If the bad news is that major global equity markets are heading towards forming a bear market, then the even worse news is that the increased price volatility looks set to be the dominant theme for the next few months.

A relief rally can’t be ruled out, and well-known analyst and broadcaster Jim Cramer of CNBC has told investors to be “poised for one incredible, tremendous rally”. At the same time, experienced portfolio manager Jeremy Grantham of Grantham, Mayo, & van Otterloo, a firm with $118bn of assets under management, says the 2022 sell-off is only half done.

Inflation Uncertainty

The reason for the extreme mismatch in valuations is that no one can call if the interest rate hikes being processed now will stem the rise in prices or result in stagflation. The decision by the US Federal Reserve on 4th May to raise base rates by 0.50% was the biggest increase in 22 years, but it might not be enough.

The record books suggest it takes between six months to two years for rate hikes to work their way through the economy. Any sign of a slowdown in inflation would be enough for equity investors to pile back into the long positions; the stock market always reacts before the real economy. But after a decade of low rates, the concern is that the economic system will be off the pace in terms of converting rate rises into price stability.

Fed Mistakes

Another reason to think the policy will take time to become effective is that the Fed is ‘losing the room’. The decision not to raise rates in Q4 of 2021 was justified by the risk of Omicron Covid having the potential to cause a further lockdown. It was a coin toss as to whether that would be the case, and the Fed called it wrong. Their approach can be understood even in hindsight, but confidence is shaken – you’re only as good as your last trade.

Inflation Has Been Underestimated

There’s no room for any hubris in the City and on Wall Street. As recently as 6th May, the forwards market was predicting that 8% inflation would have worked its way out of the system by June. That market now shows institutional investors see inflation at 8.26% as late as September.

It has been quite a year for investors. Sterling has plummeted against the US dollar to trade at levels not seen since Brexit, and the equity markets have haemorrhaged cash. Market darlings including Apple, Amazon, and Netflix stocks are now down from their 2022 highwater marks by 15.96%, 35.31%, and 70.85%, respectively.

Taking a view on the next market move is made difficult by the number of variables in play. Inflation concerns and interest rate hikes top the list for many. There is also the question of Covid, fresh lockdowns in China and a global supply chain which never properly recovered from the events of 2020. Throw in a dose of geopolitical uncertainty in the form of the Ukraine-Russia conflict, and the only certainty at the moment appears to be that there is no certainty.

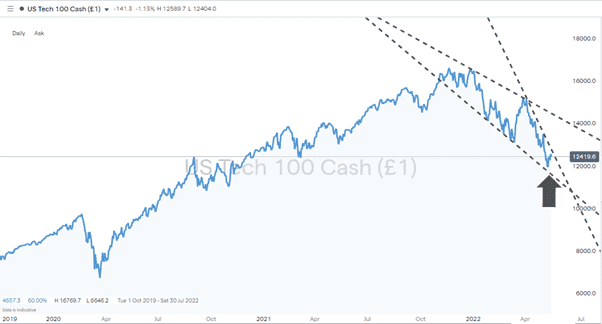

Nasdaq 100 Index – 2022 Sell-Off

Source: IG

Navigating the current market successfully requires a back-to-basics approach, and diversifying positions to spread risk and smooth out returns has never been more important. But the art of diversification is constantly evolving. The traditional 60:40 strategy, which gained popularity in the 1970s, promoted allocating 60% of available capital to domestic equities and 40% to government bonds. That approach doesn’t accommodate the new markets and instruments such as ETFs, which have sprung up and offer a new way of optimising returns.

Diversify Using ETFs

Whether you’re new to investing or an old hand, the booming ETF (Exchange Traded Fund) sector offers a cost-effective way to gain exposure to a wide range of instruments with the click of just one button.

ETFs operate similarly to traditional funds, and investors can gain access to a basket of assets that a specialist provider manages. Those firms don’t pick stocks and try to outperform the market; instead, they aim to mirror the performance of a sector. The passive nature of the management technique means that the annual average costs of ETFs are below 0.50%, and as they trade using live prices, you can buy into and sell out of an ETF at any time – there’s no need to wait for a month-end dealing date to come around.

With so much uncertainty in the markets, the good news is that the ETF industry has evolved to cover nearly every corner of the financial ecosystem. It’s possible to buy a single ETF which offers exposure to specialist sectors such as solar energy, global large-cap stocks or government bonds. The performance of markets so far in 2022 highlights the genuine risks, and ETFs offer a way to manage the threats while keeping enough exposure to the markets to benefit from a rally.

iShares Oil & Gas Exploration ETF

Source: IG

Crowdsourcing information about scam brokers can help others avoid falling into the traps set by disreputable brokers, and you can share your experiences here. If you would like to know more about this particular topic or have been scammed by a fraudulent broker, you can also contact us at [email protected]

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2025

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #2 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #3 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #4 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #5 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #6 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox