Thanks to the Independence Day celebrations, a shortened US trading week has left a range of asset groups trading sideways and provides a chance for investors to focus on one of the ‘next big things’ – data. News out of China over the weekend adds more strength to the idea that regulators and governments are looking to lock horns with big tech, a move that could have significant consequences for investors.

In China on Sunday, Cyberspace Administration China (CAC) ordered app stores in the country to remove ride-hailing service DiDi from their platforms. The allegation is that the company has engaged in the illegal collection and use of personal data. The direction of traffic is clear to see as China passed a significant data security law in June. There are more additions to the rule book in the pipeline, including the Personal Information Protection Law.

For investors, much of the concern is that tech is the sector responsible for most of the market IPOs. The IPO market has exploded in 2021 and attracted hordes of retail as well as institutional investors. One crazy statistic is that the IPO market has already posted a record annual return of $171bn and has done so in less than six months.

DiDi Global – 10 min price chart

Source: IG

DiDi listed on the New York Stock Exchange only last week. The company’s stock listed at $14 but in intraday trading was up to $16.65 per share. The 19% gain has since been wiped out thanks to China regulators acting only days later. The firm has a market cap estimated to be close to $80bn, so it is not an obscure start-up. That means such regulatory risk not being picked up in due diligence research has left many institutions in an awkward position. A firm making a debut on a foreign exchange and then being frisked by their domestic regulator is not a good look.

Over the last few months, China has also blocked Ant Group’s $34.5bn listing. However, it’s not just new firms that are under scrutiny, as demonstrated by the $2.8bn anti-trust fine handed to Alibaba. High-profile firms Tencent and ByteDance were both summoned by the State Administration for Market Regulation (SAMR) in April. They were told to upgrade their data self-inspection protocols or fall foul of anti-trust regulations.

DiDi – Implications for the Wider Markets

IPOs are psychologically crucial to the financial markets. The opportunity to trade new and exciting shares lifts the markets and encourages timid investors out of cash and into stocks, even if only in small sizes. If regulatory risk scales up, then the number or success of tech-IPOs could be jeopardised.

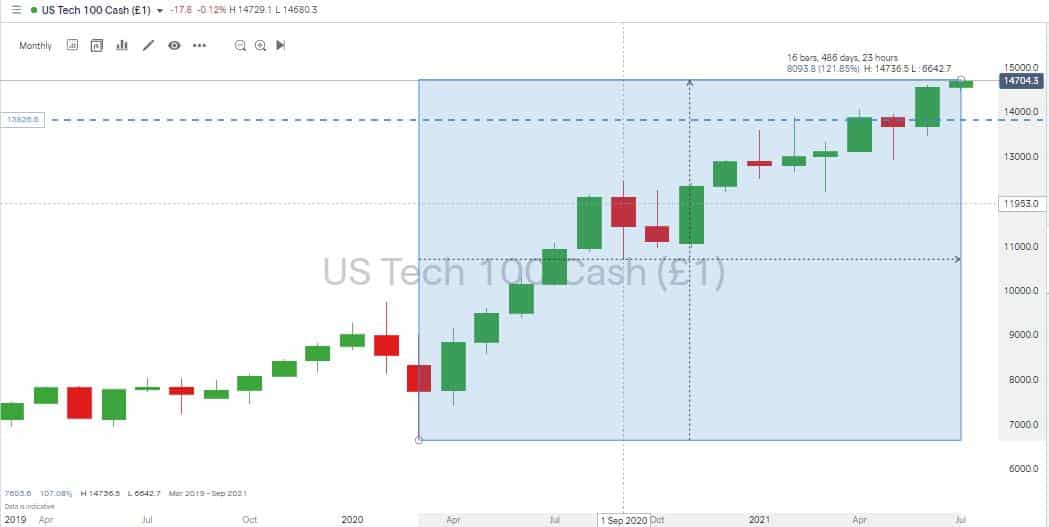

There is also the fact that the tech sector has been the driving force behind the global recovery from Covid-19. Puncturing that particular balloon would have implications for all asset groups. The Nasdaq 100 is up more than 120% from the lows of March 2020, while the tech-light FTSE 100 has yet to return to pre-pandemic price levels.

Nasdaq 100 – Monthly Price Chart

Source: IG

If you want to know more about this topic or have been scammed by a fraudulent broker, please contact us at [email protected]

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2025

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #2 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #3 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #4 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #5 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #6 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox