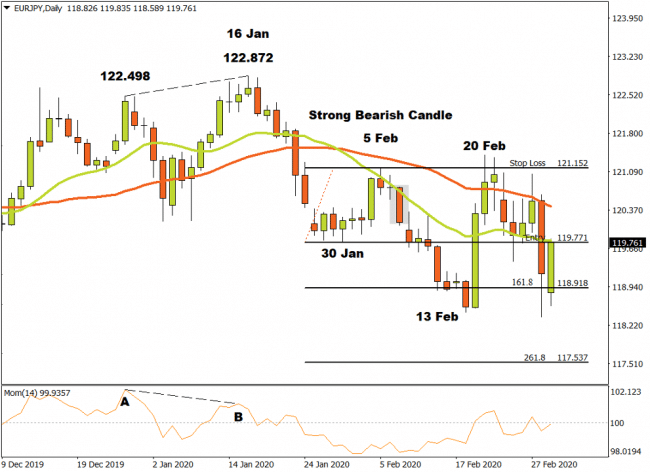

On February 17 a situation was deliberated where the EURJPY currency pair was in the early stage of a new downtrend with a short position triggered and reached its first target. It is important to emphasize the fact that after a possible set-up is identified, it is critical to work out exactly what the calculated risk will be and just as important to know where the possible targets will be. We have to accept the fact that we do not know what the market will do but we can identify and act on a set-up as defined by our strategy or method and know how to manage any resulting risk accordingly. The advantage of this can be clearly demonstrated in the EURJPY currency pair situation.

After the short position was triggered on February 10 and the first target reached on February 13, a news event caused a dramatic bullish reaction and buyers flooded the market. The market broke through the 15 and 34 Simple Moving Averages and the Momentum Oscillator broke through the zero baseline into positive terrain. In the process the resistance level at 121.152 was broken, the anticipated scenario was invalidated and the short position was liquidated to protect trading capital.

Important to note is the fact that when the first target that was reached and part of the open position closed, this has reduced the remaining open risk.

As long as sellers and buyers maintain an impartial sentiment with neither supply nor demand dominating, the outlook for the EURJPY currency pair on the Daily time-frame will remain neutral.

For more information, please visit: FXTM

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2025

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #2 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #3 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #4 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #5 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #6 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox