Author – Bilal Jafar

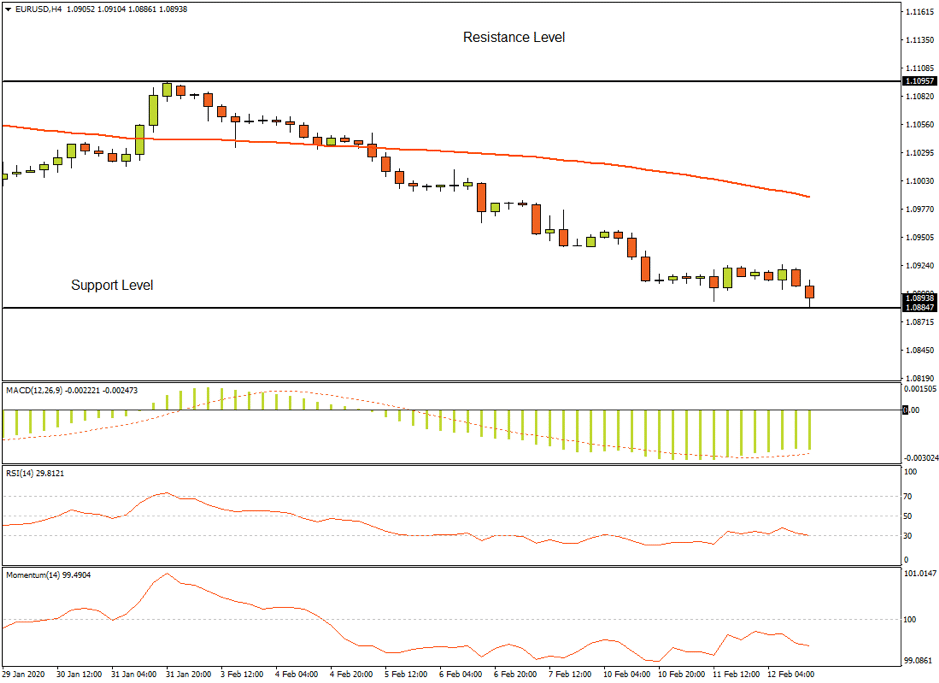

The EURUSD on the 4-hour timeframe remains under extreme selling pressure as the currency pair reached 1.08847, a level not seen since October 2019. The pair dipped below the key level of 1.09000 on February 12 and registered the lowest level of the period under study at 1.08847. Price action in the EURUSD is mainly driven by the recent strength in the US Dollar.

On the technical side, sellers are keeping a close eye on the lowest level of 2019 at 1.08789. A break below this level could strengthen the argument for further bearish movements. The price is currently trading below the 50-period Simple Moving Average with negative Moving Average Convergence/Divergence (MACD).

Technical Analysis

As the 4-hour chart illustrates, the currency pair is making successively lower tops and lower bottoms since January 31. As of writing, the price is hovering around 1.08938. Bears are in full control of the market as the current price is trading near the lowest level of 2020.

Technical Indicators

By applying Oscillators analysis, all four key technical indicators confirm the negative bias in the market. As the chart shows, the price is currently trading below the 50-period Simple Moving Average. The MACD is recording values below the zero-line. As of now, the momentum is below the key level of 100, which shows that the downside move is strong. Relative Strength Index is showing values below the 50 mark which supports the selling pressure.

In an alternative scenario, the key resistance level lies at 1.10957 registered on January 31, bulls must break this level in order to regain the bullish sentiment.

For more information, please visit: FXTM

Disclaimer: This written/visual material is comprised of personal opinions and ideas. The content should not be construed as containing any type of investment advice and/or a solicitation for any transactions. It does not imply an obligation to purchase investment services, nor does it guarantee or predict future performance. FXTM, its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness of any information or data made available and assume no liability for any loss arising from any investment based on the same.

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 81% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2024

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex & CFD Broker |

Best Trading Conditions

Visit broker

|

||

| #2 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #3 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #4 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #5 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #6 |

|

Global CFD & FX Broker |

ALL-INCLUSIVE TRADING PLATFORM

Visit broker

|

||

| #7 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #8 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox