Efforts to move cryptocurrencies into the mainstream took another hammering last week when crypto lending platform Celsius filed for bankruptcy. It’s not a story with a happy ending for millions of clients of the platform who now stand to lose a large part of their holdings.

What Went Wrong At Celsius?

As with many things crypto, Celsius was ‘like’ something from the established financial system, in this case, a bank; but at the same time not like a bank in the way that mattered.

From its New Jersey base and four global offices, Celsius offered a global client base the option to deposit digital assets such as Bitcoin and Ethereum and, in return, receive an interest rate style return on their positions. Borrowers were also catered for by the company at the time of going bust, having $8bn of loans placed with clients.

The figures in terms of debt to assets ratios weren’t off the scale and compared well to high street banks. The $8bn of loans was counterbalanced by the platform’s $12bn of assets under management. But if AUM wasn’t the problem, what was, and what does it mean for the price of cryptos in the near and long-term?

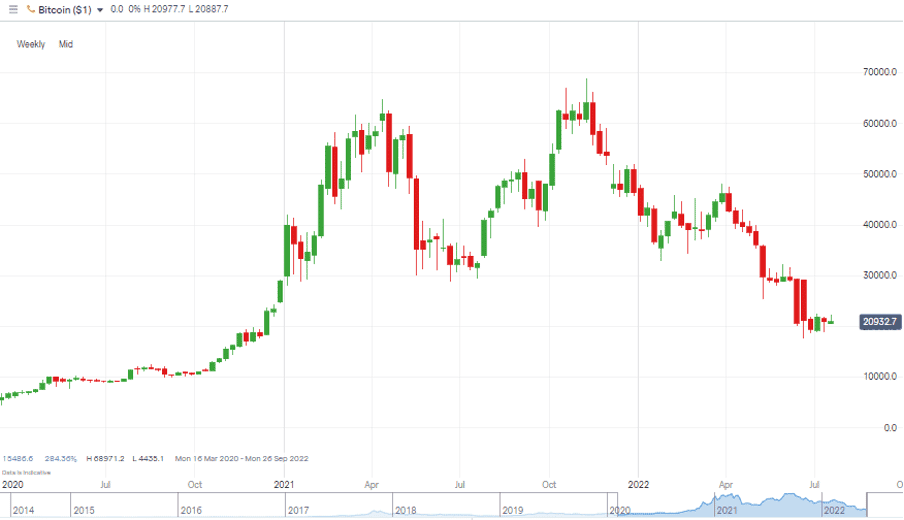

Bitcoin – Weekly Price Chart –June 2020 – July 2022

Source: IG

Celsius’ problems stem back to the old enemy of any struggling firm, cash flow. Despite the billions on the balance sheet, its liquid assets only totalled $141m in value when it closed its operations. Part of the reason for this was the crypto price crash throughout 2022, which drove the value of assets such as bitcoin down by as much as 74% from their recent peaks.

Plummeting crypto prices triggered renewed concerns about the value and viability of digital assets. Those questions remain, but ironically the way that Celsius managed the wind-down offers some hope that the crypto ecosystem is beginning to look more credible.

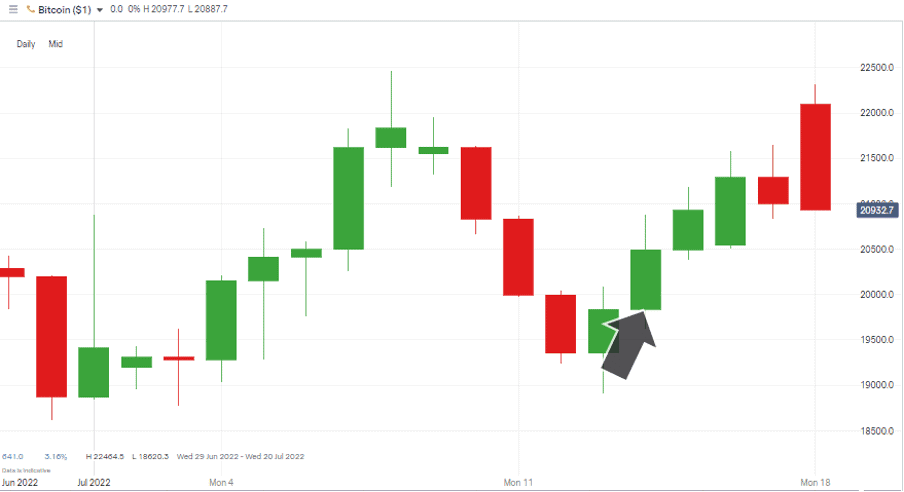

Bitcoin – Daily Price Chart –June 2020 – July 2022

Source: IG

When they realised the game was over for Celsius as a lending platform, the management decided to restrict withdrawals to prevent a run on deposits. That would have allowed some customers to be paid in full while leaving others behind. Following the news that the wind-down would be orderly, the price of bitcoin then rallied, posting a 15.51% gain from the lows of Thursday 14th July to the highs of Tuesday 19th July.

Lessons To Take From The Collapse of Celsius

Investors will be left out of pocket, and other platforms will fail the stress test that the demise of Celsius triggers. But this isn’t the bloodbath it could have been and isn’t a case of scammers setting up a fictitious operation and fleeing the country overnight. It is, though, very much a reminder for crypto traders to use a trusted broker from this shortlist of firms which ForexFraud have reviewed and rated. Trading bitcoin and other cryptos is almost guaranteed to be a bumpy ride but setting up an account with a legit broker is step number one towards safer crypto trading.

Crowdsourcing information about scam brokers can help others avoid falling into the traps set by disreputable brokers and you can share your experiences here. If you would like to know more about this particular topic, or have been scammed by a fraudulent broker, you can also contact us at [email protected]

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2025

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #2 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #3 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #4 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #5 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #6 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox