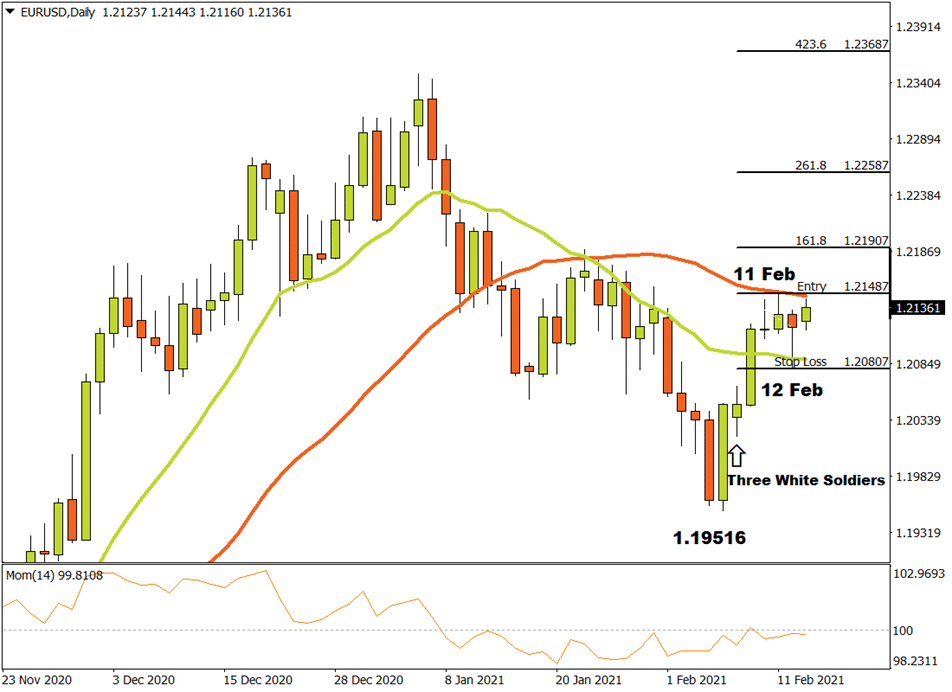

The bears maintained a strong grip on the EURUSD currency pair on the D1 time-frame, which encouraged a downtrend until 5th February. A lower bottom occurred at 1.19516 — the low price appealing to the bulls as they started entering the market.

This caused the price to be driven upwards. It was this motion that allowed the market to surpass the 15 Simple Moving Average, briefly touching the 34 Simple Moving Average. Also, the Momentum Oscillator momentarily passed the zero baseline into the green and a Three White Soldiers Candle Pattern formed during the bullish upward action. As such, technical traders would have noted that a new trend was possibly in the making.

With the market having made a top and realising the possibility of critical resistance level on 11th February at 1.21487, the bears tried to regain control without success. A higher bottom formed on 12th February at 1.20807, which was an indication of the bulls having put up a strong fight.

If the price of the EURUSD makes it past the critical resistance level of 1.21487, then a possible three price targets may be calculated. If traders apply the Fibonacci tool to the 1.21487 resistance level and drag it to a support level close to the 15 Simple Moving Average at 1.20807, a projection of the first target can be made at 1.21907 (161 %). It’s likely that the second price target will be at 1.22587 (261.8%) and the third and final target may be expected at 1.23687 (423.6%), should the uptrend continue.

The bullish scenario will need to be revised if the support level of 1.20807 formed at the higher bottom is reached.

On the condition that market players maintain positive sentiment towards the currency pair, and there remains a demand that overwhelms supply, the outlook for the EURUSD pair will remain bullish.

For more information, please visit: FXTM

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2024

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex & CFD Broker |

Best Trading Conditions

Visit broker

|

||

| #2 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #3 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #4 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #5 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #6 |

|

Global CFD & FX Broker |

ALL-INCLUSIVE TRADING PLATFORM

Visit broker

|

||

| #7 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #8 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox