Bitcoin and Ethereum, the two flagships of the cryptocurrency market, have recently seen their prices go into a tailspin. BTC is the market leader in terms of being a store of value, and ETH the more likely to offer a blockchain-based means of exchange – but both approaches are currently finding little support from investors.

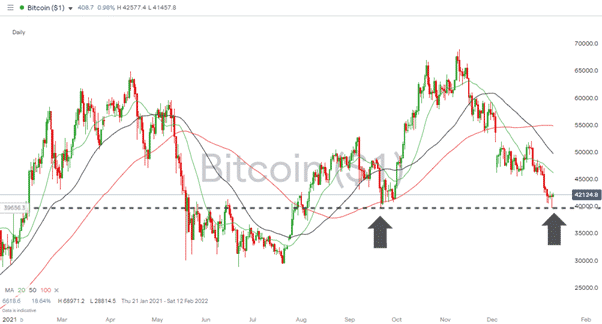

Bitcoin Daily Price Chart – 2021-2020 – At Key Swing-Low Support Level

Source: IG

Bitcoin is already at a key long-term price support level, and Ethereum appears to be heading that way. The question is whether this is part of the usual high volatility crypto experience or the result of a paradigm shift in terms of regulatory restrictions on trading?

The market is supported by specialist crypto platforms and online brokers that offer crypto trading and other asset groups such as equities and forex. The former, the crypto specialists, can appeal to the anti-establishment end of the crypto fan base. They are unregulated and sometimes offer a more comprehensive range of Altcoins, but unfortunately for them, they appear to be firmly in the sights of regulators.

That regulatory oversight has primarily involved authorities offering increasingly stern guidance to retail traders. Crypto markets may have unique characteristics, but prices are still ultimately driven by supply and demand so far.

Regulatory Clampdown On Crypto

In June in the UK, the Financial Conduct Authority (FCA) ruled that the world’s biggest cryptocurrency exchange, Binance, couldn’t conduct any “regulated activity” in the UK. The FCA does not regulate cryptocurrency markets or crypto platforms but requires exchanges to register with them. Binance has not registered with the FCA and, therefore, cannot operate an exchange in the UK.

Asian regulators are also reigning in the market. In September, China’s regulators declared all crypto-related transactions “illegal” and must be banned. The move caused Bitcoin to lose 5.5% of value in one day. Singapore’s intervention included the Monetary Authority of Singapore (MAS) placing the Binance.com platform on the Investor Alert List.

Crypto Price Rally Despite Regulatory Guidance

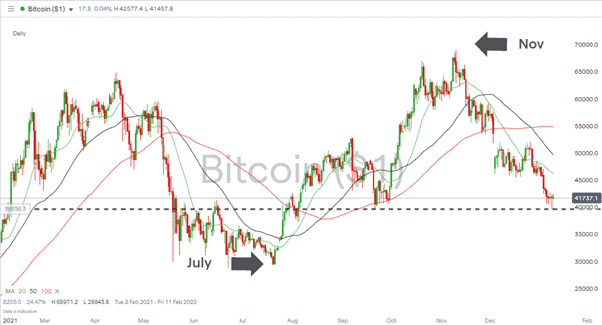

One interesting feature of the market is the lag between the clampdown starting and prices falling. Regulators began applying pressure in Q3 of 2021, but the price of Bitcoin more than doubled between July and November.

Bitcoin Daily Price Chart – 2021-2020 – Q4 Rally

Source: IG

It is also the case that crypto traders and investors can still find ways to access the market. Multi-asset brokers such as eToro provide a user-friendly route into the market which doesn’t involve specialist wallets. The broker is regulated at a higher level – although trades in crypto are not – suggesting that the price moves are so far part of the typical extreme peaks and troughs associated with the market.

Crowdsourcing information about scam brokers can help others avoid falling into the traps set by disreputable brokers and you can share your experiences here. If you want to know more about this particular topic, or have been scammed by a fraudulent broker, you can also contact us at [email protected]

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2025

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #2 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #3 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #4 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #5 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #6 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox