Cryptocurrencies have been the rage of the investment community, even after a meltdown in valuations back in February, but the 14th of November will go down as another “Black Day”, as coin values shed $30 billion of market capitalization. Bitcoin, the leader of the pack with roughly 53% of that figure, had been hovering for months just below the $6,500 level, but soon fell from that perch, threatening to go below the psychological barrier of $5,000. It has rebounded today to $5,500. Analysts are still putting the pieces together for why the sudden reversal occurred, but the lesson here is that Market Risk can be just as pervasive as Fraud Risk. You must stay alert.

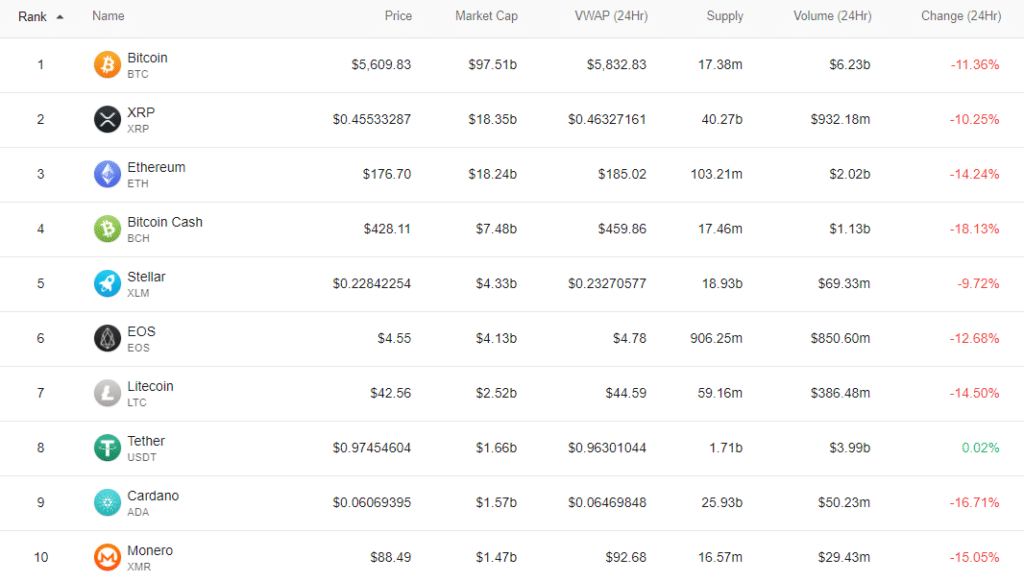

A quick review of articles on our website for the past few months reveals that cryptos have dominated the news stream. The field is exciting, but along with that unregulated excitement is a level of fraud that is undocumented in any other investment arena, not even from the “Wild, Wild West” days in the nineties when retail forex trading came into vogue. Volatility in the crypto world had nearly vanished over the summer months, but everyone, perhaps, had been swept up in complacency, until Wednesday. The carnage was everywhere to be seen, as can be discerned in the “Top Ten” chart below, but lesser known rivals and Initial Coin Offering tokens absorbed more of the damage:

Foreign currencies are known for their wild valuation swings. Volatility can explode off the screen in an instant, based on some data release or related news flash. It is widely known that cryptocurrency prices gyrate wildly. Compared to forex, volatility in this area is more like forex on steroids, the reason cryptos have already earned the reputation of being the most volatile asset class in history. From a trading perspective, volatility brings opportunity for gain, but only when tools can ascertain a level of predictability. It is far too early in the game for momentum oscillators or trending indicators to be reliable.

The term that applies to this type of situation is Market Risk and especially high Market Risk at that. You do not want to trade in these shark-infested waters, unless you have nerves of steel and years of experience at your beck and call. Why is volatility so high? The cryptocurrency arena is still in its infancy. The industry’s ten-year anniversary is approaching for when the first Bitcoin transaction was recorded at the point of sale, even though the concepts had been under development for years before that eventful day.

The entire ecosystem has rocketed forward over the past decade, especially in the past few years. Independent entities have mushroomed across the globe to deal with every aspect of the so-called “revolution”, with very little in the way of regulatory oversight to guide its progress. Some estimates put the number of coin systems at 1,500 or more, but the valuations are maintained daily by various online aggregators. The market cap for the coins or tokens, if you will, is just below $200 billion. If you throw in exchanges, miners, and all of the other support entities, then you can double that figure. $400 billion is not a shabby enterprise, approximately equal to four IBMs, by comparison.

Banks, government officials, and regulators have tried their level best to stop this “revolution” in its early tracks, but to no avail. Even despite massive losses due to data breaches and organized hacking compromises, the phenomenon has survived and thrived, growing at even a quicker pace, after each setback. When the investment community finally jumped on board in early 2017, prices began to skyrocket. The growth rates were asymptotic. Sustainability was not in the cards. Bitcoin, for one, began that year languishing slightly above $1,000, only to approach $20,000 by yearend.

Across the board, “asset bubbles” were forming beyond anyone’s imagination, but investors were not deterred. Everyone was caught up in the excitement and never suspected that they might be the last one caught holding the bag. The collapse came in early 2018, when buyers were nowhere to be found, and sell signals were in abundance. To its credit, Bitcoin did not suddenly go to zero. For most of 2018 following the collapse, it has been range bound between $6,200 and $6,500. Even when equities were bleeding out in October, cryptocurrencies were holding their respective beachheads.

And then came the 14th of November. The day after has been calm. Bitcoin has found support at $5,500. Analysts were fearful that a penetration of $5,000 would send terror through the market, but that level was not tested in today’s action. Other alternative coin systems are busy licking their respective wounds, as well, but no one is throwing in the towel. There are far too many positives on the horizon, and several well-respected CEOs for major consulting firms and several large corporate businesses have recently touted cryptocurrencies as the wave of the future.

What are these business leaders saying about the cryptocurrency market and its long-term viability? Nigel Green, the CEO and founder of The deVere Group, one of the largest financial consultancies in the world, recently predicted that, “The pace of mass adoption will speed up and the cryptocurrency market cap can reasonably be assumed to reach at least 5000% above its current valuation over the next decade.” If we start with a $400 billion market cap, including coinage, exchanges, and miners, then a “50X” multiple equates to $20 trillion. That figure is 7% of today’s equity and bond pool of about $300 trillion securities. Such predictions may seem staggering, but are possible.

Why did Market Risk and volatility suddenly latch onto cryptocurrencies?

With maturity, comes attention, especially from the analyst community, which has tried its best to apply technical analysis to the nuances of the crypto world. Veterans of the art form accept that it is far too soon in its infancy period to be applying techniques that work fine for traditional asset classes, but this wise admission has not deterred a subset of folks from using their tried-and-true “tools” to gain insights. Everything from pattern recognition to something as obscure as Metcalfe’s Law, a method for valuing networks tied to the square of the nodes present, have been employed, but with spurious results.

Perhaps, for these reasons, investors did not heed the call of analysts that thought a wedge or converging triangle was forming in the Bitcoin chart. Such a pattern would, under normal conditions, suggest that a change in direction was imminent and more than likely in the same direction as the trend that had preceded it, in this case down. For other traded instruments, TA patterns can often be self-fulfilling prophesies, since, once recognized, the herd mentality takes over. Bitcoin and all other altcoins did plummet, but the reasons are more likely tied to fundamental causes of some sort.

The suggested fundamental causes took on three flavors:

- When stocks and bonds were selling off in October, it seemed as though many investors sought refuge in the crypto world, thereby conferring a type of “safe haven” status on cryptocurrencies. Virtual currencies maintained their values to a degree during October for this very reason, it was thought. Then came November. Stocks were recovering, and the “risk-on” rush had begun again in earnest. Being a “safe haven” is a double-edged sword, so to speak. Investors withdrew. Cryptos fell, as a result;

- Another group postulated that the imminent “hardfork” of Bitcoin Cash was the root of the problem. When an established coin system decides to go in two different directions, a fork in the road, the consequences can be far reaching. Bitcoin Cash was actually the result of a “hardfork” of Bitcoin, but where there is uncertainty, anxious investors react by selling;

- Lastly, the more probable cause was a speech made by Christine Lagarde, the IMF chair, at an Asean Summit in Singapore of fintech executives. Her motives were unclear. She sounded as if she was supportive of digital currencies, saying that developing countries need better value exchange systems. Then she dropped the bombshell – central banks should be the ones to create and control these systems, not the independent marketplace, as has been the case up until now. Was this just one more attempt by bankers to shut down the cryptocurrency revolution? Oddly enough, the managing director of the Monetary Authority of Singapore, Ravi Menon, had said in March: “The Republic’s central bank does not have a compelling argument to issue digital currency, as digital payment networks are already conducting electronic transactions here.” Ms. Lagarde may be uninformed.

Traders – Beware of Market Risk, but do not forget crypto Fraud Risk

If you are trading cryptocurrencies, the market gave you a quick reminder that risk in the form of volatility never sleeps in the crypto world. You must be ever mindful of the potential for dramatic swings in market prices, both up and down. Fraud risk, however, remains pervasive in the cryptocurrency space. Operating standards and regulatory oversight that is truly protective may be miles down the road. Although Blockchain Technology claims to be fraud proof, it is the peripheral infrastructure that must connect to this fraud-immune software that is susceptible to criminal intent. Every sub-system is ultimately at risk. While we wait for the cyber-crime wave to subside, here is a brief reminder of the many different “faces” of crypto fraud:

- Exchange Hacking: Hundreds of millions of $-losses have been recorded;

- Account Takeover: Protect your access keys – Do not put them on a phone;

- Mining Fraud: Crooks have raised millions, only to disappear with the loot;

- ICO Scams: 9 out of 10 ICOs fail – a heavy proportion are due to fraud;

- Trading Support: No one has the greatest trading app for cryptos;

- The Big Unknowns: Check your daily news feed for the latest schemes.

Every week brings a new series of arrests, revelations, and clever schemes to be avoided. We live in a high-tech world, and organized crime has invested heavily in the latest technology. Security and law enforcement professionals will remain behind the curve for some time to come, meaning that you are your first and last line of defense when it comes to crypto fraud prevention. Stay aware and skeptical at all times!

Concluding Remarks

We were reminded this week that cryptocurrencies are the most volatile asset class in market history. Market Risk suddenly flashed upon the scene, perhaps, overshadowing the constant flurry of articles that reveal crypto scams and frauds in progress. As always, awareness is your first step towards risk containment and prevention.

Be cautious, and be safe!

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2025

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #2 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #3 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #4 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #5 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #6 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox