Elon Musk’s bid to buy Twitter is on the rocks, largely thanks to the maverick entrepreneur putting it there himself. His newfound passion for thorough due diligence on the terms of the deal contrasts heavily with his initial approach, which involved Tweeting one-line bids and updates on social media. The question for the wider market is whether this is classic brinkmanship and part of an effort to reduce the offer price or a lifting of the lid on the tech sector’s true value. It’s a high stakes game with important ramifications for Musk and Twitter shareholders and the wider market.

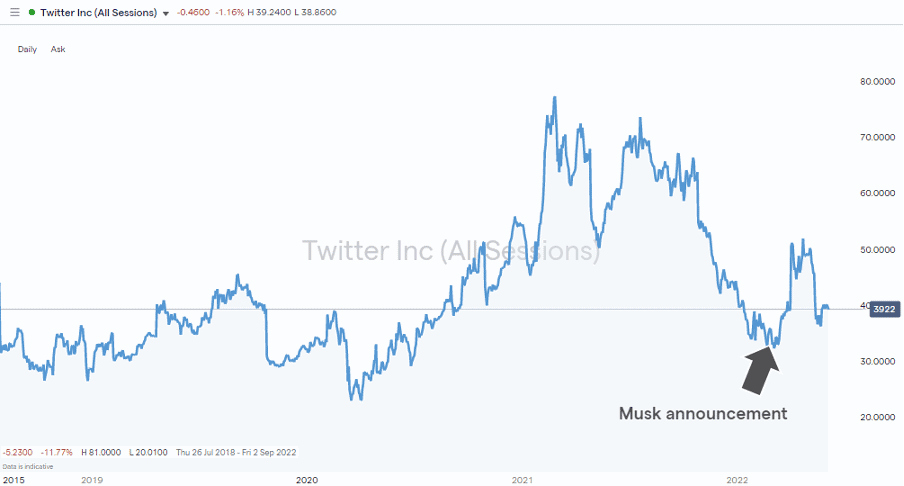

Twitter Inc – Daily Price Chart –2019 – June 2022

Source: IG

How Many Genuine Users Does Twitter Have?

The proposed $44bn buyout of Twitter by Musk has stalled due to both parties taking a different view of how many of the firm’s accounts are genuine users. Twitter puts the number at under 5%, whereas Musk thinks as many as 20% of the accounts could be bots.

Establishing the actual state of the firm’s user base is obviously vital for Musk. After all, advertisers won’t want to spend cash promoting their products to farmed accounts. For shareholders in other firms such as Meta (Facebook), Snap, and Alphabet (Google), there is a risk of the questions being asked of Twitter rolling over to the platforms they have invested in.

The timing couldn’t be worse; this year, Meta, Snap, and Alphabet stock prices have already lost 42.58%, 68.27%, and 14.52%, respectively. But several high profile thought-leaders think the 2022 sell-off is only half-baked. A revelation that social media stock valuations are massively off could act as a catalyst for further downward momentum.

Musk Has The Least To Lose

The alternative view is that Musk is just shaking down the Twitter shareholders until they agree to a lower deal price. The truth is that he has little to lose from standing his ground. If Twitter gives him extensive access to its user database and it is found to be overinflating the number of genuine users, he can decide whether to proceed or not. He’d be buying in at a price which reflects the reality of the situation. He’ll protect his cash pile and have more time to devote to his other projects if he walks away.

Contagion Risk

If Twitter refuses to share the requested data, a question mark would still sit over the firm and the sector as a whole. It would be the investors in other social media platforms which haven’t had a thorough analysis conducted who would be looking over their shoulder. Or, more likely, heading for the door.

Crowdsourcing information about scam brokers can help others avoid falling into the traps set by disreputable brokers, and you can share your experiences here. If you would like to know more about this particular topic or have been scammed by a fraudulent broker, you can also contact us at [email protected]

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2024

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex & CFD Broker |

Best Trading Conditions

Visit broker

|

||

| #2 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #3 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #4 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #5 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #6 |

|

Global CFD & FX Broker |

ALL-INCLUSIVE TRADING PLATFORM

Visit broker

|

||

| #7 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #8 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox