New protocols at eToro mean it’s a very Happy Christmas for traders. The minimum size on trades in crypto, stocks and ETFs has been slashed to a tiny $10. This not only makes risk management easier to carry out but at the same time opens the door to profits being made in more speculative markets. Nothing is ever guaranteed in the markets, but for the +20m account holders at eToro, at least they now have enhanced tools for managing their accounts.

Source: eToro

Is Using Risk Management Tools Risky?

Stop Loss and Take Profit instructions, which are automatic instructions to buy some or all of a position at specific price levels, can be a trader’s friend but also their enemy. There’s no way of swerving the traditional advice that newbies should use them – they can instil some discipline into trading strategies. Stop losses also allow investors to bail out of a losing position before it potentially wipes out their account.

The problem with stop-losses is they can be triggered during freak market events such as a flash crash and traders can be kicked out of positions that would ultimately come good. Take profit instructions also have their critics as they put a cap on the upside. There is also the question of where to set them and that involves extensive practice, which is best done in a demo account.

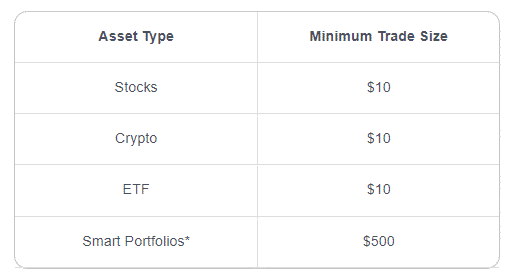

eToro’s New Trading Minimums

Source: eToro

Why is Trading in Small Size Important?

Trading in small size offers a different route to successful risk management. By spreading cash allocation across a lot of small positions, single stock risk is mitigated and ‘noise’ is reduced. Ironing out the peaks and troughs of P&L performance can take some of the emotion out of trading and reduce the risk of panic-fuelled decisions being made.

eToro’s decision to allow positions in cryptos, stocks and ETFs to be as small as $10 can also help enhance returns. The countless stories of traders buying a tiny amount of crypto and seeing the value rocket to a life-changing amount have to be taken with a large pinch of salt. FOMO can result in chronic decisions being made. But eToro’s $10 minimum does allow traders to allocate small amounts of cash to a large number of cryptos in the hope of catching the next big thing.

eToro’s simplified functionality is incredibly popular, but the $10 minimum is now an equally important feature of its platform.

Crowdsourcing information about scam brokers can help others avoid falling into the traps set by disreputable brokers and you can share your experiences here. If you want to know more about this particular topic or have been scammed by a fraudulent broker, you can also contact us at [email protected].

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2025

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #2 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #3 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #4 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #5 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #6 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox