Bankruptcy notices are becoming more common in our industry of late. You need only peruse a few of the more prominent industry “rags” to notice that a change is taking place. FinanceMagnates recently posted the following attention grabber: “Breaking: Gallant Capital Markets Files for Bankruptcy Protection.” Another LeapRate headline also jumped off the screen: “LQD Markets bankruptcy update: $2.7 million repaid to clients, expected deficiency of $2.9 million.” These two firms may not be big hitters in the world of foreign exchange, but they are indicative of the financial instability that may be lurking just beneath the surface at a few of our forex brokers.

These two bankruptcies are not the only ones within the retail forex trading arena. There have been others and not only in North America or the European region. Many of the problems in our forex world began with the financial crisis in Cyprus in 2013, were exacerbated by the Swiss Franc Debacle at the start of 2015, and have carried over into 2016 after the shocking exposé that unscrupulous business practices seemed to be the new normal in the binary options space. Couple these events with an avalanche in consumer complaints, major bank rate-fixing scandals, declining trading volumes, and increased regulatory clampdowns, and you have a recipe for heavy credit risk.

Like it or not, our industry is definitely in a transition period. Consolidation and merger announcements, together with occasional bankruptcy notices will, unfortunately, be de rigueur for some time to come. The FCA, CySEC, and a host of other regulatory bodies are determined to take charge of their respective markets and set compliance bars at much higher levels. Due to newly enacted rule changes, customer acquisition and retention strategies must undergo dramatic redevelopment, a direct hit on the revenue dynamics of every brokerage concern, both large and small. Readjustment will take time. There will be winners and losers, and, if recessionary forces take over the global economy, then the reshuffling process may become cutthroat at a later stage.

What are more details on the recent spate of broker bankruptcy announcements?

In a previous article, we outlined seven fundamental risk drivers that would impact our industry in 2017. The seventh and final one on the list spoke to the reorganisations that would soon become commonplace: “Declining revenue, tougher regulations, intense competition, and an enraged public spell trouble with a capital “T” for brokers and ultimately for traders. Mergers and acquisitions are now commonplace, as many entities hang on for their dear lives. It would be wise to monitor your current broker’s performance. If it smells like trouble, consider making a change midstream.”

Apart from apparent acquisitions of competitive programs or the outright relocation of a broker to a new jurisdiction to escape impending regulatory nightmares, here are three recent stories of brokerage firms that bit the dust:

1) GCMFX (a sub of Gallant Capital Markets Ltd): A brief summary of major points regarding this story reads, as follows: “Foreign exchange brokerage, Gallant Capital Markets also known as GCMFX filed for bankruptcy protection in the US Bankruptcy Court for the Eastern District of New York. The firm regulated by the British Virgin Islands Financial Services Commission published an official announcement on its website on Friday, the 14th of April.” When you get behind these details, however, you begin to see how convoluted financial misgivings can get before action is taken. Although it is a BVI registration, the CEO and primary owner, Salvatore Buccellato, is a U.S. citizen and “remains the controlling shareholder of Gallant via his US holding company Prime Trade Holdings Corp.” Back in 2014, a major portion of Gallant was sold to WSM Investments, a firm owned and controlled by a Czech executive by the name of Jiri Kubicek. Why is this fact important? Within the past week, “Kubicek was placed in handcuffs and taken away by Czech police in Prague on suspicions of fraud and money laundering, connected to investigations of his company WSM Investments.” Police claim that client funds have been used by Kubicek to do all manner of things except for which they were intended, i.e., forex trading using WSM’s proprietary robot algorithms. There is one positive to note. Gallant was only seeking protection from creditors, not a full liquidation proceeding. It claims that a regulated counterparty was refusing to honor its withdrawal commitments and that it needs time to remedy the situation. Whatever the reason, clients may not see their funds for quite some time. In a related matter, GCM Prime, another subsidiary of Buccellato’s Prime Trade Holdings Corp., is distancing itself from the fray. In a separate statement, its management asserted: “GCM Prime is an independent FCA regulated company. Gallant Capital Markets, an FSC registered company, voluntarily filed for Chapter 11 reorganization and has no effect on GCM Prime. GCM Prime was not acquired by Gallant nor does it share a similar management structure.” It claims that client funds are safely segregated, as well.

2) LQD Markets Ltd, a Cyprus-based firm: In this particular case, LQD Markets is not a new arrival to the bankruptcy court, but it demonstrates how slowly the wheels of a bankruptcy investigation and liquidation can turn. LQD was one of many forex brokerage houses that found itself on the wrong side of Swiss Franc positions when the SNB unexpectedly removed its peg to the Euro on January 15, 2015. RSM Restructuring Advisory LLP is the special administrator that has been assigned this case, and, incumbent upon its role, it occasionally releases a progress report on the proceedings. RSM has fortunately found and distributed to victims a little more than $2.7 million. After fees and administrative costs, the liquidator expects to reimburse clients roughly $4.4 million, leaving a $2.9 deficit in missing funds. The payback ratio of 60%, however, is much higher than was originally estimated, after it was suspected that the firm’s CEO had absconded with the missing cash.

3) Forex Brokers, a New Zealand-based firm: This broker was founded in 1995 in New Zealand, but began having problems in late 2016. Vendors had complained that they had not been paid, and client withdrawal requests were inadvertently delayed. As is often the case, the management team informed clients that its bank was the problem and that a solution was imminent. Any delays in processing withdrawal requests (this firm had actually stopped answering the phone) are always an early sign that financial trouble may be brewing in the back office. The report from the court appointed liquidator now lists $10 million in liabilities and a mere $40,000 in assets. A 60% payback ratio is not in the cards for these customers.

A decline in industry trading volumes is at the core of the problem.

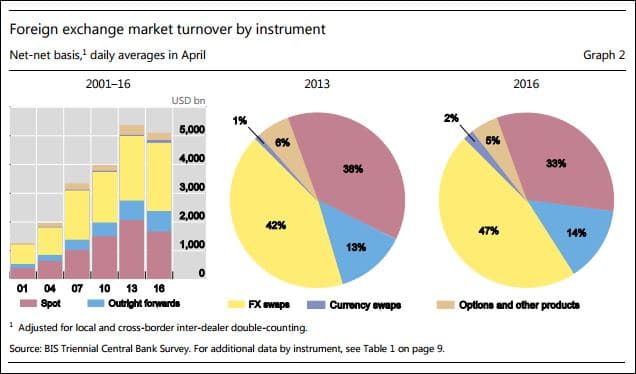

As the saying goes: “A rising tide lifts all boats,” but it can also cover a multitude of rocks that rest just below the surface. Forex brokers have been the benefactors of a tsunami of rapidly increasing growth demographics since the nineties, as noted in the chart above. The Bank for International Settlements (BIS) triennial Central Bank Survey provides the data on the nature and growth of turnover in the foreign exchange industry. There are many components in our favorite market, but the “Spot” portions depicted in the bar and pie charts pertain to our sector of the business.

As can be discerned, for the first time in our industry, volumes have taken a major dip in the southerly direction. As per the metaphor in the above paragraph, when the tide goes out, it exposes a number of rocks, which represent dire financial consequences for those firms that were not prepared for them. The Cyprus financial crisis and the Swiss Franc Debacle had decimated a number of firms and left many clinging by their very fingernails, in hopes that volume growth would help them overcome their respective financial woes. Such was not to be the case, and, with regulators across the globe tightening compliance screws, so to speak, the prognosis going forward is not good.

What can one do to protect themselves from broker credit risk?

Pressure from the financial crisis in Cyprus was more isolated than the systemic risk brought about by the SNB lifting its Euro-peg. Many brokers on the island had already segregated client deposits in offshore Tier-One bank accounts. The ones that did not either had to seek additional capital, get acquired, or had to close their doors. These actions were swift, but a few survivors were left clinging to their lifeboats.

For those that do not remember, the Swiss Franc Debacle was broader in scope. Here is one synopsis of the carnage: “The event caused heavy losses to foreign exchange brokers who suffered extraordinary slippage in the open market. A few hours after the crash, a major retail forex broker, Alpari UK, announced bankruptcy. Another leading Forex broker FXCM reported a loss of $225 million, and its stock price plunged almost 90%. IG suffered a loss of £30 million during the event. Citibank reported a massive loss of $150 million amid the EURCHF flash crash. The event caused a massive $1 billion crash in global stock markets.” The SNB was never held accountable for its rash actions.

How does one protect themselves from a potential broker bankruptcy surprise? It is very difficult, near impossible, to predict and protect against systemic risk. Diversification does not work, if there is a system-wide debilitating event. One safety measure is to always ensure that your funds are segregated in an offshore Tier-One bank account. If the broker will accept a tri-party custodial agreement, then more protection may be available, but this type of legal maneuvering may be problematic for your broker.

When financial problems start, your broker may resort to breaking his covenants or resorting to shady business practices. If there is a hint of this maneuvering, move your funds. It is always best to deal only with a locally licensed broker, one that must comply with capital requirements dictated by the local regulator. Check from time to time to ensure that the correct level of capital is maintained. Lastly, dealing with a foreign broker is a nightmare waiting to happen. When everything hits the fan, you will never be able to enforce your legal rights in a foreign jurisdiction.

Concluding Remarks

Broker bankruptcies are on the rise, and this current spate of bad news may only be the tip of the iceberg. Financial pressures are building on several fronts, from increased competition to declining volumes, and from the threat of economic recession to the constraining nature of regulatory reform. Is your broker safe and secure?

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2025

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #2 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #3 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #4 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #5 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #6 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox