We are quickly approaching the end of the first quarter of 2018, and, although industry pundits have produced a plethora of articles seeking your attention, the key topics that should be top of mind seem to be lost in the shuffle. Every investor has individual needs when it comes to forex news, but sifting through today’s running narratives from our forex industry rags results more in noise than in useful information. In this vein, less is more, and, as a result, our objective in this article is to dispense with the noise and, hopefully, deliver the highlights of recent headline coverage.

Any review must also be concise and limited to salient points, opinions, or discussions, but not ignore popular areas. For this “quick hit”, we have chosen to talk to the following themes:

- Industry Volume News;

- Bitcoin and Blockchain Technology;

- Playtech and Teddy Sagi;

- FXCM and Global Brokerage Inc.;

- Cross-border Prosecution Success or Failure; and lastly,

- China

Half a dozen seems about right, although we could write all day about what is happening or could happen in China, from possible forex bans to what will work going forward. With that as an introduction, let’s get down to the facts at hand.

Industry Volume News

We continually hear that our industry volumes are contracting, but we also hear reports that specific banks or forex brokers are experiencing either pronounced increases or similar decreases. Without an industry consolidator receiving current reports from a statistically valid population set, we are left to ponder if one entity’s experience is representative of the whole or unique. Market shares do shift over time for a multitude of reasons, having to do with internal growth dynamics, outright program buyouts, or even merger and acquisition activities.

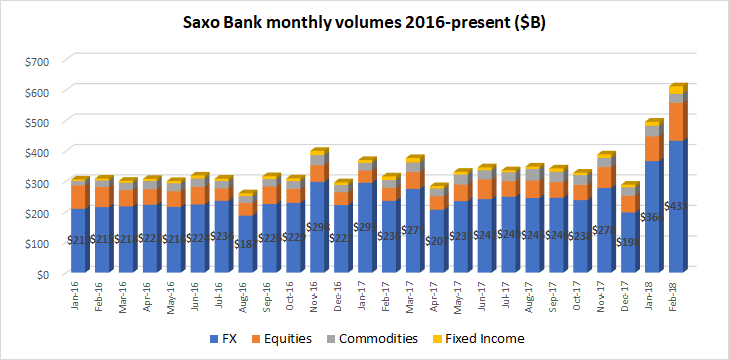

With that pretext in mind, it was amazing to read the following headline: “Saxo Bank trading volumes top $600 billion in record February 2018.” Not only were volumes good in February, a short trading month at that, but they followed an excellent January, as well. The Copenhagen-based bank has had a change in ownership, and is in the process of re-organizing for the future. The latter half of 2017 was down, but management cites new customers as the reason for the current uptrend. From a purely, forex perspective, trading volumes topped out at $433.2 billion, or 71% of the total, a new record for monthly foreign exchange turnover. It remains to be seen if this is a harbinger of good things to come for the rest of our industry’s participants. The bar chart below paints a vivid forex acceleration trend:

Bitcoin and Blockchain Technology

Bitcoin and its brethren cryptocurrencies have been the rage in the investment community of late, gaining immediate popularity, as prices skyrocketed during 2017. What goes up, however, will come down if fundamental foundations have not been solidified. Bitcoin has been on shaky ground from its infancy for a host of reasons, but as quickly as it rose above $19,000 a coin, it plummeted like a rock. Profit taking was only one reason. It did recover to $11,000 and change, but recent news has knocked it down to $9,200, still a hefty valuation when all fundamental variables are taken into account.

The travails of Bitcoin and others are well documented, if you spend the time to search and review, but who has that amount of time? Regulators are always a threat. In fact, one US body just ruled that cryptocurrencies are a commodity, which may force a level of disclosure and market liquidity that could cripple this fledgling “commodity”, along with its partners. As is usually the case with Bitcoin, there are more things going on than meet the eye. Binance, the largest cryptocurrency exchange in the world, reported a major hacking attack against its infrastructure. The crooks have not gotten away with any loot, but they were patient, well capitalized, and may not withdraw from the scene.

The reasons do not stop there. Mt. Gox, which had been the largest broker in the early days, but had also suffered excruciating losses in 2014 from organized hacking schemes, is now in bankruptcy. Its trustee sold $400 million in Bitcoins five days ago, fueling an angry response from traders and investors alike. The liquidation, however, was less than 1% of that day’s trading volume, an unlikely culprit for blaming for major movements in the market. Bitcoin does bounce back over time, a good thing, but primarily due to supply constraints in the system and the fact that bankers and consultants believe that Blockchain Technology may be the next wave of innovation in financial services.

Bitcoin and others may rely upon this technology to operate, but each cryptocurrency has no ownership right to this intellectual property. Yet, coin valuations seem inordinately tied to the passing fortunes of anything bearing the label of blockchain, whatever the source might be. With these thoughts in hand, how could we resist a “Guest Editorial” byline that read: “How proper application of blockchain technology could change retail FX.”

Athol Nourse, a senior FX industry executive with over 17 years of experience, has used blockchain technology to create what he calls a “broker-less” trading platform. It will go live on March 31 under the name of SPECTRE: “SPECTRE, which is built on the Ethereum blockchain, removes the broker out of the picture entirely, thereby disrupting the current model and empowering the trader. SPECTRE’s aim is to disrupt the digital options and classic retail FX/equities trading industries and lead a paradigm shift.” In an era where fraudulent brokers manipulate price feeds, tamper with payout ratios, and literally steal client capital balances, it is refreshing to hear that technology may overcome these bad behaviors. Time will tell.

Playtech and Teddy Sagi

We have often covered the antics of Teddy Sagi, Israel’s ebullient billionaire with a checkered past, and his flagship company, Playtech, ever since he went on a very public corporate buying spree back in 2015. Young Teddy was jailed in the 1990s for stock fraud, and word on the street was that this experience ruffled the sensitive feathers of regulators, who eventually blocked his more prominent M&A ambitions. Our fearless leader, however, was undaunted. He did buy entities outside of the UK and continued to produce extremely favorable financial results, regardless of any momentary setbacks.

The most recent release from Playtech touted 2017 as just one more growth year, but a more in depth study of the numbers revealed that the last half of the year witnessed a material slowdown in most key business units. Gross revenue was down some 9% from the first six months’ worth of turnover, perhaps, another reason why Teddy may have sold 12% of the company back in November.

The latest news is that he sold another 4%, such that US investment management giant, T. Rowe Price Group Inc., with 10.2% ownership, is now the largest shareholder of Playtech. Teddy is now “Number 2” and stated he wanted “to further develop my London property portfolio and be at the vanguard of the co-working revolution”. The shared office movement is currently booming in London.

FXCM and Global Brokerage Inc.

The travails of FXCM have made for good storytelling with bits of intrigue, takeover, and bankruptcy filling page after page in our daily rags. Leucadia, the hedge fund that raised FXCM from the ashes of the Swiss Franc Debacle back in 2015, has finally taken over the reins and added its name to the corporate logo. Global Brokerage Inc. has been left to twist slowly in the wind, while the bankruptcy trustee decides how to dispense its final funds. There is $3.1 million on hand, but now legal and investment advisory firms are scrambling like vultures to rip away any remaining meat on the carcass.

Cross-border Prosecution Success or Failure

Finding the crooks that perpetuate fraud is one thing. Prosecuting them in a court of law is quite another task. Today’s criminal thieves are sophisticated and know how to skirt the law and operate just beyond the reach of law enforcement officials. Yes, financial regulators in developed countries have executed cooperation agreements to facilitate the prosecution of cross-border fraud, but there are rare examples where the process actually works. It can work more easily if the scam artist believes that a foreign residence will protect him in the long run.

For this reason, many eyes have been watching the latest attempt by the CFTC to follow through on just such a case. Jiongsheng Zhao, a 38 year-old trader/fund manager and resident of Australia, has already been jailed in Australia for misleading investors and diverting $5 million of invested capital for his own personal benefit. He had promised over 40 investors excessive returns in a scheme that involved “spoofing” the E-mini S&P 500 futures contract market. Spoofing is an attempt to manipulate a market by placing large orders, but then canceling them before execution. Zhao engaged in a pattern, which “included 3,100 discrete instances of spoofing”. The CFTC must jump through a number of hoops to extradite Zhao, thereby demonstrating the various difficulties that US regulators encounter when they try to prosecute foreign nationals.

China

China — the last frontier for financial services and most any other type of service, for that matter. But, as lucrative as the market may seem at first glance, Chinese officials have been quick in every venue to lock down domestic benefits for domestic players and tread hard on any foreign-based service provider. It has taken a decade for the financial services arena to solidify. Officials have now made it clear that they intend to decide what is worthy of its citizens. In that regard, they have banned Domestic Exchanges, Binary Options, ICOs and Bitcoin providers.

They have also come down hard on FX brokers, CFDs, and leveraged products, declaring all illegal unless expressly authorized by local regulators. There will be no “Wild, Wild, West” attitude in the Middle Kingdom. Foreign banks have also had to tread lightly, since they do not have access to the government’s easygoing liquidity provisioning and must still satisfy capital requirements established in their respective countries of incorporation. As one outsider grimaced, “The future for the entire commercial structure of the Chinese industry is, well, Chinese.”

Concluding Remarks

What a difference a year makes. Last year, regulators were flying off the handle, issuing new guidelines, rules and regulations at every turn. That toxic environment has settled back down a bit, but the same old news stories just keep on adding another chapter in the process.

We were due for a breather, but never let your fraud guard down!

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2024

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex & CFD Broker |

Best Trading Conditions

Visit broker

|

||

| #2 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #3 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #4 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #5 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #6 |

|

Global CFD & FX Broker |

ALL-INCLUSIVE TRADING PLATFORM

Visit broker

|

||

| #7 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #8 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox