Other than an occasional news flash about another indictment of ICO (Initial Coin Offering) promoters for misleading investors, the ongoing battle between our friendly regulators and crypto-currencies has been rather low profile in the press. Headlines have generally hyped the fantastic returns that have vanished like snow in the desert, while the regulatory community debated, with constant consternation I might add, what a crypto-currency was and how and who should protect the general public. Regulators seem content to warn consumers of “the three ‘Rs’ of ICOs: Risks, Rewards and Responsibilities”, while fraudsters rake in millions.

Not much has changed since last September, when we wrote: “Initial Coin Offerings, or “ICOs”, are the latest rage, riding on the coattails of crypto-currency zealots that believe that Bitcoin or Ethereum or any other variety of this genre is the best thing going since sliced bread. The religious zeal that accompanies crypto-currencies and their blockchain technology is nothing short of extraordinary, but intrinsic manipulation of supply/demand dynamics has driven valuations beyond the realm of believability. ICOs, the latest variation on this continuing saga, have disrupted the venture capital world, but are they a “good thing”?”

Read more about bitcoin and other trading news

We continue to counsel our readers to be wary of these get rich schemes. The “asset bubble”, which formed some months back, has been deflated, leaving many investors wishing that sanity had prevailed before they had established their positions. In the meantime, regulators in both the UK and the United States have re-grouped. An update of their various concerns follows. As always, know what and whom you may be dealing with, if you proceed. Caution is advised!

Recent Headline: “London remains wary of jumping on crypto bandwagon”

A bit of background information seems in order at this moment. Banks and regulators have had a difficult time accepting Bitcoin and its other brethren for roughly a decade. What started as a revolution of sorts, where fringe supporters fought hard to replace banks as a medium for regulated exchanges of value, has now morphed into something of a technology darling that embraces blockchain technology, as its foundation for the future. As much as it tried, the financial infrastructure could not stop this phenomenon in its early tracks, despite concerted attempts around the globe in multiple jurisdictions.

The Financial Times summarized it as follows: “The tentative approaches to crypto-currencies by the world’s leading financial centres reflect the strident debate over whether the likes of Bitcoin, Ethereum and Ripple should be embraced or shunned. Critics view crypto as a tool facilitating money laundering, with a level of volatility and a lack of fundamental underpinnings that disqualifies it as a reliable store of value. Proponents argue that cryptos are an alternative medium of exchange that will free people from a financial system run by commercial banks and regulators.”

Regulators, primarily the big ones in the UK and the US markets, are caught within a dilemma of their own making: Is Bitcoin a currency or a security? It seems that the legal jargon that defines both and that has stood the test of time for decades cannot draw a clear box around crypto-currencies. Each organization’s ability to arrest, indict, and prosecute hangs in the balance. It is no laughing matter. It is almost as if the criminal world has discovered a medium for its schemes that cannot be easily defined and shut down.

London has always been revered as the financial center of the globe, when it comes to currencies, and it has historically profited handsomely from its support of new financial products. The City of London, however, has not jumped all over crypto-currencies. Most insiders claim the wait is on to see how this new “fad” evolves. Per Mark Yallop, chairman of the FICC Market Standards Board: “Their overall size, even in aggregate, is so small that they are too small to really be of relevance in wholesale markets. UK market participants have been very cautious in engaging with them because of fears about their vulnerability to fraud, financial crime and other ‘conduct’ risk categories.’’

Investment houses may be playing it coy, but banks are not chomping at the bit either. Max Boonen, a former Goldman Sachs trader, noted: “Banks have been unusually strict in dealings with crypto. It’s nearly impossible to open an account for crypto in the UK. The problem is that in the UK there is a perception that banks have issues with anti-money laundering and decided to be a lot more conservative.” The appetite is not there, nor do the bankers sense a competitive threat from non-bank entrepreneurs. Mark Carney, governor of the Bank of England, is on the record stating that crypto exchanges will have to live up to the same standards, as do security exchanges today.

As the market waits, bankers will most likely be late adopters, waiting for others to risk capital and build beachheads that will later be gobbled up as the latest acquisition target, when the timing is right for the big boys to step in and clean up. In many respects, traditional forex brokers took the same approach with binary options. By the time each broker decided to build their own product or acquire a suitable firm, the shady side of the business had already maneuvered to steal billions, while others sat on the sidelines.

How are regulators in the United States dealing with crypto-currencies?

In the U.S., you have a mix of regulatory agencies, each promoting its own agenda, and then, on top of this milieu, you have the states and whatever actions they may throw into the pot. Some states, like Texas for example, like to go rogue by flexing their own muscles, but, by and large, the host of others prefer to follow whatever New York or California or the federal regulators deem appropriate. There is not supposed to be undefined overlaps, but ambiguous definitions have never prevented an aggressive official from taking actions that might generate favorable press coverage.

The SEC does not have a currency mandate, as does the CFTC, but recent actions in the market have forced the organization to jump into the fray. As one reporter described it: “For years, the Securities and Exchange Commission (SEC) was cautious in its approach to virtual currencies, but given an environment where virtual currencies may be offered and sold like securities, the SEC has been compelled to take action. The SEC has voiced its approval of efforts by state securities regulators and industry groups like the National Association of Securities Administrators (NASAA) to implement coordinated crackdowns on fraud in the virtual currency arena.”

The SEC does have mandates in three specific areas: 1) the sale and offering of securities, 2) fraud or misleading disclosures involving securities, and 3) the regulation of exchanges on which securities are traded. ICOs, unfortunately for the promoters involved, look too much like a security offering. SEC staff recently opined that, “ICOs, or more specifically tokens, can be called a variety of names, but merely calling a token a ’utility’ token or structuring it to provide some utility does not prevent the token from being a security.” Promoters, however, want to raise the money and run, a scenario that far too easily fits right into the conman’s playbook for outright fraud.

What about the CFTC, which does have a currency mandate? As one reporter stated: “By contrast to the harder approach from the Securities and Exchange Commission, the CFTC strives to embrace crypto-currencies, choosing not to classify them as securities. Their leaders have successfully argued before New York judges that crypto-currencies like Bitcoin are not securities because they are not backed by the government, and they don’t have liabilities attached to them.” There is also FinRen, which attacks money laundering through secrecy acts, OFAC, which will freeze foreign assets if necessary, and states attorney generals, which follow directives from federal regulators, to contend with, as well.

The CFTC, although working closely with the SEC on several cases, has demonstrated its willingness to be more receptive to crypto-currencies by allowing specified exchanges to trade in crypto-derivatives: “In December 2017, the Commodity Futures Trading Commission (CFTC) cleared trading of Bitcoin futures through the CBOE Futures Exchange and The CME Group, and several new Bitcoin ETF applications were quickly filed to capitalize on this development. In January 2018, the SEC staff requested the withdrawal of several of those applications, however, citing concerns about liquidity and valuation.” At the end of the day, the lack of volume would kill these derivative attempts.

If London, the SEC, and the CFTC are not true believers, then who is?

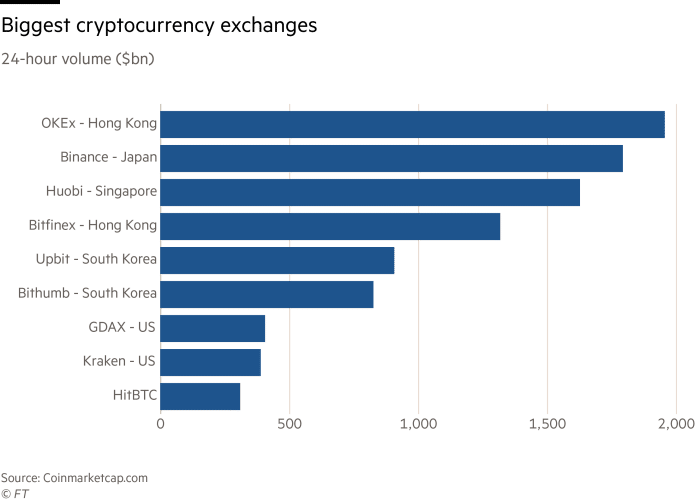

It is almost a given that, if the West is hesitant about new products or technology in any way, then Asia will pick up the baton and run with it. Such is the case with crypto-currencies. Yes, there have been firms in London that have experimented with crypto-derivatives. Plus500 and IG have dabbled in this arena, but as one analyst noted: “These firms take their cue from news out of the more developed markets in Asia. Growth and innovation in crypto-currencies reside mainly in Asia, a region that hosts the biggest crypto-currency exchanges as well as a source of the cheap electricity Bitcoin miners need.” Asian entrepreneurs are not as encumbered by regulations or political whims, as long as there is a good profit motive to be had.

86% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

While the West has sat idly by, Asia has already built an infrastructure to beat the band. Numbers do not lie. In just a few short years, crypto-currency exchanges in Asia dominate the market, as detailed in the chart below:

Concluding Remarks

The crypto-currency market is, in many ways, like the “Wild, Wild, West” days of old in the world of foreign exchange. Regulators and bankers have been contemptuous of the phenomenon, choosing to attack and retreat, as each salvo failed to slow down the beast in their midst. The global market, however, is uniquely competitive. If one group refuses, another will take up the effort, as long as the opportunity for gain is present.

Crypto-currency zealots will forever be decrying the attractiveness it offers to money laundering thieves and fraudsters on several levels, ICOs being only one such avenue that criminals pursue. There are a host of fraudulent schemes enabled by the world of crypto-currencies, many of which we have detailed in articles on this website.

At the end of the day, there is a lot of money to be made and lost in legitimate business activities in this arena, but investors must forever be wary of anything that sounds too good to be true. Stay skeptical, and practice due diligence!

Are you ready to trade?

Sign up with 61% of retail CFD accounts lose money

61% of retail CFD accounts lose money

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2025

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #2 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #3 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #4 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #5 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #6 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox