2018 will go down in history as a year of struggle for the retail forex brokerage community, especially in the EU where the preponderance of enterprises has chosen to place their headquarters. If it were not the new MiFID II rules that went into effect in January, then surely the ESMA crackdown on the industry in the summer months was just one more, bitter pill to swallow. Industry volumes had already been slipping a bit when the year commenced, but new ESMA regs related to binary options, CFDs, and forex have cut deeply into what used to be a thriving component of the industry.

The first salvo, MiFID II, had been debated for years, but its implementation was designed to modify marketing behavior across the entire EU investment arena, not just retail forex trading. Per one analyst: “The updated rulebook affects every corner of the continent’s financial services system. It was designed to offer greater protection for investors and inject more competition into the trading of all asset classes. Rules designed to curb inducements, which affected brokers who offered research for free as a ploy to attract managers to trade with them, have begun to hurt brokers, who have suffered a dramatic fall in commissions. According to one report, Commissions paid to brokers dropped 28 per cent in the UK during the first quarter compared with the same quarter in 2017.”

Marketing distribution kingpins also mucked up the works, as these new rules went into effect: “One minute you’re using Google Adwords and posting to social media. The next, you’re staring finance-related ad bans in the face from social giants such as Facebook, Instagram, Google, Twitter, Snapchat, MailChimp and more. As more and more companies jumped on the regulation bandwagon in a bid to prevent unlawful advertising from ICO scammers and such, it’s fair to say that forex brokers were left in a bit of a muddle, as they struggled to revamp their marketing plans.”

As if these changes were not enough, General Data Protection Regulation (GDPR) was also commanding precious resources to revise the way that you contacted your customers. Mailing lists had to be updated to protect consumer rights, while confusion still reigns over how to go about fulfilling its directives. Yes, consumers were to have control of their personal data, but the need for enhanced security protections translated to more calls for private consultants to eat away at already thin margins.

And then came ESMA’s crackdown on binary options, CFDs, and rolling forex. Binary options were banned for three months, beginning in July, while stricter operating and leverage rules were applied to CFDs in August. Both sets of rules were designed to be temporary, which added to the uncertainty of their long-term intent, and, after the initial three month period for both, ESMA announced that timeframes would be extended another three months. In the meantime, if your traders met a defined “professional test”, then they were immune from the new rules. The IG Group, for one, claimed that 50% of its client base qualified.

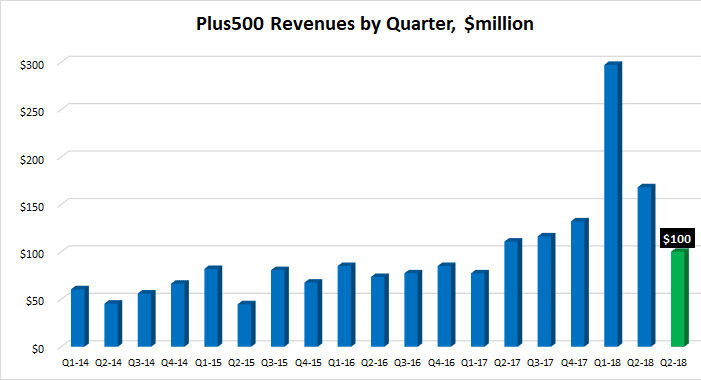

What have been the financial impacts? We noted the drop in commissions of 28%, but the results of the ESMA actions are just now coming to light, as the titans in the industry, those traded on the London Stock Exchange and elsewhere, weigh in on third quarter earnings. As public companies, these entities had already forewarned their shareholders in previous guidance statements that revenues and earnings would take a material hit in the months to come. How big of a hit? Plus500* has already announced that revenues fell 40%, when comparing Q3 to Q2 of this year. Gulp!

*81% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

How has the MiFID II direction been received?

Market volatility may be the top concern for brokerage houses, but a recent survey actually revealed that, “The Markets in Financial Instruments Directive II is considered the second biggest challenge facing financial advisers in the UK, greater than Brexit, cyber security, and macroeconomic risks. The findings also show that more than half of advisers believe MiFID II has been an “unnecessary burden”, with a similar number seeing the regulation as a “waste of time and money”.”

As you might expect, most of the survey’s 1,000 respondents failed to see the rationale of the directive, which was designed “to harmonise regulation for investment services across EU member states.” There was also a consensus that fees would have to increase to fund these changes, which may take more time that expected to be implemented. There was also a concern that rules were devised under the presumption that London, the accepted dominant player in EU financial markets, would remain in the trading bloc. The hope now is that European elections next spring might change seats of power and allow for a more accommodative set of consumer protection rules.

As for retail forex brokers, the “ESMA Effect” is rippling through the industry.

The guessing game is over. There has been all manner of speculation as to what the impact of stricter rules on the fastest growing sector of the industry might be, but until actual earnings reports for the September-ending quarter are released, the real evidence and materiality of financial impacts continues to be the big unknown. Yes, guidance guesses have appeared in previous quarterly reports that cite anywhere from 10% to 30% shortfalls, those reports emanating from the “Big Four” trading titans in London, i.e., The IG Group, Playtech, Plus500*, and CMC Markets.

Plus500* recently released its Quarter Three Trading Update, and it is not encouraging. Revenues for the third quarter, which contained two months where the new CFD leverage caps were in place, were down 40% compared to the previous quarter, but only 14% down when compared to the same quarter from a year ago.

*81% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Additional negative details relate to client profitability and the cost of acquiring new customers. Per one report: “The “ESMA effect” was most noticeable when looking at Plus500’s* ARPU, or average revenue per customer. Q3 ARPU came in at $981, versus $1,232 in Q3 last year. (Low market volatility during Q3 didn’t help matters much either). Meanwhile the company’s cost of acquiring a new client rose significantly, up to $1,581, versus just $677 in the first six months of the year.” The company also mentioned that 8% of its “professional” clients accounted for 38% of revenues, and that, going forward, only 30% of its revenues would be at risk of the “ESMA Effect”.

The IG Group was actually the first to report on earnings impacts, but only because the firm happens to have adopted a 31 May fiscal yearend. IG reported a month back, but, in its case, only the month of August would have displayed the “ESMA Effect”. Overall for the company, revenues were down by 5%, when comparing Q1 of this fiscal year with the same quarter a year back. Management cited both the imposition of new ESMA rules, as well as volatility, as the reasons for the decline. It also noted its success of classifying 50% of its account base as “professional traders”, the reason for the muted impact.

In its early release of its Trading Update, CMC Markets spoke first about low volatility and range-bound markets as the key reasons that volumes and revenues were down for its September-ending quarter. Management actually claimed that it was too early draw any real conclusions about the impact of ESMA restrictions, but they did re-forecast their estimates for a full-year impact to 20%. Previously, management’s predictions had fallen in the 10 to 15% range.

Playtech, actually the second largest of the four by market capitalization, has yet to publish its Q3 report. The firm, however, has had a spate of bad luck of late. As we recently wrote: “Playtech stumbled along, having to make not one but two earnings warnings, the kiss of death, when it comes to impressing investors. Shares promptly lost another third of their value. Despite a few bumps along the way, Playtech’s newly created Financial Division was busy delivering increasing year-over-year revenue growth from 2016 onward. These revenues, however, account for something just north of 12% of total revenues. The problems were with the core business and concentrated in Asia.” The firm has yet to give any material guidance on possible headwinds from ESMA rules.

Are there any positive signs regarding revenue growth in the forex industry?

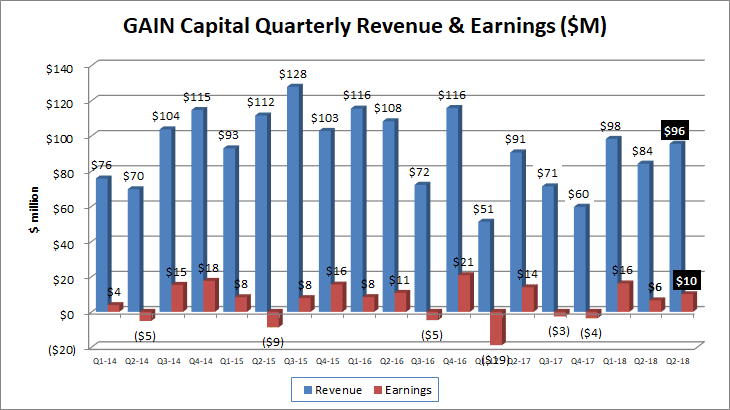

What about a large forex house traded on a public stock exchange? GAIN Capital released its third quarter earnings report last week. GAIN owns the popular Forex.com franchise and “reported its financial results for Q3-2018, indicating a healthy rise in Revenues and profitability during the third quarter of 2018, despite a drop off in trading volumes and the sale of the company’s GTX institutional division. Overall for Q3, Revenues at GAIN Capital came in at $95.5 million, 13% above Q2’s $84.2 million. The company’s Q3 net profit of $10.0 million compares to a net profit of $6.5 million in Q2.”

With all the talk about a lack of volatility and that market behavior has been totally range bound, not exactly the best conditions for trading in any venue, you would think that the entire industry would be suffering from a systemic slowdown in transactional business. If you first look to the big players like the Chicago Mercantile Exchange (CME), you can get a general perspective, based on futures trading alone. The CME just released its data for the third quarter. On one call, its management team admitted that trading volumes have slowed on exchanges around the world, after a robust first half. They did note strength in the FX futures arena, but their average daily volume for all products did decline by one percent for the quarter, not material, but a decline just the same.

By the looks of this chart, a favorable revenue trend began in early 2017 and continues:

Concluding Remarks

2018 has been a rough year for brokers in our industry. Volume slowdowns require attention to ensure positive earnings flows, liquidity, and outright survival in a very competitive marketplace. If that were the only story, then so be it, but there has also been an avalanche of new legislative regulations, many curbing the ability to generate revenue and acquire new customers, issues related to the viability of the enterprise.

Yes, volumes have receded, and yes, volatility has led to several range-bound situations, but the “ESMA Effect” still weighs heavy on the industry. In any event, monitor your broker carefully to assess how it is faring the regulatory storm and volume pullback. If something does not seem right, then you might want to consider a change.

We can help.

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2025

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #2 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #3 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #4 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #5 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #6 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox