Retail forex trading is a global phenomenon. Growth dynamics for the past two decades across the globe attest to this very fact, but each region and each nation, for that matter, have developed at their own pace. Developed economies can easily boast of better banking infrastructure and Internet access, but technology knows no boundaries in this day and age. People of all nationalities and cultural diversity have welcomed the opportunity to trade major currency pairings, as well as their local currency, if laws permitted. Central bankers typically frown on speculation, but they have been receptive. Unfortunately, with thriving business comes fraudulent antics. This article explores Forex scams Malaysia is currently vulnerable to.

It sounds as if our industry is a paradise, awaiting every citizen of the planet to bathe in the glory of our favorite pastime or career path. There is, however, a problem with this rosy picture. The criminal element in our society has been observing the action, always looking for just the right opportunity, and has been more than quick to target the most unsuspecting consumers, especially in our developing markets. Malaysia is a prime example. Recent headlines have been rampant with stories about “get-rich-schemes” involving foreign exchange and the efforts of local authorities to shut them down.

What are a few basics about Malaysia, its currency, and its central bank?

For those of you that are unfamiliar with Asia Pacific geography, Malaysia is one of the major emerging economies of the Pacific Rim. It is definitely on the move. Per one source, “Peninsular Malaysia shares a land and maritime border with Thailand and maritime borders with Singapore, Vietnam, and Indonesia. East Malaysia shares land and maritime borders with Brunei and Indonesia and a maritime border with the Philippines and Vietnam. The capital city is Kuala Lumpur, while Putrajaya is the seat of the federal government. With a population of over 30 million, Malaysia is the 44th most populous country.”

The currency for Malaysia is known as the Ringgit, or by its international symbol, “MYR”. Malaysia, like many of its Asian brethren, is highly dependent upon international trade. In this case, there is a heavy dependence on gas and oil exports. As you might expect, the Ringgit has not fared that well since 2013, as oil prices, along with the prices for several other mined commodities, have plummeted. Countries like Malaysia are waiting for demand to pick up, especially in China, but the Ringgit over the past four years has fallen from 3.0 to the U.S. Dollar to 4.34 at its last reading, a decline of some 31% in value.

As with other countries in this situation, the central bank of Malaysia has tried its best to curtail unnecessary capital flows that might depreciate the value the local currency on the international stage. Bank Negara Malaysia, “BNM” for short, is the central bank for the country, and, as with other central banks, one of its primary missions is to oversee the value of its domestic currency, do what it can to keep conversion rates stable, and thereby regulate to a degree its impacts on the pricing of local goods and services.

What is the regulatory framework in Malaysia?

BNM, however, is separate from the local regulatory entity that has domestic oversight responsibility for investment vehicles. Many developing countries have followed this model where two government entities work together, but the problem with this approach is that some things may fall between the cracks, so to speak.

As one website notes, “The Securities Commission (SC) oversees exchange-traded products, as well as commodity and forex futures and the activities of brokers in the country. Regulations, however, have not been updated to accommodate retail forex trading, and in some cases, pronouncements from government officials have suggested that some forms of trading may be illegal.” Where there is confusion, fraud will surely follow.

Many central banks and security commissions around the globe, particularly in developing markets, have had difficulty adjusting to the nuances presented by modern retail forex trading. Existing regulations may only deal with buying forwards or contracts in the futures market, previously established modes of investment, but when it comes to dealing with trading positions in the spot forex market without actual currency delivery, the legal framework of existing law may fall short of addressing the real world of foreign exchange trading possibilities.

Due to the confusion found within local laws and official efforts to protect consumers from fraud, a single question is often heard: “Is online Forex trading legal in Malaysia?” The BNM on one hand wants to restrict wide fluctuations in the Ringgit and has, for obvious reasons, often sanctioned only licensed banks and financial institutions to offer forex trading and only when it does not involve the Ringgit. Leverage can be nonexistent, another reason why locals might prefer to deal with a foreign-based broker or with a local provider that seems to be speaking their language and obeying their customs.

What is the nature of current forex fraud schemes in Malaysia?

Greed is alive and well in Malaysia, from the perspective of both an innocent citizen, as well as from the purview of local fraudsters. It is not uncommon for individuals with good credit to borrow millions of Ringgit to invest in schemes that can offer as much as a 20% return every month. The thinking is that the loan could be paid back in a manner of a few months, and then everything after that would be cash in the bank. Foreign exchange is often touted as the vehicle to riches, but rarely is any principal ever used to conduct trades. These Ponzi-type con games lure in investors, but rarely return a any portion of the original investment.

Here is one reporter’s lament: “Unfortunately, dodgy, too-good-to-be-true investment schemes are all the rage again in Malaysia. Propelled by mobile and Internet technologies, these cleverly designed products – ranging from investments in foreign exchange (forex) to gold, palm oil and pyramid selling – continue to lure investors with promises of very lucrative returns for very little or no risk over a very short period of time. Although the dangers and features of such schemes have been well articulated in the media over the years, with multi-billion-ringgit losses being reported, many ordinary Malaysians still fall victim to the various financial scams promoted by dubious companies and individuals.”

The Bank Negara Malaysia and the Securities Commission have done their level best to warn consumers by posting alerts and listing unauthorized schemes, companies and individuals on their respective websites. To date, the BNM has 288 entities listed, while the SC has 188 items on its “black list”. Most current estimates put the actual total in excess of 400, and many of these fraudulent enterprises are doing business in other Asian markets, including China. Firms will typically open a local office for credibility reasons and purport to have a headquarters in the United States, another ruse that works more often than you might think.

The biggest headline grabber of late goes by the call letters of “JJPTR”, a Chinese anagram for “Jie Jiu Pu Tong Ren”. Translated roughly to English, this phrase purports to “saving the common people.” No one has been saved. Monthly returns of 20% were promised, but now losses could run as high as RM500million, or over $100 million U.S. Dollars. Investigators believe this figure to be conservative, claiming that the real number may be closer to three times this amount.

The ink had not dried on these stories before authorities had shut down three more entities of similar ilk: “Three such schemes – Change Your Life (CYL), Richway Global Venture, and BTC I-system – are said to be heading the same way after its members failed to receive their “profits” on time as promised.” More details about these fraudulent companies follows:

- “CYL, which started in November last year, promised 7.5% returns weekly, which is equivalent to 30% a month.”

- “Members of Richway Global Venture, an agriculture-cum-forex “investment” scheme which started in May 2016, are complaining that they have not been paid this month.”

- “BTC I-system, a scheme which claims to invest in the Bitcoin digital currency, could also be in trouble with investors no longer getting their payouts. It promised 30% back every 15 days, excluding Sundays.”

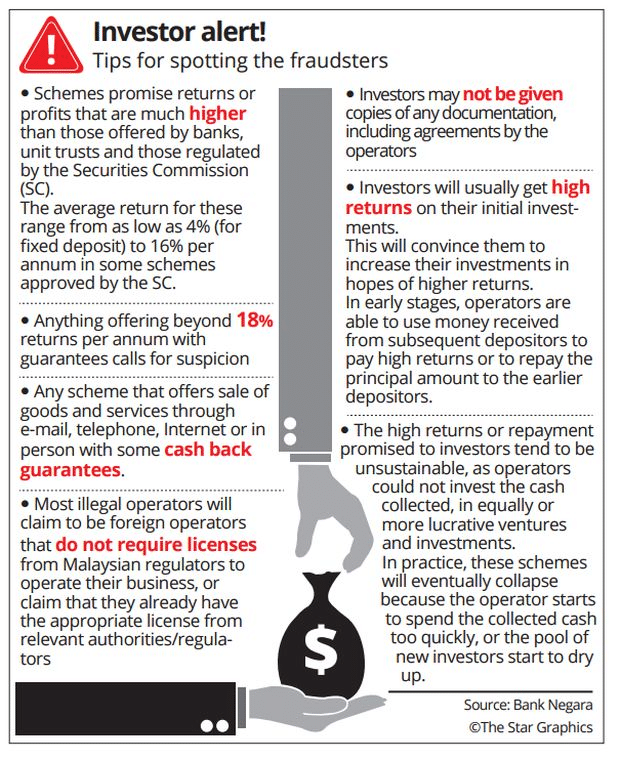

Bank Negara has posted the following graphic on its website to warn consumers:

There is only so much that authorities can do to warn consumers of the perils of “High-Yield Investment Programs”, or “HYIP”, industry jargon for these types of fraud. Local actions can be initiated, if the perpetrators are onshore, but, if the brokers operate in a foreign jurisdiction, then your rights are limited. Per one local lawyer familiar with the current dilemma: “The central bank cannot regulate offshore companies. Bank Negara can only regulate or recognise financial institutions such as banks and finance firms that are based here.”

How can one protect themselves from unscrupulous brokers or fund managers?

Crooks today are very well educated and well resourced in the art of deception. They are especially drawn to the Internet, where online anonymity can easily disguise their identities, their whereabouts, and whether they are a regulated entity in another jurisdiction. In other words, they know how to use your greed as a weapon against you and then fleece you of your hard-earned and often borrowed cash. Here are a few tips on fraud prevention:

- Always check with local authorities for proper registrations and certifications;

- Be skeptical of any outrageous promises, especially claims to pay returns that are well over accepted norms in other investment fields;

- If you still wish to go with a foreign concern, check with foreign regulators to determine if the entities are legitimate with no pending claims;

- Start out with small amounts. There is no reason to “bet the ranch” at the outset;

- Test the firm’s withdrawal procedures early on to see if delays are prominent;

- Looks can be deceiving – Do not be swayed by glowing pictures or testimonials. They could be as fake as the value proposition that sounds good as gold;

- Resist any pressure that forces you to act quickly or you might miss out;

- Lastly, trust your gut feelings. If it sounds too good to be true, then it more than likely is. Walk the other way!

Concluding Remarks

Forex fraud schemes are alive, well, and global, especially in developing markets where retail forex trading is something new or where the crooks from foreign jurisdictions prey upon local citizens. Be skeptical at all times, and be sure to keep your greed in check. Remember — You are your first and last line of defense when it comes to preventing forex fraud!

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2025

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #2 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #3 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #4 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #5 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #6 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox