Written on 03/08/2020 by Theunis Kruger, FX Trainer at FXTM

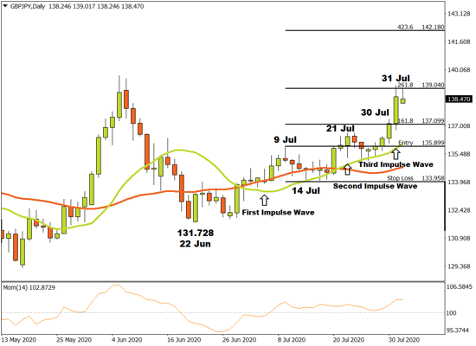

A possible bullish scenario was observed on July the 20th in the GBPJPY currency pair on the D1 time-frame. On July the 21st, the bulls decided to stay and a long position was triggered when demand overcame supply. It is necessary to know that it is good practice to take a calculating risk with any trade, as there is no way to know or predict the market movements after the trade is in place.

Placing a stop-loss at a logical pre-determined level helps to protect your trading capital if the market direction changes unexpectedly for some reason. Although it might be the beginning of a new uptrend from a structural point of view, how far the demand will take the market can never be accurately forecast.

After the GBPJPY currency pair crossed the critical resistance level at 135.899 on July the 21st, a higher top was formed and the bears tried to pull the market lower.

During this downward move, any traders that did not plan their money management properly might have succumbed to emotions of fear and closed the position while still in a confirmed early stage of an uptrend. Using the Fibonacci tool with extensions and taking partial profit, a high probability money management process can be used to effectively manage not only risk but more importantly, mental pressure as well.

The first target at 137.099 (161 %) was reached on July the 30th and with a surprising boost in demand pressure, the second price target at 139.040 (261.8%) was triggered on the 31st of July. With a third upward impulse wave in progress, a corrective wave might be anticipated before a possible fourth impulse wave where the third and final target might be touched at 142.180 (423.6%) if the upward momentum continues.

As long as the upward bias remains intact and demand overcomes supply, the outlook for the GBPJPY currency pair on the Daily time-frame will remain bullish.

For more information, please visit: FXTM

Disclaimer: This written/visual material is comprised of personal opinions and ideas. The content should not be construed as containing any type of investment advice and/or a solicitation for any transactions. It does not imply an obligation to purchase investment services, nor does it guarantee or predict future performance. FXTM, its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness of any information or data made available and assume no liability for any loss arising from any investment based on the same.

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2025

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #2 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #3 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #4 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #5 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #6 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox