The recent reduction in crypto price volatility shouldn’t be taken as a sign that the story has ended. In fact, the consolidation at current levels reflects a period in which the market is maturing. That could throw up opportunities for those looking to get into positions before the next bull run starts.

The change in the mood of crypto markets is possibly best highlighted by the fact that in the week beginning 25th April 2022, the price of Bitcoin and Ethereum moved less than that of gold. Ether’s price move was a modest +0.14%, with gold’s week-on-week move a negative 2.82%.

Crypto – The Calm Before The Storm?

Long-time followers of the crypto markets will point out that Bitcoin, Ether, and other coins have gone through periods of price consolidation before. Price surges such as the +450% rally in the six months between October 2020 and April 2021 grab the headlines; however, the intervening periods are when opportunities to enter into long crypto positions arise. The Ukraine-Russia conflict, inflation, and oil prices may currently be centre-stage, but the technical analysis for crypto markets shows some interesting situations are developing.

Bitcoin Technical Analysis

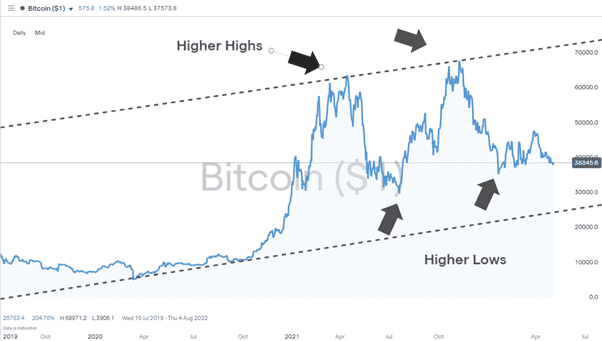

The 2019 – 2022 Daily Price Chart for Bitcoin confirms that one of the basic principles of a bullish market is being maintained: price printing higher highs and higher lows.

Bitcoin Daily Price Chart Jan 2020 – April 2022

Source: IG

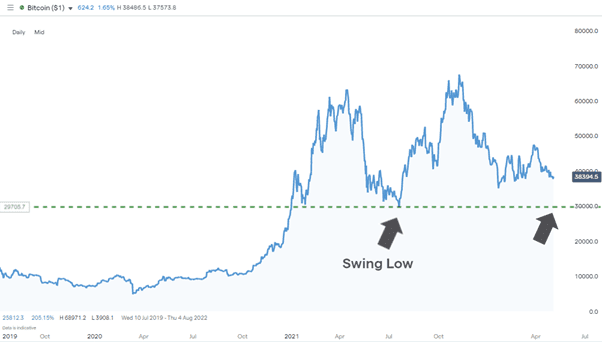

As long as the swing-low price of 30,464, which dates to 20th July 2021, holds, the long-term bullish price pattern is still in play.

Bitcoin Daily Price Chart Jan 2020 – April 2022

Source: IG

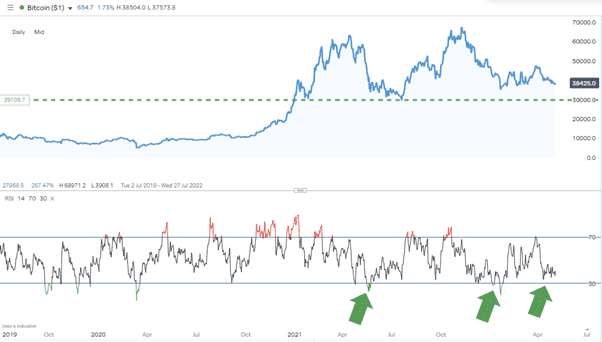

The daily RSI at 36.6 is comfortable for those looking to buy Bitcoin but waiting for that metric to hit 30 could optimise a trade entry point as it did in May 2021 and January 2022.

Bitcoin Daily Price Chart Jan 2020 – April 2022

Source: IG

Ethereum Technical Analysis

The Daily Price Chart for Ethereum tells a similar story to that of Bitcoin, but in the case of Ether, the price looks like it’s about to touch the supporting trend line dating back to November 2020. Bullish strategies could be about to reach a trade entry point.

Ethereum Daily Price Chart Jan 2020 – April 2022

Source: IG

It’s also the case that Ether is printing higher highs and higher lows.

Ethereum Daily Price Chart Jan 2020 – April 2022

Source: IG

Both of the long-crypto strategies would benefit from a catalyst coming into play. For example, that could be in the form of an announcement that the coins are becoming more mainstream. The fact that some of the heat has dropped out of the market since 2021 makes it possible in 2022. Politicians would not have wanted to be seen as fuelling a speculative price bubble. There is no doubt that the opportunities crypto offers are still a ‘problem’ for the traditional financial infrastructure.

We’ve been here before with crypto, and price rallies have followed. While the bullish technical analysis holds, it’s worth considering buying in during the lull. Whether you’re a newbie or a seasoned trader, the core principles of investing still apply. They include only investing capital you can afford to lose and ensuring you trade using a trusted broker, such as on this shortlist of good crypto brokers that have been reviewed by the Forex Fraud team.

Crowdsourcing information about scam brokers can help others avoid falling into the traps set by disreputable brokers, and you can share your experiences here. If you would like to know more about this particular topic or have been scammed by a fraudulent broker, you can also contact us at [email protected]

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2025

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #2 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #3 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #4 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #5 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #6 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox