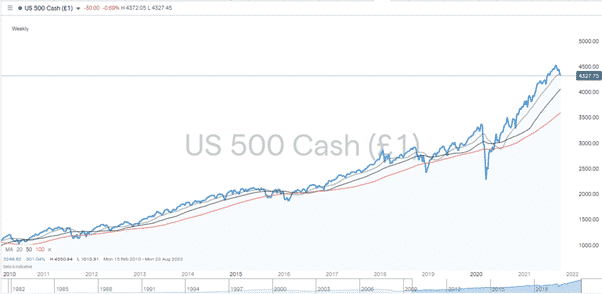

Pressure on equities continues. Hourly price charts have been printing lower lows and lower highs since the start of September and, at first glance, appear stuck in that downward channel. Monday morning’s news that Hopson Development might bail out beleaguered Chinese conglomerate Evergrande hasn’t calmed many nerves.

Source: IG

Just as the Evergrande pressure point has been eased, another has appeared. US officials are starting to raise the possibility of tariffs on Chinese goods due to breaches of the trade agreement between the two countries. Threats of restrictions on international trade will be delivered with some sense of irony given the global logistics crisis. Parts of the world’s supply chain are already breaking down even without help from point-scoring politicians. And oil price hikes can’t be ruled out due to the convening of the latest OPEC summit, which starts on Monday.

Factor in a worldwide tightening of monetary policy, and the question to be asked is whether the 6th of September 2021 marks the end of a 10-year bull run?

Source: IG

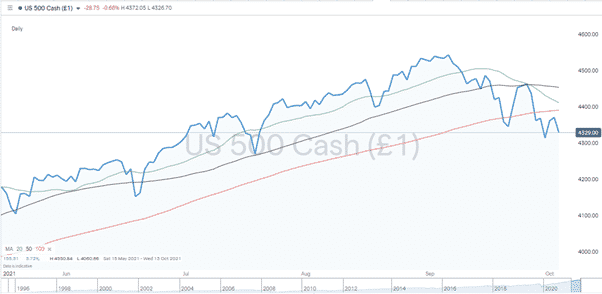

Equity Index Moving Averages

The S&P500’s Daily moving averages have formed a pattern that can only be described as bearish.

Last Monday’s downward intersection of the 50 SMA by the 20 SMA formed a textbook sell signal which would have been profitable for anyone looking to short equities on the back of the wide-spread uncertainty. The next point of interest is the almost inevitable breach of the 100 SMA, which could happen this week.

Source: IG

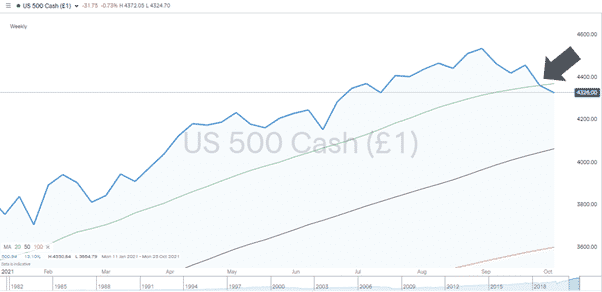

On a weekly chart, price has broken to print below the 20 SMA, with that metric now providing stiff resistance in the region of 4369.

Source: IG

Top of the Market or a Dip to Buy?

The picture of economic fundamentals is unclear, a situation not helped by so many factors being in play. An argument can be made that they reflect the fallout from past events, largely the Covid pandemic. With many and varied parts of the global economic system readjusting to that shocking event, there is a temptation to consider the current situation as part of a process of reorganisation. Adopting that conclusion moves them some way from being leading indicators of the next price move. It also points to the recent downward price move being a timely and technical analysis-based check on stock valuations that moved to the top end of the scale through the summer months.

The multi-year equity bull run, which started in the 1990s, survived the Dot-com Crash, the 2008 Financial Crisis, a US-China tariff battle, and Covid. For the bulls, it’s easy to consider Evergrande as a minor inconvenience in comparison. Will Beijing allow a firm that is too big to fail to go under? Or as looks more likely, will it manufacture a solution to the crisis and a tightening up of future policy. Each of the different situations does stack up, but none look insurmountable. The time to buy could be approaching, even if it doesn’t appear to be immediately visible.

Crowdsourcing information about scam brokers can help others avoid falling into the traps set by disreputable brokers and you can share your experiences here. If you want to know more about this particular topic, or have been scammed by a fraudulent broker, you can also contact us at [email protected]

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2025

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #2 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #3 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #4 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #5 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #6 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox