The commodities supercycle, which is currently building momentum, is the epitome of how to make substantial returns from long-term trends. Successful trading is all about trading with the trend and then having the discipline to stay in positions. While commodity supercycles don’t come around very often, it’s time to take notice when they do.

What is a Commodities Supercycle?

The commodity markets have experienced four periods of exceptional sustained price growth. The first occurred in the 1880s during the industrial revolution and the emergence of the US as an economic superpower. The supercycle of 1933-50 was caused by the demand for materials needed to support a war campaign and subsequent post-war regeneration. The supercycles of the 1970s and the 2000s were caused by supply constraints that drove prices higher as economic growth among the BRICS (Brazil, Russia, India, China and South Africa) took off. After a period of stable prices, a heady mix of supply and demand factors point to the next supercycle forming now.

Why is a Commodities Supercycle Forming Now?

Commodity supercycles can last for more than a decade because supply constraints take years to resolve. Even though producers would like to profit from higher prices, they just can’t scale up their production levels fast enough.

New mines typically take ten years to come into production, whereas increasing production levels of soft commodities such as cotton and coffee require years of planning and investment. At the same time, demand can spike overnight following the fundamental laws of supply and demand that can send commodity prices hurtling upwards.

Base Level Demand for Commodities is Increasing

Several emerging countries are beginning to fulfil their economic potential, taking global aggregate demand for commodities to higher levels. This mirrors the emergence of the USA in the 1880s and the BRIC countries in the 2000s, which acted as triggers for previous supercycles.

All eyes are on India, where credit agency Moody’s predicts economic growth in 2022 of between 9.1 – 9.5%. The IMF predicts that economic growth across Africa will be 3.8% in 2022, and before Covid, expansion rates were predicted to be 5.5%.

Speculators

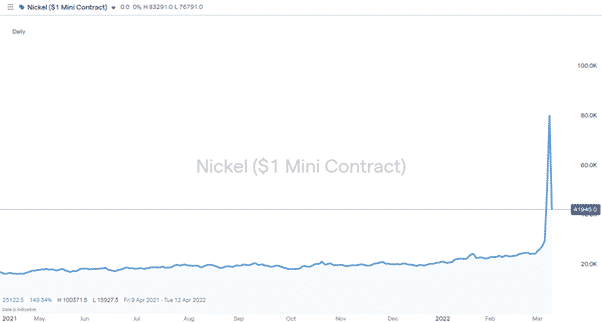

Base level demand in the commodity markets comprises manufacturers that need a physical asset to carry out their day-to-day business. The role of speculators also needs to be considered. With the commodity markets being relatively small compared to the equity and forex markets, a wave of ‘hot money’ can have a magnified effect, as demonstrated by the 217% price rise in the nickel market in March of 2022.

Nickel Price Chart – 2021 – 2022

Source: IG

The Transitions to a Global Low-Carbon Economy Will Send Commodity Prices Higher

World leaders have cast off any lingering doubts about global warming being caused by human activity and have initiated a shift away from carbon-based fuels. The next phase of the project involves delivering an overhaul of the world’s existing infrastructure networks, and ironically that represents a massive drain on the world’s resources.

The commodities needed to transition from old to new technologies include the copper and nickel required for electric vehicle batteries and the iron ore required to produce steel for wind turbines. Uranium and nuclear power are, in many minds, the best way of securing a sufficient baseload of electricity due to the problems of inconsistent supply associated with some other renewables.

Inflationary Pressure From China Will Drive Prices Higher

Recent global growth has been fuelled mainly by the emergence of China. The country’s political dynamic enabled the government to build an economy based on a large and relatively cheap labour pool, but that situation is changing. The booming China middle class is an economic success story, but as they demand higher wages, that will feed through into increased global inflation.

According to the China National Bureau of Statistics, the country’s factory-gate inflation rate hit a 13-year high in August 2021. The year-on-year increase was an eye-watering 9.5%, and the details of the report include a 57.1% increase in prices in the coal mining and washing sector.

A Backdrop of Cyclical Lack of Investment in New Mines

Catalysts for increased demand for commodities are firmly in place, but it’s supply constraints that keep prices at higher levels for a long time. Just a hint that manufacturers might struggle to source the commodities they need for their business operations can lead to stockpiling and panic-buying, but producers of commodities are restricted to the extent to which they can profit from higher prices. Developing the required capacity is logistically challenging and time-consuming.

It can take years to rectify the mismatch between demand and supply, resulting in long-term price rises.

Previous commodity supercycles were triggered by years of underinvestment in supply chains, and it looks like that situation is about to return. The Covid pandemic and global lockdown of 2020 left mining firms facing an existential crisis as economic activity ground to a halt. Social distancing made it harder to carry out activities, and mining firms were left with little option but to protect their balance sheet and scale back on investment. Those lost years were associated with minimal exploration and development of new mines. They can’t be replaced, which points to a bottleneck forming in the industry and a long-lasting impact on prices.

Commodity Prices are Already Rising

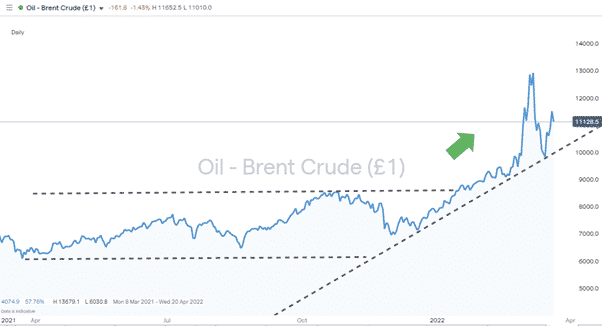

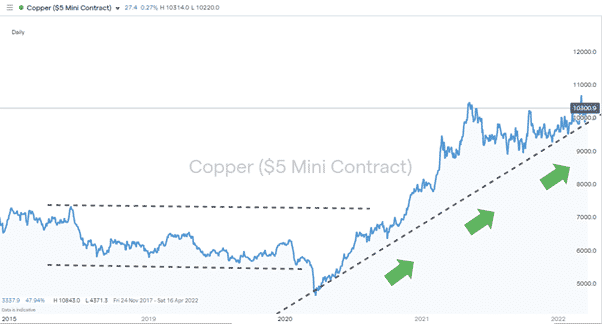

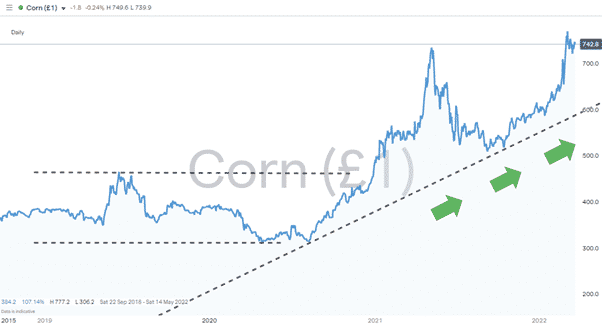

Prices in the commodity markets are already pointing to upward momentum forming. Given previous supercycles have been associated with multi-year increases, it’s not too late to join the party. Instead, the charts below can be interpreted as confirmation of a breakout.

Brent Crude Oil – Price Chart 2021 – 2020 – Price Breakout

Source: IG

Copper – Price Chart 2018 – 2020 – Price Breakout

Source: IG

Corn – Price Chart 2018 – 2020 – Price Breakout

Source: IG

Crowdsourcing information about scam brokers can help others avoid falling into the traps set by disreputable brokers, and you can share your experiences here. If you want to know more about this particular topic or have been scammed by a fraudulent broker, you can also contact us at [email protected]

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2025

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #2 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #3 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #4 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #5 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #6 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox