After a barnstorming start to the week, financial markets have given up some ground. The sell-off in the SPX500 (S&P500) index began just before the US exchanges opened on Tuesday and continued through the Asian session. The SPX500 and US30 (Dow Jones Industrial Average) have now given up approximately 1% of their value from Tuesday’s highs and are down on the week.

SPX500 – 1H price chart

Source: Tickmill

US30 – 1H price chart

Source: Tickmill

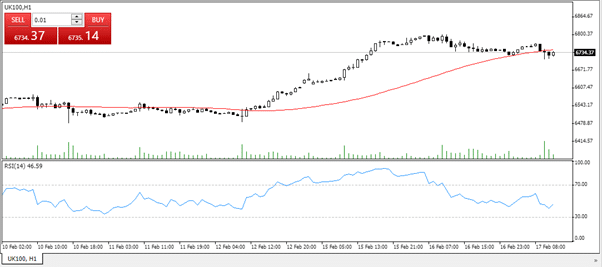

An interesting divergence is that the FTSE100 is still in positive territory. The index has a more substantial weighting towards banks and oil stocks that have found support from the crude oil price, talk of inflation and higher interest rates.

UK100 – 1H price chart

Source: Tickmill

The Dip-buyers Dilemma

Is this price consolidation a chance to buy the dip while price trades below the 50 SMAs or a sign that nagging concerns are still clouding the big institutional investors’ decision-making?

The absence of any dramatic announcements relating to pandemic stimulus measures appears to have given analysts the chance to consider some of the potential downsides. Any recovery looks likely to involve some degree of mass unemployment, even if it is frictional as people rotate out of jobs which no longer exist.

Inflation Concerns are Hanging Over the Markets

Inflation appears to be the new buzz-word and is the metric increasingly likely to determine in which direction prices will head.

The yield on the benchmark US 10-year Treasury note fell to 1.287% at the open of European markets on Wednesday. Simultaneously, the longer-dated US 30-year T-bond saw its yield slide to as low as 2.059%.

The fall in yields and the rise in prices are low-key but significant events; fixed income desks take the long-view. Their decisions can set the mood music which more short-term speculators will dance to.

The Five News Events to Watch Out for on Wednesday

The data releases out on Wednesday which triggered the slide indicate that Treasury yields will be worth keeping an eye on. The below numbers are likely to fill in some of the gaps.

- US retail sales for January – is due out at 8:30 am Eastern Time.

- Industrial production numbers for January – due to be published at 9:15 am. ET.

- December business inventories – released at 10 am ET.

- The National Association of Home Builders release February numbers relating to the housing market index at 10 am ET.

- Minutes from the US Central Bank’s Federal Open Market Committee’s last meeting will be released at 2.00 pm ET.

Any suggestion that inflationary pressure is building will muddy the waters. Central banks may express a readiness to increase base level interest rates to control the price rises.

The alternative scenario is that “a little bit of inflation” might not be seen as a bad thing. It would undoubtedly erode the wartime levels of debt that governments have taken on to deal with the Covid-19 pandemic.

Inflation might be bad news for bond-holders; however, risk-on asset groups such as equities could see price rises as investors take positions to hedge against the risk of their cash pile wasting away.

If you want to know more about this topic, or have been scammed by a fraudulent broker, please contact us at [email protected]

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2025

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #2 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #3 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #4 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #5 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #6 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox