The whipsawing prices of Bitcoin and other cryptos have dazzled and dumbfounded the trading community. Anyone who bought BTC in February 2020 and sold out 14 months later posted a +1,000% gain. On the other hand, a recent report notes that 40% of Bitcoin holders are currently showing a loss on their position.

Despite, or more likely because of the extreme price volatility, the feeling remains that getting a trade right could result in a life-changing return from one position, which still attracts many to the market. The government of El Salvador, which has used Bitcoin as legal tender since 2021, is leading the charge to buy the current dip and on Monday announced it had bought 500 coins for its balance sheet.

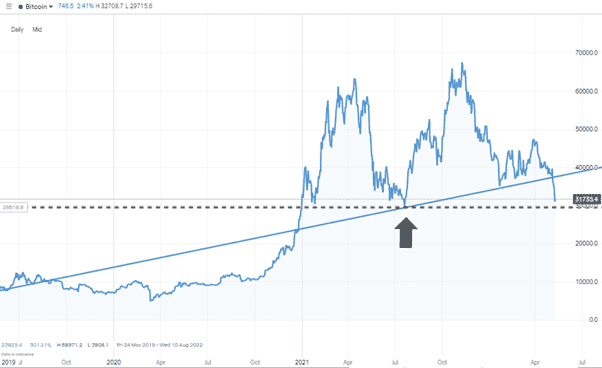

Bitcoin – Daily Price Chart – July 2019 – May 2022 – Reaching key support level

Source: IG

Correlation Between Bitcoin and Nasdaq 100

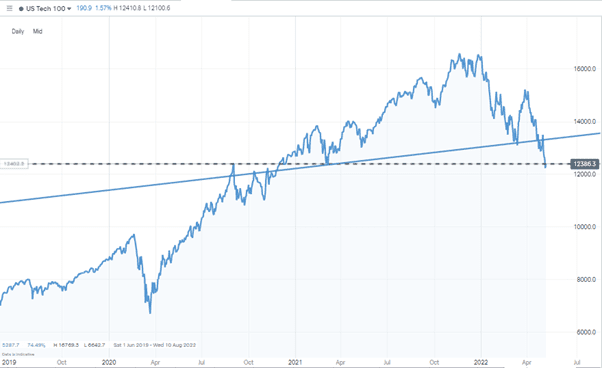

One interesting trend emerging amidst the recent sell-off is a correlation between the price of Bitcoin and tech stocks. This pattern emerged soon after the market lows of March 2020, but a recent report from Bloomberg reveals it is accelerating. In fact, the 40-day correlation between the Nasdaq 100 index and the dominant cryptocurrency BTC reached an all-time high of 0.6945 on April 8th, 2022.

NASDAQ 100 – Daily Price Chart – July 2019 – May 2022 – Reaching key support level

Source: IG

Anecdotal evidence points to buyers of Nasdaq stocks being early adopters and tech-savvy, which suggests a link between the two markets. The recent sell-off in the Nasdaq 100 has also been matched by a price plunge in Bitcoin that could reflect investors heading to the door of both markets at the same time.

Establishing if there is a causal effect to the correlation is tricky but taking the relationship as a given opens the door to trading Bitcoin price moves in an easier, safer, and more cost-effective way. Setting up an account with an online broker such as IG or eToro takes minutes and opens the door to obtaining exposure to tech stocks and Nasdaq futures. Those brokers also offer superior customer protection against the specialist and unregulated crypto platforms which have sprung up.

Market giants that are currently struggling include Apple, Amazon and Netflix, down from their 2022 highwater marks by 15.96%, 35.31%, and 70.85%, respectively. Even greater risk return can be found in stocks which have only recently come to the market. Of a group of 53 tech stocks which were listed in 2021, all but three are now trading below their offer price (for IPOs) or opening price (for direct listings).

Final Thoughts

Tech stocks might not be ‘the new crypto’, but following recent price moves, they’re getting there. The markets to trade them have tighter spreads than crypto, there’s no need for specialist wallets, and greater regulatory protection is also included. That makes tech stocks the current cost-effective route for those looking to scale up on risk-return.

Crowdsourcing information about scam brokers can help others avoid falling into the traps set by disreputable brokers, and you can share your experiences here. If you would like to know more about this particular topic or have been scammed by a fraudulent broker, you can also contact us at [email protected]

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2025

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #2 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #3 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #4 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #5 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #6 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox