Headlines this week have been replete with stories related to the Bank for International Settlements (BIS) finally publishing its long-awaited 75-page tome on a new “Code of Conduct” for the wholesale foreign exchange industry. The world’s largest banks have all been found guilty, assessed fines in excess of $10 billion, and been scolded like children in the press for committing what has been termed the greatest scandal in the history of the forex industry. Reputations have been severely tarnished, and the public’s trust for these enormous financial institutions has been sullied to the point of extinction.

It was nearly one year to the day that the BIS published its thoughts for resurrecting the image of Interbank market players. A blueprint for fair play and transparency became a project that every large banking executive could grab onto, support, and speak eloquently about, as if a lifesaver had been thrown to a drowning bunch of thieves. In times like these, it is often the case that our friendly bank’sters will gloriously take to the high road, eschewing the low and unscrupulous ones that had somehow infiltrated their ranks, committed unspeakable crimes, and now were gone forever.

Has the problem really been fixed? As Yogi Berra would say, “It is Déjà vu all over again!” We heard this same tune back after the Great Recession, when out favorite bank’ster buddies were caught selling worthless securities to every investor, pension fund, and government entity across the planet and never disclosing the potential for loss or an accurate rating of the risk of those suspect securities. Every senior executive was appalled by the behavior of “those down in the ranks”, but not a single person went to jail. Large fines were paid and absorbed, as if they were just a cost of doing business.

In case you missed it, a brief recap of a scandal of monumental proportions

We have written several articles on this topic over the past two to three years (Yes, it has been that long in the making, but only once it was discovered). In May of 2015, we wrote the following summary:

“Was this some fly-by-night scheme that traders used to amuse themselves? According to U.S. Attorney General Loretta Lynch, these actions were a “brazen display of collusion” and “you-scratch-my-back-and-I’ll-scratch-yours forms of plotting” that spanned a 5-year continuous time period. Press releases disclosed the following details:

- “Five major banks Wednesday agreed to plead guilty to criminal charges and pay more than $5.5 billion in collective penalties to settle charges their traders routinely manipulated the world’s foreign-exchange market for their own profit.”

- “Swiss banking giant UBS agreed Wednesday to pay $545 million to settle a probe by U.S. authorities into its role in manipulating interest and currency rates.”

- “The Department of Justice, the Federal Reserve and other U.S. and European authorities and regulators said corporate units of Citicorp(C), JPMorgan Chase (JPM), London-based Barclays (BCS) and Royal Bank of Scotland (RBS) acknowledged their traders rigged foreign exchange prices of U.S. dollars and euros from Dec. 2007 to Jan. 2013.”

- “The $2.5 billion in criminal fines levied as part of the resolutions represent the largest federal anti-trust penalties ever obtained by U.S. authorities.”

Lynch went on to say that, “Starting as early as Dec 2007, currency traders at several multinational banks formed a group dubbed ‘The Cartel.’ It is perhaps fitting that those traders chose that name, as it aptly describes the brazenly illegal behavior they were engaging in on a near-daily basis.” The prices in the foreign exchange market “influence virtually every sector of every economy in the world.” The actions of these traders “inflated the banks’ profits while harming countless consumers, investors and institutions around the globe — from pension funds to major corporations, and including the banks’ own customers.”

The legal actions taken apply primarily to the U.S. market. Regulators and law enforcement officials across the globe, however, jumped on the bandwagon and exacted their own form of domestic justice. Our largest banks had rigged the system and had been caught with their hands in the forex cookie jar. What do senior executives do when hoisted on their own petards in such a fashion? Plead complete ignorance, of course! How dare anyone besmirch the reputation of the entity that has created outrageous profits at the public’s expense. They usually wait until their annual bonuses have been deposited securely in their personal bank accounts before making such frivolous claims, on advice of counsel, no less.

What exactly is the Forex Code of Conduct?

The BIS was the perfect foil to raise our sullen bank’sters from the proverbial ashes. Someone needed to do something to restore the public’s confidence in the largest financial institutions across the globe. The BIS announced its intentions a year ago and began the process of finalizing the all important “Code of Conduct” that would guide wholesale foreign exchange trading back down the path of integrity and all that is right in the world. Can you hear the angels singing and organ music in the background? A resurrection is in progress, but, of course, justice and truth cannot be rushed!

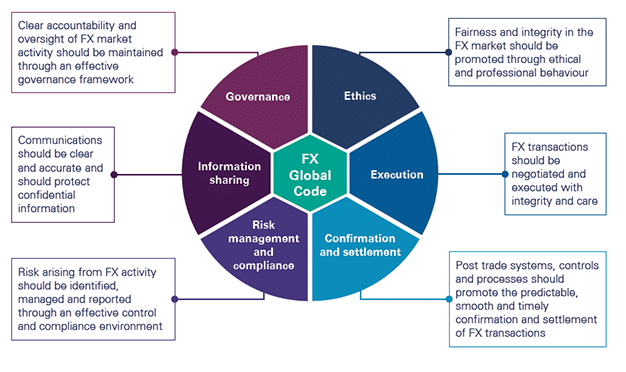

Here is one line-by-line recap, summarized by a group of interested attorneys of the six major tenets of this new code:

1) Ethics: Market Participants are expected to behave in an ethical and professional manner to promote the fairness and integrity of the FX Market.

2) Governance: Market Participants are expected to have a sound and effective governance framework to provide for clear responsibility for and comprehensive oversight of their FX Market activity and to promote responsible engagement in the FX market.

3) Execution: Market Participants are expected to exercise care when negotiating and executing transactions in order to promote a robust, fair, open, liquid and appropriately transparent FX Market.

4) Information Sharing: Market Participants are expected to be clear and accurate in their communications and to protect confidential information while promoting effective communication that supports a robust, fair, open, liquid and appropriately transparent FX Market.

5) Risk Management and Compliance: Market Participants are expected to promote and maintain a robust control and a compliance environment to effectively identify, manage and report on the risks associated with their engagement in the FX Market.

6) Confirmation and Settlement Processes: Market Participants are expected to put in place robust, efficient, transparent and risk-mitigating post-trade processes to promote the predictable, smooth and timely settlement of transactions in the FX Market.

What has been the initial public response to such maneuverings?

As you might expect, there have been many glowing testimonials in the press as to how these wonderful tablets delivered from on high will re-establish credibility and suddenly remove the cause for the problem in the first place – our bank’sters’ insatiable greed for profits and large bonuses. Their greed is at the bottom of these problems. A Code of Conduct is a nice thing to have, but it will not clean up the industry. Here is how the BIS project leader summed up the proceedings:

- David Puth, CEO of CLS and Chairman of the Bank for International Settlements’ Market Participants Group: “The public perception of financial markets, deeply shaken by the financial crisis of 2008, was made worse by certain behaviors in the foreign exchange (FX) market. To help restore trust in the FX market, the industry has come together around a set of common principles and best practices – the FX Global Code. The Code is about how we can build a stronger marketplace, by working together across the public and private sectors to identify the best practices for the industry. We are far from done. However, I think we are in a position to begin to restore confidence, public trust and promote the effective functioning of the wholesale FX market, and ultimately build a better marketplace.

Not a single spokesperson was heard from the major offending members of bank-dom. They chose to remain in the shadows. There was one contrary voice:

Rodriguez Valladares, who trains banks and financial regulators as managing principal of MRV Associates in New York: “I’m embarrassed that we have to have a code in which people say they’re going to avoid conflicts of interest and abide by ethical practices. When you have things like codes and principles, it’s an even longer path to get it into industry practice.”

What does it all mean for both the short and long term?

It will easily take major banks a year or more to institute new policies across the board to incorporate these new ideals. Principles are one thing, but trying to convert them to operating rules that everyone understands will take more time. Regulators will take many years, as well, to develop audit plans to ensure compliance. Legislating integrity has never been an exercise that worked in the past. Banks are still fighting the new rules and regulations that followed the Great Recession, a testament of their will to have their way, regardless of the consequences.

It will be a sad state of affairs, however, if large banks use this new Code as a weapon against smaller participants in the industry. They will surely claim that smaller banks, brokers, and financial third parties are guilty of worse sins. Regulators should focus on them, shut down the offenders, and force foreign exchange trading into national exchanges, tightly controlled to force transparency. These tactics have been used in the past to gain market share by forcing smaller players to exit stage left.

The amusing part of this story is that the “Top Ten” banks in the world have paid a greater price than just the $10 billion in fines that have been assessed. Euromoney recently released its latest statistics on forex trading volumes. From 2009 to the present, the “Top Ten” dropped market share from 80% down to 63% over the past eight years. Traders have spoken with their feet! Hooray for competition!

Concluding Remarks

As we wrote in 2015, “Have bankers gotten the message? Did $6 billion in fines wake them up? If you combine another $4 billion in November fines, the total of $10 billion only represents roughly 20% of the sum of forex revenues for these banks over these five years. While the fines and bad press may be embarrassing for each of the banks in question, these global leaders will not retreat from the foreign exchange business.”

The new Code of Conduct is but a first step to something that will be determined at a much later date. Bank’sters have not caved into behaving ethically in the past. Why is today any different? Stay tuned!

Stay updated with the latest forex industry news

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2025

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #2 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #3 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #4 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #5 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #6 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox