Enthusiasm has returned to the crypto market, as market valuations have soared after Bitcoin finally formed a firm bottom in late December. After a passive January, which brought out the critics claiming that the consummate token of the group would plummet below $2,000, before ever regaining any strength, if ever, to speak of. Crypto Winter seemed as if it would never turn to Spring.

But the critics were wrong. Bitcoin accelerated past $4,000, then $5,000, and appeared prepared to blow past $6,000, as well. But, as often happens in this totally unregulated market, a “Black Swan” entered stage left. An alleged fraud of $850 million between the Crypto exchange, Bitfinex, and the Tether stablecoin system, USDT, hit the news and destroyed both the enthusiasm and the confidence in the entire system. Valuations went into a death spiral. Bitcoin, hovering below $5,600 at the time, took a dive down to the $5,000 level, only to finally bounce back to $5,200.

BTC now trades at $5,170, after the world has had over 24 hours to digest the news and lick its wounds. Experts have come forward to say that, although the news was bad for the industry, its impact would not be lasting. Crypto advocates with long memories have experienced this “two steps forward, one step back” scenario more times than they can count. Bad news tends to fade away, after the reality of favorable fundamental forces creeps back into the crypto consciousness.

The Bitfinex/Tether scandal came after a multitude of analysts were proclaiming that the next stop for Bitcoin was $6,000, and then, after a predictable round of profit taking, BTC would go “parabolic” again, blasting its way to $10,000 and beyond. The brave analysts that painted pictures of this “beyond” were castigated by many as being emotionally unhinged, hearkening back to the days of “irrational exuberance” before the Internet bubble burst nearly two decades ago.

Investors, always in search of a higher return and whatever is hot at the moment, cannot ignore Bitcoin and its altcoin brethren. Before the current slump, Bitcoin had appreciated an unheard of 80% in only four months time. Several other tokens had performed even better, but have also pulled back, a bit harder than the market share leader. Cryptos, based on their volatility alone, offer traders a risk/reward opportunity that is attractive beyond measure, but these waters are not for the faint hearted. Liquidity can be a major issue, even with Bitcoin at times of market turbulence. Spreads widen, often too widely.

What were these optimistic analysts seeing to support their favorable forecasts? Most all of them were totally focused on their charts and the technical signals that were shouting “Higher, Higher…” As we learned in our early tutorial days, however, technical signals do not move markets. Fundamental forces are the cause and effect of market price behavior. Although several technical indicators seem to be converging at once to point true north, there are several fundamental forces at work that are singing the same tune. We will discuss these in a bit, but first, let’s review the present scandal of the day.

What exactly went down with Bitfinex and Tether?

First of all, here are the players in this debacle:

- iFinex is headquartered in Hong Kong and registered in the British Virgin Islands. It owns and operates Bitfinex, a crypto exchange, as well as the Tether (USDT) stablecoin system, which has a current market capitalization of $2.85 billion;

- Bitfinex is a crypto exchange, founded in 2012 and also headquartered in Hong Kong. It has been hacked several times and had serious difficulties with its banking relationships in October of 2018. Critics have accused it of price manipulation;

- Tether is a cryptocurrency, which goes by the call sign of “USDT” and is supposed to be pegged “1:1” with the U.S. Dollar. The entity has the same stockholders and management as Bitfinex, which has raised many questions in the past about how the reserves of USDT, nearly $3 billion, are managed, if they exist or have been mishandled;

- The New York Attorney General’s office broke this story, based on a lawsuit filed by its attorney general, Letitia James. Ms. James has said: “New York state has led the way in requiring virtual currency businesses to operate according to the law. And we will continue to stand-up for investors and seek justice on their behalf when misled or cheated by any of these companies.”

The alleged fraud involves the mishandling of $850 million by iFinex, as reported by Ethereum World News: “A document unveiled by the New York Attorney General’s (NYAG) office on Thursday has revealed that iFinex, the company behind both Tether (USDT) and Bitcoin exchange Bitfinex, is being sued. Per a lawsuit issued by official Letitia James, iFinex Inc, which is the company behind the two aforementioned crypto startups, promoted the “issuance, distribution, exchange, advertisement, negotiation, purchase, investment advice, or sale of securities” in New York State, which is illegal without the proper licensing and documentation. The suit has also revealed that Bitfinex purportedly sent $850 million to a Panama-based company, failed to secure the funds later, and went on to raid almost $1 billion of Tether’s cash reserves to satisfy its customers.”

The latter revelation confirmed what many critics had speculated for months – that management had been dipping into the Tether reserves in order to cover up other shortfalls. Forbes reported: “Bitfinex’s operations, including its connections to Tether, have long been a subject of rumor and controversy. While the executives have claimed the two entities operated at arms length, the attorney general challenges this claim, and points out that the same individuals appear to control both of them.”

The response from iFinex was total denial and that the attorney general was acting in bad faith. They also claimed that the $850 million were “seized and safeguarded” and that “they have been trying to find remedies to get the funds released.” Another report sums up the management’s current position: “The pair [Bitfinex and Tether] claim they are “financially strong – full stop.” Furthermore, they vow to fight what they call the gross overreach by the New York Attorney General’s office against “companies that are good corporate citizens and strong supporters of law enforcement.””

The “good news” in all of this is that experts now believe that Tether does have the reserves to fully back the USDT deposits, albeit that a portion of those monies are comprised of a line of credit, supposedly opened to comply with stablecoin contracts until the missing $850 million is released.

In any event, Forbes concluded that: “Bitfinex, which is incorporated in the British Virgin Islands, relied on a shadowy network of money agents, including “human being friends of Bitfinex employees that were willing to use their bank accounts to transfer money to Bitfinex clients. The fallout for investors from all this remains to be seen.”

Aside from the Bitfinex/Tether scandal, fundamentals for Bitcoin are strong.

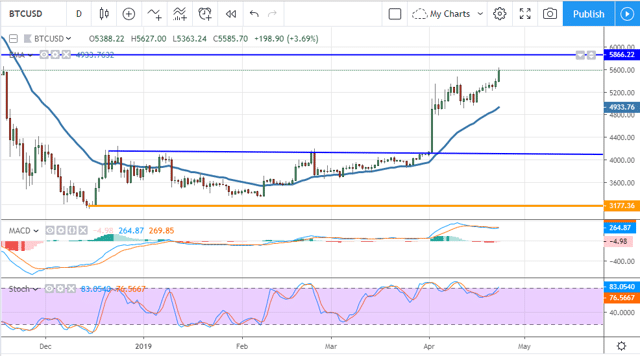

Technical analysts have been overjoyed with what has been playing out on “BTC/USD” charts. The positive signs have led these so-called experts to forecast $6,000, almost in unison, as the next achievable goal. Along with these positive predictions, each analyst will note one or two fundamental situations that support his or her thesis, but in actuality, there are half a dozen or more good storylines. Let’s begin with the chart:

This daily chart depicted a brief breakout that occurred

prior to the Bitfinex/Tether scandal hitting the airways. The obvious “Pennant

and Pole” pattern is one good sign, but low volatility, the second lowest in

history, permeated 2019 until April, as evidenced by the small candlestick

formations, and signaled the possibility of an imminent major breakout.

Stochastics also indicated that overbought conditions no longer persisted, as

well. A “Golden Cross”, not shown here, augurs good fortunes, too.

Positive fundamentals are numerous and have often been cited in other articles:

- Bitcoin Dominance: Bitcoin is Number One, has been around the longest, and is the gateway to all cryptocurrencies. BTC’s market share of the system recently accelerated from 50.5% to 54.6% in just four weeks, as token holders shift allegiances;

- Institutional Attention: Forbes’s recently published its new “Top 50” list that revealed that major global corporations have been investing millions behind the wave of blockchain innovation. The news had been riddled with articles about Fidelity Investments, the Bakkt and ErisX exchanges, IBM, Facebook, and even JPMorgan Chase making inroads into the crypto arena. Eventually, when the time is right, major banks, hedge funds, and brokerages will proliferate the space with a tsunami of capital that can only open the floodgates to higher valuations;

- Miners are Returning: With Bitcoin values over $3,550, mining is now very profitable again, suggesting that computing power behind the network will meet future demands. The “Hash Rate”, a measure of this computing power, has nearly returned to all-time highs from early 2018;

- Stablecoins at the Ready: Researchers at Forbes posit that there are 120 stablecoin projects in process, while the market cap for the top 20 is nearly $4 billion. These reserves are literally cash pegged to the USD or other indicia, waiting to be transferred into risk-based tokens, when investors so decide;

- Future Scarcity: The Bitcoin money supply cannot be inflated in the same fashion that central banks print fiat currencies. The ceiling for Bitcoin is 21 million. There are roughly 17.7 million in circulation, although about six million of these are tied up in technical arrangements. When institutional investors and the general public want to buy, supply will be fixed, thereby pressuring prices to rise to meet demand.

How high can Bitcoin go? Based on the above support, one analyst wrote in his newsletter: “A move above $5,800 will probably go to $8,000 and, if that happens, I expect to start seeing increased media coverage and a little FOMO buying. Longer-term, the target is $20,000.”

Concluding Remarks

Once again in Crypto-Land, we have chaos, turmoil, drama, and, yes, volatility, that special attribute that makes trading viable and which thrives on uncertainty. The confidence in all things crypto has been shaken again, but we can postulate, based on similar experiences in the past, that this ill wind will blow away and that saner heads will prevail.

Will Bitcoin ever hit $20,000? Do remember that the crypto industry is still in its nascent development stage, far from being a very structured, regulatory compliant environment, where institutional players rule the roost, and markets behave as expected. Volatility will continue to be the byproduct until maturity comes, which will translate into opportunity, risk, and reward, if traded properly.

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2025

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #2 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #3 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #4 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #5 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #6 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox