At the turn of the year, trading floor conversations may have focused on a ‘paradigm shift’ in the economy, from low to high inflation. However, Monday’s wild markets point to an equally significant move, from low to high price volatility. Decisions made on managing risk look as crucial to the bottom line as the original decision of what asset to buy and when.

What Just Happened?

The build-up to Wednesday’s update by the US Federal Reserve on interest rate policy could have been expected to be associated with traders holding fire until Jerome Powell shared his thoughts. At least, that’s the way things usually pan out. Instead, major indices and currency pairs posted intra-day price moves that were off the scale.

A quick cross-reference to recent price history puts these moves into context.

The NASDAQ 100 index recorded a staggering intraday price range of 13,721 – 14,595. After a brutal sell-off during the first half of Monday, the index recovered to post an almost 6% gain in the space of only four hours.

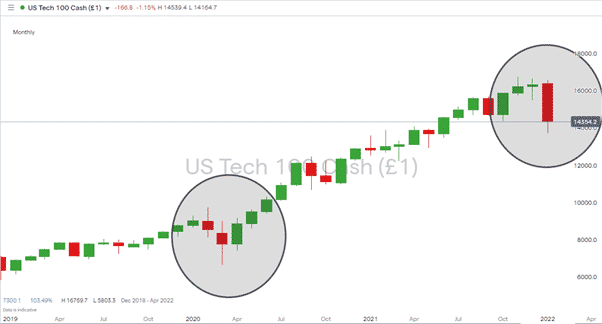

The monthly price chart for the index shows how the rush out of tech stocks in January is on a similar scale to the major crash at the height of the Covid pandemic in Q1 of 2020.

NASDAQ 100 – Monthly Price Chart 2019 – 2022 – January’s Sell-off In Perspective

Source: IG

With markets losing and gaining +5% in value in the space of 12 hours, there will be many nursing losses due to stop-loss instructions coming into play. Building automated instructions into positions does allow for a more hands-off approach to trading, but short-term price crashes can be painful.

Techniques For Managing Risk In High Volatility Markets

With volatility spiking, it could be time to consider alternative approaches. Those currently looking to ‘buy the dip’ in the NASDAQ can point to that strategy having paid off for more than a decade. But with market conditions being so extreme, there is still a requirement to manage the downside.

This could be a time to consider traditional, almost old-fashioned, techniques that don’t fully use the functionality of online platforms. Trading in small sizes is one approach. That can take the emotion out of trading and allow traders to run strategies to the natural end of their life. It also appears to be an excellent time to remember the guidance to only use funds you can afford to lose.

The sell-off may, or may not be, about to take a breather as many technical indicators point to the market being oversold on a short-term basis. An equally important question is how to navigate the trading opportunities that January is throwing up.

Crowdsourcing information about scam brokers can help others avoid falling into the traps set by disreputable brokers, and you can share your experiences here. If you want to know more about this particular topic or have been scammed by a fraudulent broker, you can also contact us at [email protected]

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2025

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #2 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #3 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #4 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #5 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #6 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox