One of the arguments put forward by fans of cryptos is that digital coins could play a similar role to gold as a safe-haven asset – a way of protecting wealth when geopolitical risk becomes a significant concern. Some similarities between the asset groups make the argument relatively plausible; however, price rises in the big coins haven’t matched the recent uptick in global stress levels.

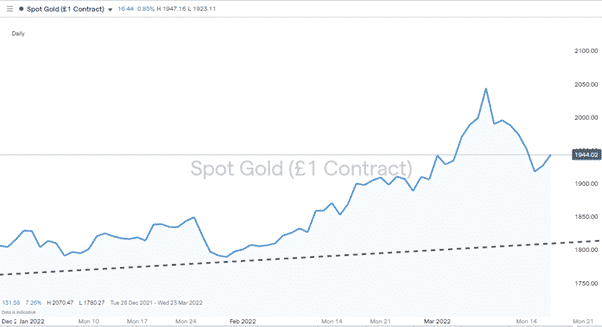

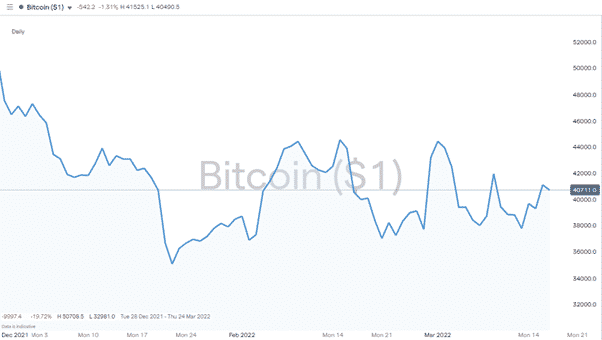

This is despite the first quarter of 2022 seeing financial markets rocked by news events that have sent prices in various asset groups shooting off in different directions. Gold is one of them, and since January 1st, the price of gold has risen by as much as 11.3%. At the same time, Bitcoin’s price has headed in the other direction, and at one point (22nd January), it was showing a year-to-date loss of 24.29%.

Gold Price Chart – 2022 Year to date

Source: IG

Bitcoin Price Chart – 2022 Year to date

Source: IG

Crypto prices are notoriously volatile, so that some divergence can be expected. Still, the fact remains that the world’s traditional safe-haven asset has made a YTD gain, and its proposed digital equivalent posted a loss. A hard circle for crypto bulls pushing the safe-haven argument to square.

Who Is Buying and Selling Crypto?

The disparity between the fortunes of the two assets has been highlighted by reports that Russian oligarchs are buying into crypto to protect their wealth from sanctions. This would represent buyers following the safe-haven strategy. Mainstream exchanges such as Coinbase and Binance have complied with regulatory directives and cracked down on transactions originating out of Russia. But there are still 400 known platforms doing business with the country, so the buying pressure could be real.

What the reports could be missing is that despite the enormous wealth of the oligarchs, the amount of liquid assets which could be moved to the blockchain is unknown. With super-yachts and offshore properties being embargoed, the move by sanctioned individuals into crypto might not be on the scale some are suggesting. It’s a good news story, but possibly not the main price driver with Bitcointradevolume.com calculating that daily trade volumes in BTC are currently $4.4bn.

What Does This Mean For Crypto?

Considering gold has been traded longer than anyone can remember, and Bitcoin was first created in 2008, there is a significant discrepancy in the amount of time crypto has been able to develop a reputation as a safe-haven asset.

The question for fans of cryptos is how long are they willing to wait for an indication that Bitcoin and Altcoins could develop the kudos required to be a ‘go-to’ asset during extreme market conditions?

With the answer to that question still uncertain, the value of cryptos is still based on their use as a store of value or a means of transaction. The pre-eminent coin, Bitcoin, does well on the first of those metrics but poorly on the second. Other coins such as Ether are making strides in being a usable currency, but it can still take between five seconds and 15 minutes for a transaction to process on Ethereum. That issue impacts the rest of the world’s population when they buy a coffee on the way to work and outweighs any possible manoeuvres by a few very wealthy individuals.

Crowdsourcing information about scam brokers can help others avoid falling into the traps set by disreputable brokers and you can share your experiences here. If you want to know more about this particular topic, or have been scammed by a fraudulent broker, you can also contact us at [email protected]

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2025

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #2 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #3 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #4 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #5 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #6 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox