The quarterly process of US corporations announcing their most recent earnings reports has for some time been a procession of ‘beats’. Since research agency Refinitiv started tracking the numbers in 1994, a healthy 65% of earnings reports have beaten analyst expectations. In Q1 of 2021, that percentage rose to a staggering 87%.

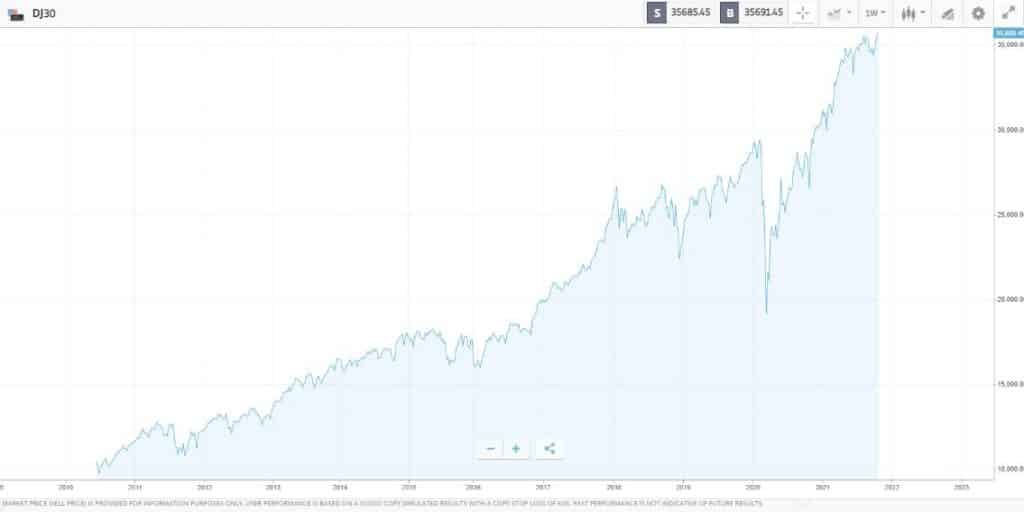

The celebrations associated with analysts once more underestimating the performance of firms go a long way in explaining the extended equity bull runs seen over the last decade. Earnings beats have become such a Pavlovian ‘buy’ signal that there is a real risk that a series of flops could derail the markets. As US firms prepare to report to their investors, there is a chance that that moment could be now.

Dow Jones Industrial Average 2010 – 2021

Source: eToro

The outperformance in Q1 of this year is part of the explanation. The problems associated with Covid, and lockdowns, were bound to take some time to work through the system. Earlier in the year, firms managed to post stellar results partly because expectations were so low, and comparisons to 2020 were always going to come off well, as the Wall Street Journal reported at the time:

“Money managers had by and large predicted that companies would post impressive growth in the first quarter because of easier comparisons against the prior year, when the coronavirus pandemic began disrupting economic activity around the world.”

Source: WSJ

Starting from that low bar means that as of Q2 and now Q3 earnings season has approached, some investors have begun to worry about when the music will stop.

Q3 Earnings

Market strategist at National Securities and perma-bull Art Hogan shared his concerns about Q3 earnings throwing up some unwelcome surprises. Speaking with CNBC, he said:

“Buckle your seatbelts! This will be the first time in the cycle you’re actually going to hear more companies guide down than guide up.”

Source: CNBC

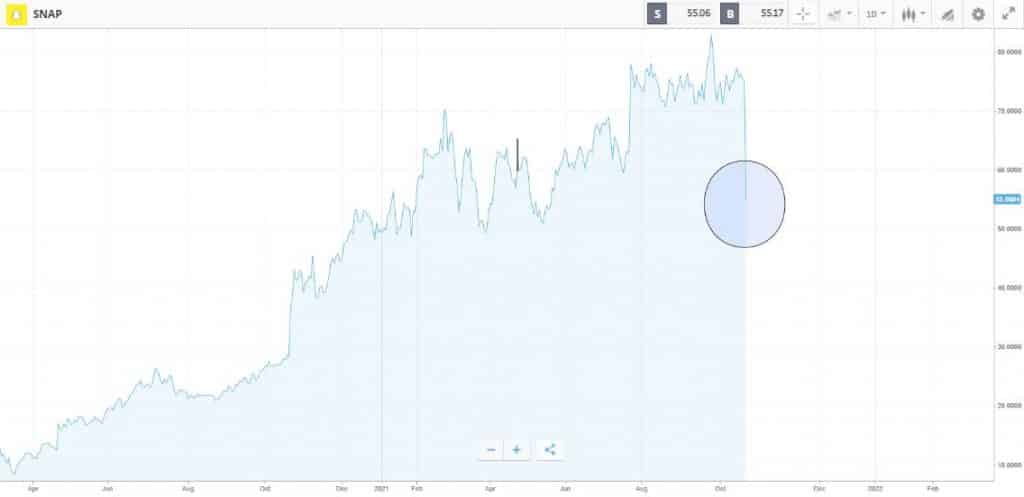

Tech firm Snap has already set the mood. Last week it posted disappointing earnings, which dragged the entire Nasdaq index lower. Snap stock is down 27% since its announcement, highlighting the potential for downside on stocks that fall out of favour.

Snap Inc Share Price – March 2020 – October 2021

Source: eToro 51% of retail CFD traders lose money

Snap cited supply-side logistics and reduced advertising revenue as being reasons for the underperformance. There have been some raised eyebrows about the willingness of a ‘camera and social media’ firm to refer to “global supply chain issues and labour shortages impacting our partners” as an issue for their largely virtual products.

It looks like “global supply chain issues” could be a convenient to use buzzword for this round of earnings releases. It would cover a range of complex to detail issues, and while justified to some extent, investors will need to make calls on a case-by-case basis on whether the tag is appropriately applied.

Crowdsourcing information about scam brokers can help others avoid falling into the traps set by disreputable brokers, and you can share your experiences here. If you want to know more about this topic or have been scammed by a fraudulent broker, you can also contact us at [email protected]

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2025

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #2 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #3 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #4 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #5 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #6 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox