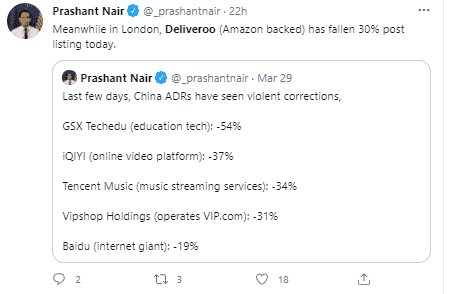

Food delivery service Deliveroo was until Tuesday hailed as a great British tech-story. Following the sale of shares to the public on Wednesday, it is now grabbing headlines for all the wrong reasons. The largest IPO on the London Stock Exchange suffered an immediate 30% price crash as investors baulked at the initial valuation price.

Source: Twitter

The Retail Investors

This is bad news for those who signed up to take shares at the launch price, many of them retail investors who were invited to take part in the float using the firm’s food delivery App. A situation made worse by the T&Cs on their deal that stops them from selling out of the position until the 7th of April. For them, the takeaway turned up cold and unappetising and will be stinking out the bin for another week.

The Banks

JP Morgan and Goldman Sachs led the float and pocketed millions in fees for apparently massively mispricing the stock. They managed to drum up enough buyers to leave the float over-prescribed at launch, but with few details of who the holders are, the banks themselves may have substantial positions on their books. Not a good look in the same week that the Archagos debacle saw some investment bank shares down more than 10%.

The Founder

Will Shu, Deliveroo’s founder, saw the value of his holding tumble from £449m to ‘only’ £334m.

The Hedgies

More bad news for early-bird buyers of Deliveroo shares came when it was reported that hedge fund managers had already sourced stock-borrow positions in the shares. They’ve begun shorting the stock and can generate more downward momentum.

If professional experts at Goldman Sachs and JP Morgan can get the valuation so wrong, what hope is there for retail investors? One factor to bear in mind is that none of the negative price influences is new. There were no skeletons found in the closet. For those considering buying in at these low levels, it’s a case of weighing up well-known pros and cons.

The Cons

- Fundamentals – Deliveroo is haemorrhaging money and didn’t even have a good pandemic, with revenue growth failing to take off in the same way it did for other firms. Reforms of ‘gig economy’ labour practises could scupper the firm’s access to cheap labour.

- End of lockdown – the firm didn’t benefit as expected from the Covid lockdown, and it could suffer from a return to more traditional eating habits. Netflix and Amazon Prime both developed their customer base in 2020 and being subscription services will find many remain with them through natural consumer inertia. Deliveroo, on the other hand, relies on impulse buying.

- Reputational risk & competition – Leaving your loyal customers on the hook with a 30% loss is bad enough, but with Uber Eats and Just Eat providing similar services, the stock market flop could have repercussions for the core business.

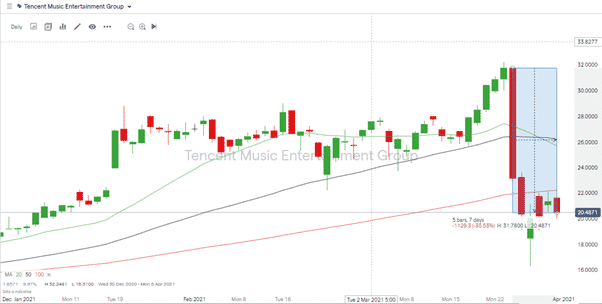

Source: Twitter

Source: IG

The Pros

- Tech sell-off – Timing is everything for IPOs. Deliveroo came to the market just as high-profile tech stocks around the world took massive haircuts. Music streaming service Tencent Music has lost more than 35% of its value in the space of one week.

- Ocado – There are precedents for high-profile launches flopping and then recovering. Deliveroo might not necessarily enjoy the same rebound as online retailer Ocado, but nothing can be dismissed.

Source: IG

If you want to know more about this topic, or have been scammed by a fraudulent broker, please contact us at [email protected]

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2025

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #2 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #3 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #4 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #5 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #6 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox