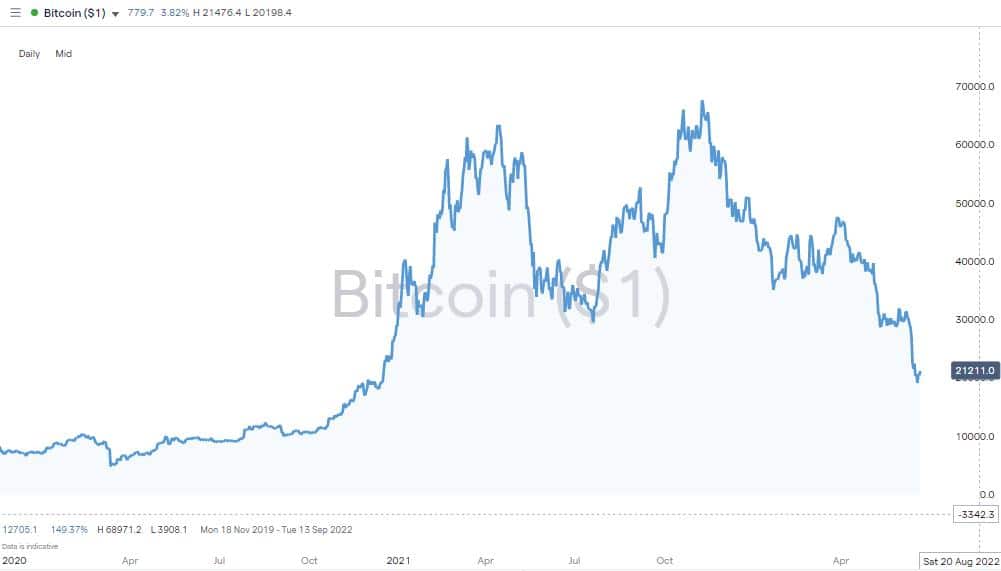

The recent crypto price crash has been extreme, even by the sector’s own high-octane standards. On a month-to-date basis, Bitcoin is currently down an eye-watering 33%. Explanations for the selloff range from those based on fundamental analysis to worrying allegations of insider trading and market manipulation.

Fingers are being pointed in all directions. One outcome is that a group of investors are interpreting the current price crash as a managed shake-down – one designed to force prices down to levels where big players can put on sizeable positions at rock-bottom prices. If this is the case, then should smaller players also be looking to put on the trade of a lifetime?

Bitcoin (BTC) – Daily Price Chart –2019 – June 2022

Source: IG

SEC Clamps Down On Crypto Insider Trading

Blockchain technology allows crypto traders to operate with complete anonymity. Whether you see this as proof that it is the technology of the future, or a murky world open to exploitation depends on your view of the crypto revolution. The SEC falls firmly in the second camp and has recently started a campaign aiming to clamp down on insider dealing, with some of the biggest specialist crypto exchanges being firmly in their sights.

According to Fox News, the regulator has sent a letter to an unnamed major crypto platform that requests information about how the company protects users from insider trading. The view being taken is that the investigation covers a number of other high-profile exchanges as well.

It’s currently unclear whether the wide-ranging enquiry is being led by the SEC’s enforcement division or the Division of Examinations. If it’s the former, then the stakes are being raised and would suggest the SEC is increasingly concerned about potentially serious breaches of the regulatory code.

The SEC has also recently announced it has taken on 20 new staff at its unit, which is responsible for protecting investors in crypto markets and from cyber-related threats. The almost doubling of the workforce gives an indication of how serious the agency is taking the threat. If the current price slump is down to market manipulation and those with inside information driving down prices, then the SEC could soon have enough information to work with.

Insider Trading and Crypto Prices

For investors wondering if this is a dip to buy, part of the question is whether removing the Wild-West element of the industry would result in it losing its appeal. The tech-minded ‘alternative’ investors who kicked off the crypto trend cherish the rebellious nature of blockchain protocols. On the other hand, this could be the last price crash before the industry becomes more regulated and more mainstream and possibly achieves its aim of becoming the global currency of the future.

Crowdsourcing information about scam brokers can help others avoid falling into the traps set by disreputable brokers and you can share your experiences here. If you would like to know more about this particular topic or have been scammed by a fraudulent broker, you can also contact us at [email protected].

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2025

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #2 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #3 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #4 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #5 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #6 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox