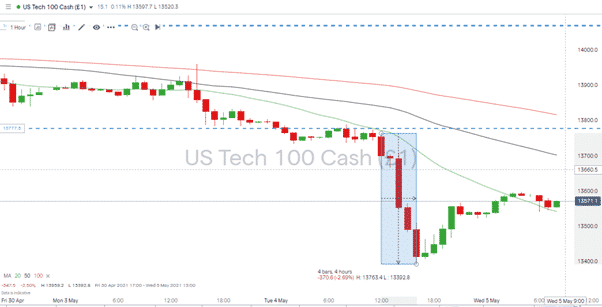

This week was always going to be a busy one in terms of planned announcements but unscheduled comments from Janet Yellen have just turned volatility up a notch. Speaking on Tuesday, the US Treasury Secretary suggested interest rates may have to rise and, in doing so, took 2.69% off the value of the Nasdaq 100 index.

Source: IG

The somewhat throwaway comments were made at the Atlantic economic forum when Yellen said:

“It may be that interest rates will have to rise somewhat to make sure that our economy doesn’t overheat … Even though the additional spending is relatively small relative to the size of the economy, it could cause some very modest increases in interest rates.”

Later in the day, there was some backtracking, especially as Yellen had overstepped the mark and commented on monetary policy issues managed by the US Federal Reserve. Yellen’s mandate is US fiscal policy and her suggestion that the economy is overheating will be brushed off by the officers of the Fed. It does, however, give rise to fears that the $5.3trn Covid relief package, which Congress has approved, could be the last act of support from the White House.

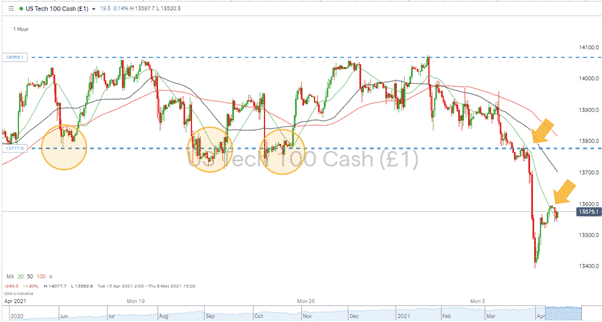

Source: IG

Despite Yellen later saying that an interest rate rise was “not something I’m predicting or recommending”, the damage had already been done for equity prices, and the shaky start to May was confirmed. Since mid-April, the Nasdaq 100 index had been trading in the range of 13780 – 14060, but Yellen’s comments were enough to cause a break to the downside. The 13780 level now forms a significant resistance to any tech stock share price recovery, and the hourly 20 SMA is also providing resistance to upward movement.

Thursday the 6th of May – Bank of England Statement

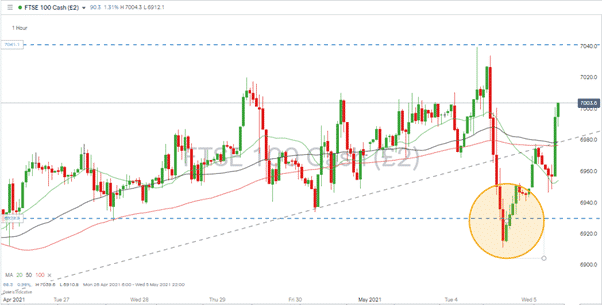

The events in the US have led to more attention being placed on the interest rate announcement due from the Bank of England on Thursday. The UK focused equity bulls are currently more optimistic and took the Yellen price plunge as an opportunity to buy the dips at the bottom of that market’s price range.

Source: IG

The recovery in UK equity futures prices, which started after the closing bell in London, carried on through the Asian session and found more momentum after European markets opened on Wednesday. For the FTSE 100, the bounce off the support level marks 6920 – 6930 as an increasingly significant price range. Resistance in the region of 7040 remains, and Wednesday’s price move could love momentum as the countdown to the Bank of England’s announcement begins.

National Holidays are Clouding the Picture

Those looking to navigate the markets this week do need to keep an eye on the economic calendar. Monday’s UK national holiday was followed by ones in China, Japan and Thailand on Tuesday. With the markets being closed on those days, there is gapping between prices of the underlying equities and equity futures. Early session price volatility as the two markets recalibrate looks set to be a theme of the week.

If you want to know more about this topic, or have been scammed by a fraudulent broker, please contact us at [email protected]

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2025

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #2 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #3 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #4 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #5 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #6 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox