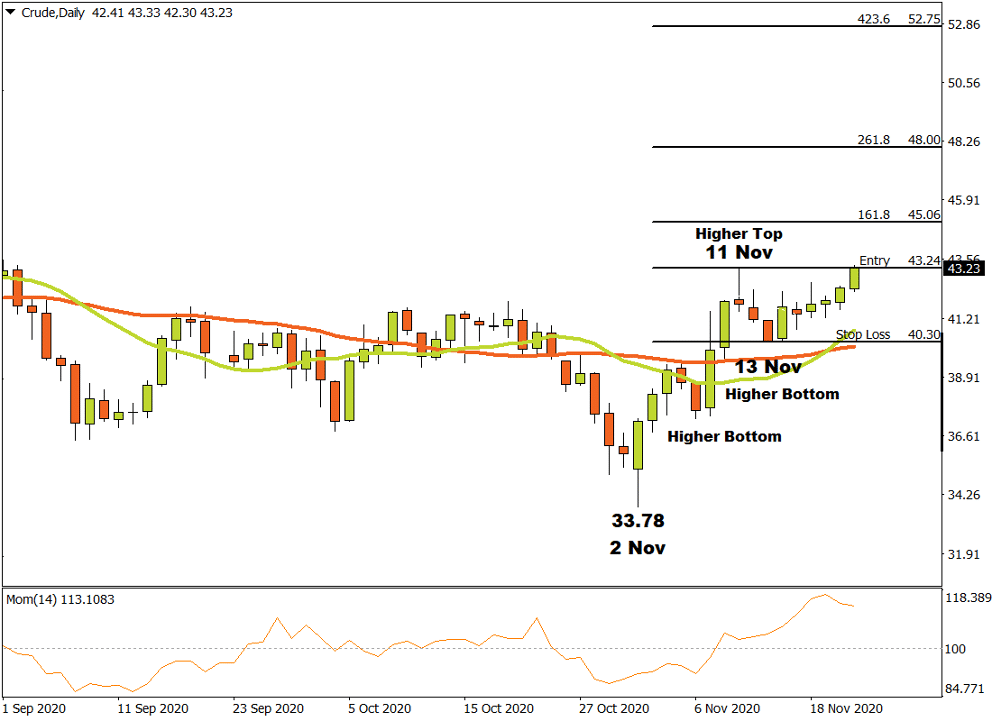

The Crude oil market, on the D1 time frame, was in a short downtrend until the 2nd of November when a lower bottom was reached at 33.78. Bulls found the price attractive and demand began overcoming supply.

After the lower bottom at 33.78, the price crossed upwards through both the 15 and 34 Simple Moving Averages and the Momentum Oscillator crossed the zero baseline into bullish territory. This was a warning to technical traders that a possible trend change might be in progress.

A higher top and critical resistance level was formed on the 11th of November at 43.24 when bears came to the immediate defence, trying to take the price lower again. They failed and on the 13th of November a higher bottom was formed at 40.30 as bulls started re-capturing the market again.

On the 23rd of November the Crude oil market breached the critical resistance level at 43.24 and three possible price targets can be calculated from there. Applying the Fibonacci tool to the top of the resistance level at 43.24 and dragging it to the previous higher bottom at 40.30, the following targets can be considered. The first target may be projected at 45.06 (161 %). The second price target might be likely at 48.00 (261.8%) and the third and final target can be expected at 52.75 (423.6%) if the uptrend continues making higher top and bottoms.

If the higher bottom at 40.30 is breached, the bullish scenario above is invalidated and traders might consider protecting their accounts.

As long as positive sentiment remains and demand overwhelms supply, the outlook for the Crude oil market on the Daily time frame will remain bullish.

For more information, please visit: FXTM

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2025

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #2 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #3 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #4 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #5 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #6 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox