so much government debt that the supply is drying up and the program could be scaled back. Analysts expect the weekly buying order to be scaled back from £3.8bn to £3.5bn. Predicting how the market will react to that is a tough call.

Covid is Still Hanging Over the Market – but in a good way

The global pandemic that shattered the financial markets in March 2020 is still a major driving force for stock prices, but this time it supports upward moves. There appears little chance of any significant policy shifts with a smaller third wave predicted to hit the Northern Hemisphere in the autumn/winter. The one thing central bankers fear the most is going down in the record book as flip-flopping on rates.

If you want to know more about this topic, or have been scammed by a fraudulent broker, please contact us at [email protected]

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2024

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #2 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #3 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #4 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #5 |

|

Global CFD & FX Broker |

ALL-INCLUSIVE TRADING PLATFORM

Visit broker

|

||

| #6 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #7 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox