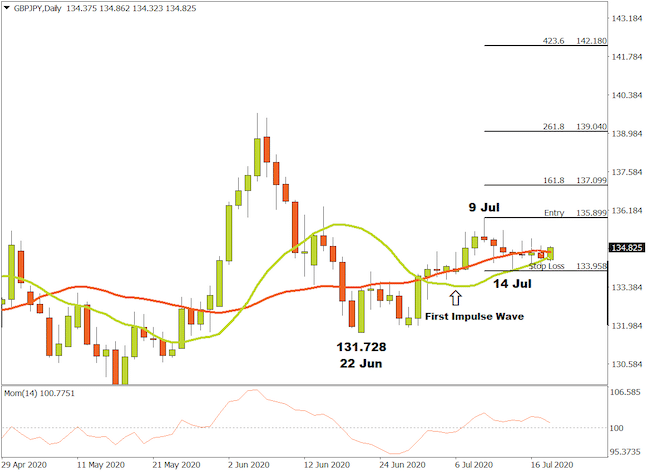

Until 22nd June, the GBP/JPY currency pairing (D1 time-frame) had been influenced by a bearish drive. Following that date, a lower bottom formed at 131.728. Bullish sentiment then prevailed.

Following this, the price continued to move upwards, through the Simple Moving Averages of 15 and 34. The Momentum Oscillator also crossed into the zero baseline, which may have made technical traders aware of a possible new uptrend.

A critical resistance level formed at at 135.899 on 9th July, whereby the bears attempted to pull the market lower. A higher bottom at 133.958 then formed on 14th July. At present, the market is being pulled toward the top of the price chart.

If the GBP/JPY currency pair cross the critical resistance level of 135.899, three price targets could be calculated from that point. By using the Fibonacci tool at the higher top (135.899) and moving it to the support area (133.958), a number of targets could be brought into consideration. The first target could be projected at 137.099 (161 %) and the next is likely at 139.040 (261.8%). A third target could be expected at 142.180 (423.6%) if this upward momentum does continue.

Should the 133.958 support level be achieved, the bullish scenario would no longer be valid and may be required for review.

If the upward momentum remains and the demand exceeds supply, the outlook for the GBP/JPY daily time-frame will stay at a bullish level.

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2024

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex & CFD Broker |

Best Trading Conditions

Visit broker

|

||

| #2 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #3 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #4 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #5 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #6 |

|

Global CFD & FX Broker |

ALL-INCLUSIVE TRADING PLATFORM

Visit broker

|

||

| #7 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #8 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox