In the first two weeks of 2021, the financial markets have thrown up more questions than answers. Price moves have been dramatic in some asset groups.

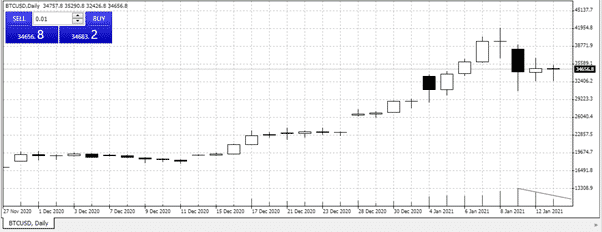

- In the first five days of 2021 Bitcoin increased in value by 50.13%

- In the subsequent four trading sessions, BTCUSD fell in value by 27.83%

- It’s not only cryptos posting high price volatility. The FTSE 100 increased in value by 7.81% in the first trading week of 2021

- Between the 6th and the 11th of January silver gave up 12.86% of its value

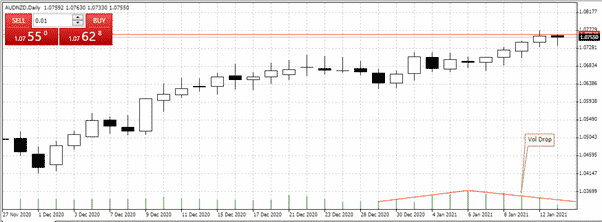

AUDNZD – Daily chart – drop in volumes

Source: FXTM

BTCUSD – Daily chart – drop in volumes

Source: FXTM

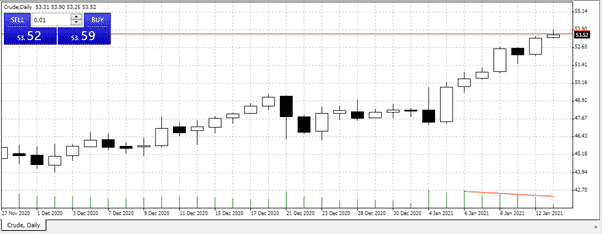

US Crude Oil – Daily chart – drop in volumes

Source: FXTM

Those looking to put on positions but who haven’t been able to find the right entry point can with some justification point to a range of conflicting indicators.

- Covid-19 infection rates are proving hard to reign in while vaccination programmes are ramping up.

- US Federal Reserve is due to meet on 26th – 27th January. Pre-summit comments from Atlanta Fed President Raphael Bostic and Dallas Fed President Robert Kaplan have suggested tapering of QE might come into play before 2021 is out. That contradicts the current stated position of the FOMC.

- Trading volumes have dropped off in all markets (see charts above).

- Geopolitical risk has ramped up. The fact that some slow-burn geo-pol issues aren’t making the news headlines is not because they’ve gone away, it’s just that more pressing topics, as below, have come into play.

- Rise of Hindu nationalism in India

- Iran restarting its nuclear weapons programme

- Nationalist-populism in Brazil

- Threats to the EU from a Eurosceptic Italy and the UK’s transition from the group going relatively smoothly

One of the essential lessons in trading is to work off the markets that are actually in front of you, not the ones you would like in front of you.

How to Safely Trade the Current Markets

With a range of catalysts in position to cause a price surge but little certainty about whether that move would be up or down, there is a risk that FOMO might cloud trading decisions.

No-one likes to feel they missed out on trades, particularly ones they were ‘sure’ about but avoided because a couple of supporting indicators weren’t fully aligned. Trading on a Demo account is one option; however, they can build rather than release frustration, particularly if a large but unfortunately virtual profit is made.

In these markets, it’s almost as important not to lose money as it is to make some. That brings the ‘least-bad-approach’ of a micro account to the top of the ‘to do’ list.

Brokers such as FXTM offer accounts with very small minimum deposit requirements. More importantly, they are fully functioning live accounts, with tight spreads, full regulatory protection and all the other trading tools.

More importantly, the Cent account at FXTM will generate a real P&L, just not one that will be large enough to blow up your account before the trading year gets properly underway.

If you want to know more about this topic or have been scammed by a fraudulent broker, please contact us at [email protected]

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2025

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #2 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #3 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #4 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #5 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #6 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox