If the foreign exchange industry is anything, it is dynamic. Spot volumes in the world’s largest market have been shrinking. Global regulators have been tightening their respective nooses with revenue restrictive assaults and blacklisting alerts. What has been the result for the first six months of 2017? News headlines have been rife with change notifications, including consolidations, staff cutbacks, office relocations to escape punitive rule changes, and mixed trading volume reports from exchanges and industry support groups. Our industry is in the midst of a major reorganization. There will be winners and losers, as risk issues sort themselves out.

For the past year or more, we have been reporting that competition has been heating up in the forex industry. The press has had a field day with the regulatory establishment, as scandals rocked the forex world. Consequently, these compliance agencies in unison have come out swinging in 2017, imposing a host of new rules and regulations, each ostensibly to protect consumers while punishing the industry bad guys. Competition for new clients is at an all time high, and, as operating margins shrink, the inevitable use of cutthroat marketing and offshore gamesmanship tactics will produce a shakeout and reshaping of our industry for decades to come.

What are the prevailing forex industry themes for 2017?

If you canvass the various forex news websites, there are three high-level themes that dominate the news flow. These storylines are often buried within the avalanche of minor news releases that pervade market channels, but for those readers that prefer a top-line view, here are the three overarching themes from our perspective:

1) Forex industry volumes are declining, as brokers fight for share.

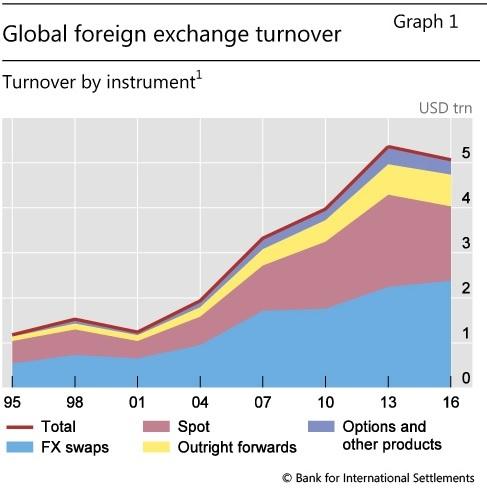

2016 concluded with dour news from the Bank for International Settlements (BIS) that Spot volumes have retreated over the past three years, since its previous review of the market in 2013. The decline may seem slight, from $5.4 trillion down to $5.1 trillion per day in turnover, but the largest decline was in the Spot market, the domain of retail forex trading. In order to put these figures into proper perspective, however, one must also understand that from 2001 through 2013, forex volumes had been compounding at a CAGR of nearly 40% a year, as depicted in the following chart:

The depicted pullback was obviously sharp and sudden, when viewed from this context. The reasons for the decline, however, are more difficult to pinpoint. International trade only accounts for a very small portion of the volume demographics. Investments and hedging currency risk account for larger volumes, while speculation takes up the slack. The latter items pertain to swaps and other products, but the fall in Spot turnover has a direct impact on the retail brokers in our arena of activity. Declining volumes bring more pressure to bear on thin margins.

When these figures were published, reporters were quick to search out more current data to assess the overall health of the industry. Various exchanges, which handle trading volumes for their respective clients, were having difficulties of their own. Their December volumes compared to a year ago and even the previous month reflected declines in the neighborhood of 10% to over 20% in some cases. The forecast for 2017 was not looking good from the get go.

What have mid-year reports in 2017 revealed? According to one recent release: “For the 12 months ending June 30th 2017, the SpotFX unit of NEX Markets marked an average of $82.6 billion daily, which is lower by 5 percent when compared to the same period ending in June last year. The number is lower by 12 percent when compared to last year, however a special factor is in play with the UK Brexit referendum sharply distorting the numbers in June 2016.”

As for individual brokerages, 2017 results have been mixed for those willing to share their results with the competition. Some groups report gains, while other, losses, as you might expect when competition is churning the customer base at the moment. It is also disturbing to note that TechFinancials, a leading provider of binary option trading platform infrastructure, has had its problems of late. Revenues for the first six months of 2017 were 39% below the same period for 2016. Regulatory attacks and negative press and publicity are cited as reasons for the poor performance.

2) Relocations and staff cutbacks are common and will continue.

How do you deal with new regulatory constraints and thinning margins? Many firms have exited stage left, only to set up shop in more welcoming and lax operating environments. Staff cutbacks are also common within this backdrop. TechFinancials has already announced staffing reductions and that senior management will receive 20% cuts in compensation. Online gaming giant William Hill plc of London made known that it will be “will be shutting its operation in Israel. More than 200 of the company’s approximately 250 Tel Aviv based employees will be laid off.”

What about relocations? TechFinancials also noted in its release that “many of the technology and R&D positions in the company have been relocated to TechFinancials’ Kiev, Ukraine office.” Leadtrade, the owner of TopOption, informed its customers and CySEC that it is shutting down, while AnyOption announced that, “We are terminating all binary option marketing services and will no longer solicit and advertise binary traffic.”

3) Global regulators continue their assault on the brokerage industry.

Regulators across the globe show no signs of letting up, although the FCA did decide to delay the implementation of its proposals related to curbing FX and CFD leverage limits in a move to coordinate the effort with ESMA, the pan-European regulator of record. ESMA announced, “It is planning its own pan-European rules for Forex and CFD trading, which could include a leverage cap, negative balance protection, stop losses on leveraged CFDs, or even limits on advertising which it may try to implement across the EU.”

On other fronts, the Turkish government is “issuing new regulations, which will make it illegal for Turkish residents to hold accounts or trade leveraged Forex or CFD products with foreign brokers not licensed by the country’s Capital Markets Board (CMB).” Headlines were also abuzz along this storyline: “CySEC to publish list of outlawed Binary Options and FX affiliates.” The agency also clarified “rules under which CIFs (mainly Forex, CFD and Binary Options brokers) can operate using third party affiliates.”

What are the implications for the forex industry going forward?

When risk levels increase for the brokerage community, then your account balances and access to the forex market are at heightened risk, as well. From 2013 forward, volumes have been in decline in the forex industry, amidst a host of crises that began in Cyprus, were followed by the Swiss Franc Debacle, rate-fixing scandals, and binary option excesses, and concluded with an onslaught from regulators that threatens the very lives of a majority of marginal forex brokers. Many members of this group are hanging on by their very fingernails, hopeful that the “good old” days will return.

Aside from financial bankruptcies and shady business practices, the major concern is that, behind the scenes, borderline brokers will relocate offshore and resort to gamesmanship to avoid regulator compliance, while deceiving their customer base entirely as to the true aspects of their backroom operations. A few industry observers have already witnessed an increase in these offshore machinations, where copies of the legitimate, regulated entity are set up to collect customer funds, divert them from the regulators’ eyes, and then bend the rules to profit handsomely at the consumer’s expense.

In other words, we are beginning to see a repeat, although on a much grander scale, of the games that were played in the binary options arena over the past several years. Bits and pieces of the operation are being outsourced to third parties in jurisdictions where regulatory compliance is near non-existent, hidden by a corporate veil of secrecy that can easily trap the unwitting public in its web of deceit. Under this scenario, client funds never find their way back to corporate headquarters, nor are they segregated in Tier-One bank accounts. Instead, they are laundered in such a way where ownership may become suspect and where legal protections may not exist. Buyer beware!

Will these trends be the wave of the future, as fraudsters and con men attempt to re-write the rules in jurisdictions that allow such behaviors to thrive? What can regulators do to stop this migration to the dark side? According to industry insiders, there is very little that the regulatory establishment can do. They can only act to protect their domestic consumers directly or indirectly through cooperation agreements that exist today. The criminal element, however, knows where these legal limits exist and knows where to set up shop to leverage any offshore advantage to the hilt. Resource constraints are another problem, such that the ability of regulators to reach overseas is more dream than reality.

Concluding Remarks

If anything, the prevailing themes for our industry in 2017 have been very predictable. High-profile scandals, both in forex rate fixing by major banking institutions and unseemly business practices in the binary options space, certainly made a regulatory backlash an inevitability. As is usually the case in these types of circumstances, regulators tend to overreact, unaware that the consequences of their actions may result in more, rather than less, risk for their domestic consumers.

How do you prepare as a trader for an uncertain world going forward? Fiscally prudent market access will be the ongoing challenge in the days ahead. When industry dynamics are scrambled for whatever reason, there will major power swings. There will be winners and losers, and risk profiles will be exacerbated. You will need to be prepared to move swiftly, when and if you notice early warning signs that your broker may be having issues in its backroom operation. It may be prudent to have a “hot backup”, one that has already been tested, passed due diligence, and found to be acceptable.

You may also want to follow news channels more closely for hints regarding broker solvency and liquidity, in addition to your daily quest for fundamental and technical insights into our quirky foreign exchange market. A subset of the trading community has already developed skills in this area and learned the hard way that account deposits can disappear at a moment’s notice. You do not need to learn these lessons the hard way, as long as you make an effort to stay informed and be prepared for whatever the market throws at you.

In any event, stay vigilant, skeptical, and know that to be forewarned is to be forearmed!

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2025

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #2 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #3 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #4 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #5 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #6 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox