The US Job numbers announced on Friday confused rather than shook up the markets. Given the number of mixed messages in the Non-Farm Payroll report, it’s little surprise that attention in the equities markets is turning to the start of the US earnings season.

The big banks will kick off the quarterly round of announcements. JPMorgan Chase, Goldman Sachs, Bank of America, Morgan Stanley, Wells Fargo and Citigroup are all scheduled to update investors on Wednesday.

Bulls may be expecting to hold fire until non-financial firms start reporting. While the market analysts at FactSet predict earnings growth across the S&P 500 in the quarter will be 27.6%, the banking sector is expected to be one of the weaker performers. The same team predict a 15% increase in the value of the index over the next year. So those same bulls may not be willing to wait too long if some earnings beats start stacking up near the end of the week. Names to watch out for from other sectors include Delta Airlines and Walgreens Boots Alliance which all post reports this week.

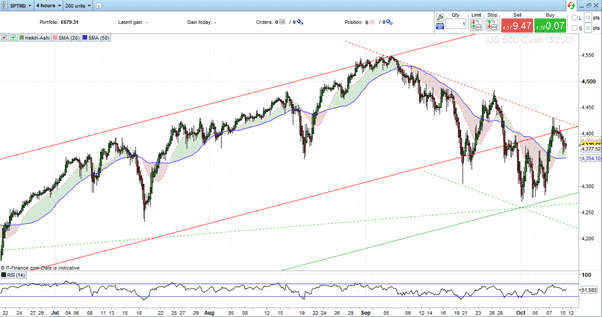

S&P 500 Index – 4hr Price chart

Source: IG

Markets Are Finely Poised

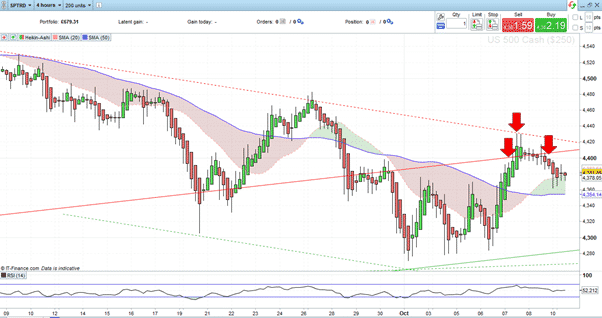

September’s sell-off in equities was during the first half of last week, followed by a period of some relative price inertia. It was Wednesday before dip-buyers stepped into the markets on the back of hopes that the NFP jobs report would trigger a rally. The disappointing headline jobs figure fed through as weakness in equities on Friday and Monday. From a technical perspective, the price strength on Thursday saw the S&P 500 price clip both the resistance and support of a falling wedge pattern before breaking to the downside.

S&P 500 Index – 4hr Price chart – Wedge Pattern Support & Resistance

Source: IG

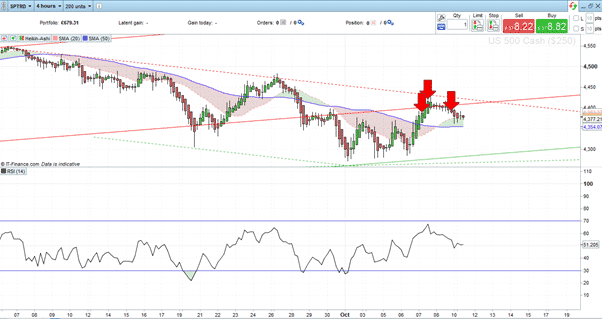

The feeling that anything could happen is also supported by the 4hr RSI stubbornly holding near 50.

S&P 500 Index – 4hr Price chart – RSI

Source: IG

The earnings season can’t come soon enough for those looking for the market to find some direction. The willingness of analysts to downplay their hopes and be pleasantly surprised to the upside is a three-monthly tonic for those holding long positions. With the S&P 500 currently 3.67% below its September highs, there is undoubtedly scope for bottom fishing.

Jobs Data Disappoints

Friday’s headlines focussed on the Non-Farm Payroll miss of the ‘new jobs’ number. Analysts had predicted 500,000 new positions would have been filled, but only 194,000 were. This ‘miss’ was interpreted as bad news, but not so bad that the US Fed’s tapering program due to start next month might be delayed. On the other hand, the unemployment rate itself fell rather than rose. That now sits at 4.8%, which offers hope to the bulls and might be a statistic they hold on to, should the earnings season act as a catalyst for upward price moves through this week.

Crowdsourcing information about scam brokers can help others avoid falling into the traps set by disreputable brokers and you can share your experiences here. If you want to know more about this particular topic, or have been scammed by a fraudulent broker, you can also contact us at [email protected]

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2025

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #2 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #3 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #4 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #5 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #6 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox