News due from the White House this week looks set to send markets spinning off in one direction or another. All eyes are on US President Joe Biden as he begins to share his thoughts on who will be appointed as the next head of the US Federal Reserve. The consensus is that it’s now a two-horse race between incumbent Jerome Powell and fellow FOMC member Lael Brainard. The shared view is that it is also a race that is too close to call at this stage.

With such a vital decision hanging in the balance and both candidates taking a very different approach to policy, markets are holding off on reacting to other data points, but something has to give.

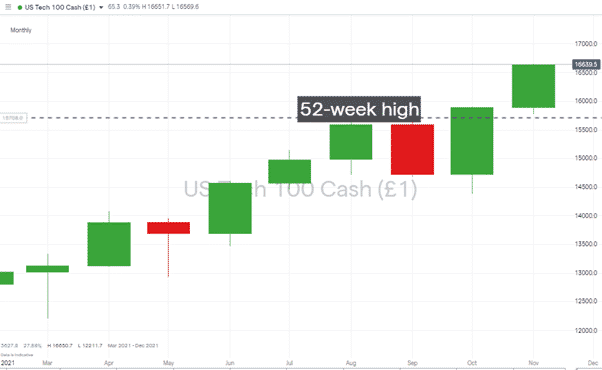

Nasdaq 100 Price Chart – Monthly Candles 2021

Source: IG

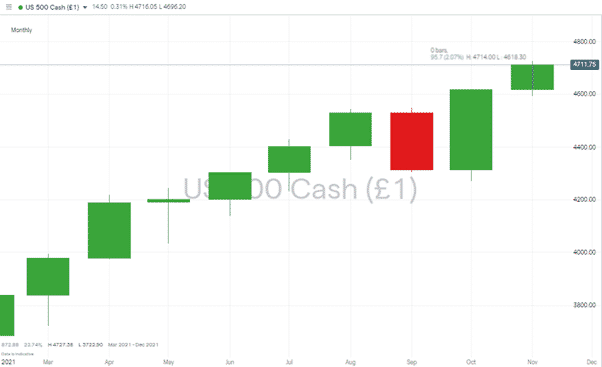

S&P 500 Price Chart – Monthly Candles 2021

Source: IG

Equity Rally Continues

Solid economic data out of the US has caused risk-on assets to rise in price through November. Inflation and unemployment numbers might be backwards-looking in nature, but the strength in the recent announcements pointed to the US making an impressive recovery from Covid. In November’s percentage returns, the S&P 500 index is up 2.07% month to date, and the Nasdaq 100 is up 4.78%.

There is an argument that those price rises should be higher. Data out at the end of last week showed the forward-looking measure, the Philly Fed US Leading Index, increased from 1.52% to 1.72% in the space of one month. The long-term average of the index is at the lower level of 1.30%. Not only has the recovery been robust, but the Philly number suggests there is little sign of it losing momentum.

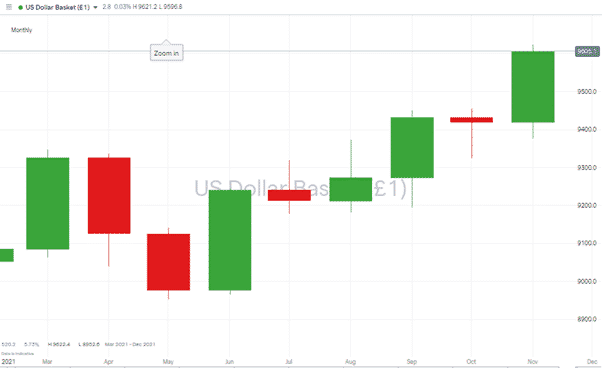

The question of whether prices should be even higher than where they are is influenced by Biden’s deliberations over who should be the next Chair of the Fed. If Powell gets the top job, then markets can expect more of the same. Brainard’s approach would include stricter regulation of Wall Street but a much more dovish approach to monetary policy. The slightest hint from the White House that Biden’s political bedfellow Brainard is being lined up to take over would be followed by a significant rally in equities and a slide in the US dollar.

US Dollar Basket Price Chart – Monthly Candles 2021

Source: IG

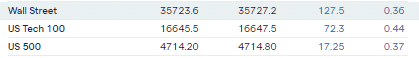

Earlier in November, Forex Fraud analysts tipped the issue of who heads up the Fed as a slow-burn factor to keep in mind. This week will see more urgency come into play, which will inevitably impact asset prices. It is a coin toss, but despite their recent bull runs, equities still have room to the upside if Brainard gets the job. A sell-off might not necessarily come about if Powell remains in post, which goes some way to explain why US futures were showing strength after European exchanges opened on Monday.

US Index Futures – Monday Morning

Source: IG

Crowdsourcing information about scam brokers can help others avoid falling into the traps set by disreputable brokers, and you can share your experiences here. If you want to know more about this particular topic, or have been scammed by a fraudulent broker, you can also contact us at [email protected]

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2025

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #2 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #3 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #4 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #5 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #6 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox