Here, a scam, there, a scam, everywhere you look, a potential scam. Regulators across the globe are on the attack again, as if the war on binary options was not enough of a struggle. In this case, Initial Coin Offerings (ICOs) are the new target. Global investors have been fleeced out of hundreds of millions, if not billions of dollars, over the course of the past two years. At present, the ICO area of crypto-space is totally unregulated, the primary reason that organized crime has jumped into the arena with both feet. The SEC, however, has stated that, outside of Bitcoin and Ether, it will be regarding all other coin offerings as securities under the law. Huge fines and incarcerations have resulted.

ICOs gained in popularity in early 2017, literally offering an alternative to the costly and time consuming fundraising process proffered by traditional venture capital type firms. It quickly became regarded as playing a “hugely disruptive role in the world of start-up financing”. Estimates vary by source, but in general terms, over $7 billion was raised in 2017, and by November of this year, over twice that figure, some $14 billion, had been forked over by investors to fund blockchain-based development projects.

Never underestimate the desire of a subset of the investing community to get in on the ground floor of the latest, hot trend in financial technology, and by all accounts, the crypto-currency space has been the hottest and most volatile sector for high-risk investing, since Tulip Mania ruled in Holland in the early 1600s. As with that craze, an “asset bubble” formed and collapsed. For cryptocurrencies, the “bubble” deflated in early 2018, but investors have not withdrawn from the space. They continue to throw money at anything even remotely connected to blockchain technology, the distributed ledger system that supports the coin ecosphere and is considered by many as the next wave of innovation that will reshape the world, as we know it, over the next two decades.

Regulators, bankers, and government officials are not amused or in awe of the crypto phenomenon. Up and until its nosedive in valuations over the past few weeks, the market cap of the entire crypto economy, including coin systems, exchanges, miners, and supporting companies, was somewhere north of $400 billion. The SEC and others were not impressed, but they are concerned about the billions of dollars of outright fraud, the potential for price manipulation, and the lack of control measures for protecting the investing public from mediocre operating standards, hacking, and shady businessmen.

The “Wild West” nature of the space is also a contributing factor for the pervasive fraud that presently grips the ICO funding method. Organized crime, perhaps responding to attacks in the binary options arena, quickly shifted gears. It is not that difficult to set up a website, present sophisticated investment materials, and make outrageous claims when everyone from IBM to the consultant down the street is hyping blockchain technology.

Exit scams are prevalent. After funds are raised, the management teams disappear with the cash. Fake ICOs are also a nuisance. Offshore entities have used all manner of ruses to lure investors to their sites, extract coins from exchange wallets, and then never issue any tokens whatsoever. More due diligence is necessary, and there are helpful ICO review websites that list and discuss planned ICOs in the pipeline.

What can we glean from past ICO experiences?

The first ICO actually took place back in 2013, a novel approach at the time that did not receive a lot of press. The really large fundraises began in 2017 and continued into the present year. With nearly two years and over 1,300 or more examples to choose from, we now have a preponderance of data to provide insights on the true nature of the ICO experience. A few significant research reports have already been published, which highlight the dark underbelly that pervades this unregulated funding method.

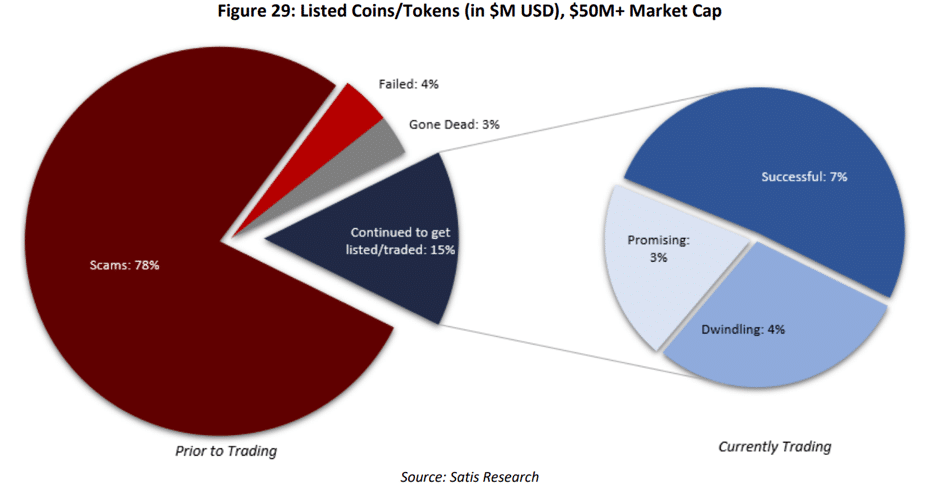

The Satis Group, an ICO advisory firm, published its study earlier this year. The approach taken by Satis was to focus on those fundraises in excess of $50 million. They then broke those ICOs down as follows:

- “Failed to List”, which contained ICOs that were considered to be either (i) scams, (ii) had failed or (iii) had gone dead, and therefore they had all failed to list and trade at all; and

- “Succeeded to List”, which consisted of those considered, as either (i) dwindling, (ii) promising or (iii) successful, but with all three sub-groups going on to trade on cryptocurrency exchanges.

The results were both sad and troubling. A mere 15% of the group was ever able to get their tokens traded on an exchange. The remaining 85% were portrayed as potential scams. A small potion, some 4%, failed, and another 3% went dead on the Internet, not exactly a good report card for ICOs in 2017. It is no wonder that regulators, investors, and entrepreneurs, looking to use this funding method, soon took a dim eye to the entire ICO proceedings. SEC Chairman Jay Clayton recently opined, “The rapid growth of the ICO market, and its widespread promotion as a new investment opportunity, has provided fertile ground for bad actors to take advantage of our Main Street investors.”

The study may have piqued everyone’s interest, but it obviously did not slow down 2018 fundraisings, which surpassed the ones for 2017 during the second quarter of the year. As regulators began their early attacks on ICOs, threatening to apply security law concepts to each one, other regulatory bodies across the planet began to follow suit. Chinese authorities, along with those in South Korea, banned the process altogether. An ICO may not have been legal in those two jurisdictions, but these bans did not block the zeal of their respective investor communities. Citizens of both countries went around the rules, invested offshore, or took a greater risk by supporting illegal domestic offerings.

In the third quarter of 2018, however, ICO fundraising efforts took a dive. The second quarter came in at $8.3 billion, but either investor awareness of frauds, the collapse of values industry wide, regulatory uncertainty, or the lack of valid business plans sent third quarter figures tumbling down to $1.8 billion. ICO Rating, another industry independent research firm, issued a report detailing the results. Out of 597 projects, 57% of the group members were unable to raise more than $100,000. Per the report: “The market in Q3 shows signs of overall disappointment in traditional ICOs as a means of venture financing… The key problem with ICOs is that a vast number of them are scams or scam-like projects…”

The ICO Rating report goes on with these factoids:

- “Startups raised 48% less through ICOs in the third quarter compared to the second.

- 75% of startups trying to raise money had nothing but an idea.

- The average return from ICO tokens in the quarter was -22%.

- 64% of attempted ICOs failed.

- 19% of companies that raised money through ICOs in the third quarter have deleted their websites and social media accounts, suggesting they were scams.”

The bad news does not stop with these facts. What happens if you trade Ether or Bitcoin for new tokens in a startup enterprise, have second thoughts, and try to sell them? The report continues: “Although most ICO tokens that are available for trading have had a terrible year, the report also explains that only 4% of ICO tokens have actually been listed on exchanges, making them an incredibly illiquid and risky investment.”

ICO Rating also noted that the declines began their slide as far back as May. Are scams really at such high levels with ICOs? It is difficult to distinguish the exact reason for failure, but the firm admitted that, “We expect some strongly hyped projects which raised significant funding to actually fail for a variety of reasons – due to being compromised as scams, to conflicts between founders, failure to deliver the promised technology or a failure of solutions offered to be widely adopted.”

Outlier Ventures, another research firm, produced a third report, which offered up other clues behind the current slowdown. Its CEO and Founder, Jamie Burke spoke in a recent interview in the UK: “We knew what was happening towards the end of last year was unsustainable. The reason it was unsustainable was a lot of it was not tied to underlying value. Being more technically involved in the industry, we were aware that the hype was running ahead of technology. The market got a bit ahead of itself…all the possibilities that blockchains and distributed ledgers offered, everybody rushed to try and realize those and the capital rushed to follow them. But the reality is the technical cycle is much further behind the market cycle.”

Burke reminded listeners that the current situation does mirror similar times in the past. In the early days of the Internet, investors threw investment capital at anything that seemed associated with the worldwide web. As a result, entrepreneurs rushed to the funding trough with any idea that would pass muster. Many such plans should never have been funded. The same is true today: “A large majority of ICOs shouldn’t have ICOed full-stop. Now, does that make them a fraud? I don’t think so. 90% of startups fail in their first three years. The numbers pretty much mirror traditional early-stage ventures.”

Although a decline has been observed, Burke also mentioned that traditional venture capital has raised another $3 billion on its own to add to the pie. The need is there, as well as innovative ideas: “Although the number and size of public token fundraises has reduced, startups, corporates and regulators continue to believe that tokens are foundational to Web 3.0 infrastructure and represent the opportunity for new business models. We don’t see ICOs as dead. They are just evolving as the industry professionalises.”

Concluding Remarks

Fraud never sleeps, and it appears to be ever-present in the crypto ICO space. As one industry insider admitted recently: “As fascinating as the crypto-sphere might be, it’s definitely not a place for the faint-hearted. Sure, cryptocurrencies have taken the world by storm, [but] in the midst of all this, there are scams, frauds, attacks, hacks, and other, similarly shady ventures.”

Initial Coin Offerings are a clever new way to fund blockchain development startups, but picking the next success story from the maze of planned offerings in the pipeline is a high-risk exercise. Does the potential reward match the level of risk that must be shouldered?

Do your due diligence, then double it, but always remain skeptical

Here you can read more about forex scams

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2024

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex & CFD Broker |

Best Trading Conditions

Visit broker

|

||

| #2 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #3 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #4 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #5 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #6 |

|

Global CFD & FX Broker |

ALL-INCLUSIVE TRADING PLATFORM

Visit broker

|

||

| #7 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #8 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox