Your capital is at risk

Your capital is at risk

2019 is not expected to be a kind year for the Australian Dollar. The currency is at risk to entering the new trading year under unexpected negative momentum amid investor fears over a synchronized global economic slowdown in 2019.

What needs to be considered for Australia heading into 2019 is that the expected economic downturn will also be evident throughout Asia and a number of different emerging markets within geographic proximity. This will be a different circumstance for the region as a whole to contend with when you factor in that these economies actually emerged stronger on the back of the world financial crisis a decade ago. This time the Asian region will be one of the first to report weaker growth.

Investors should also not forget that the Australian Dollar stands as one of the most historically overvalued currencies in the developed markets. The negative implications of prolonged trade tensions between the United States and China are going to impact Australia more than the market has as of yet priced in. China still remains as Australia’s largest trading partner, and it was the economic boom in China that had a positive knock-on effect for Australia.

I also feel that what will surprise market participants over the upcoming quarter is how sensitive the Australian currency can be during periods of market uncertainty. The Aussie relies on strong levels of risk appetite. With the previous mindset of investors “buying the dips” during stock market sell-offs aging as a trend, “selling the rallies” is going to limit buying interest in the Australian Dollar.

For investors who want to remain loyal to the Aussie Dollar in Q1, they need market euphoria from an actual resolution to the trade tensions between the United States and China. This is something completely out of the hands of Australia and I wouldn’t hold my breath that a resolution will be agreed anytime soon either, when considering that this is something financial markets have been hoping for since the second half of 2018.

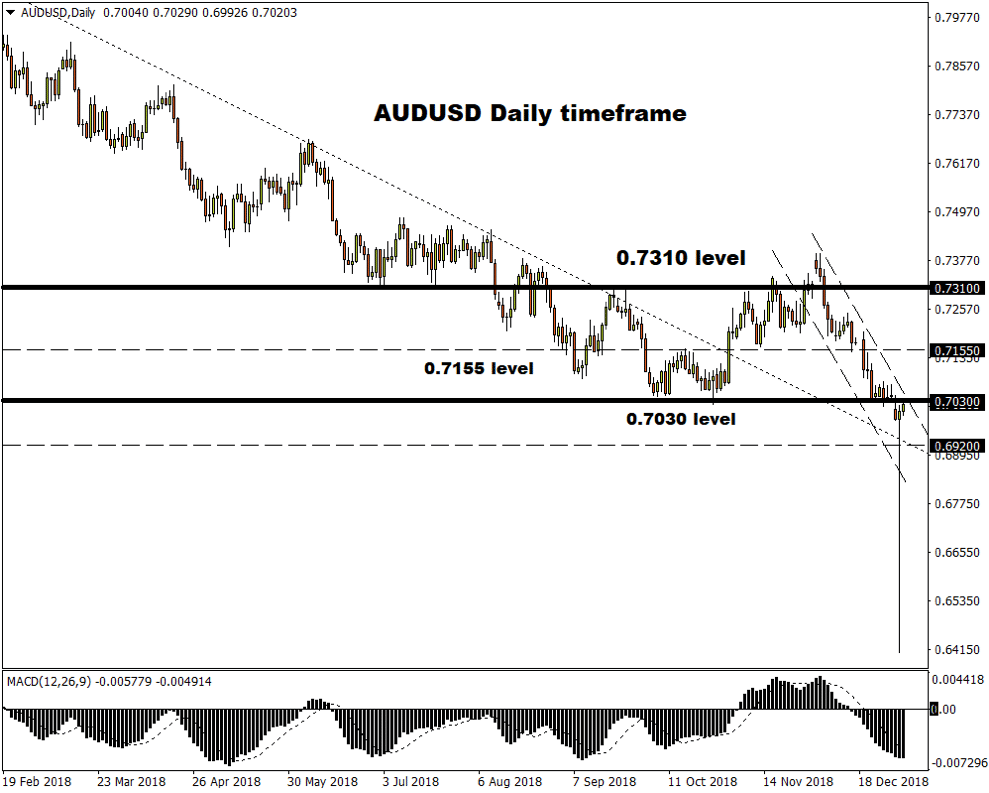

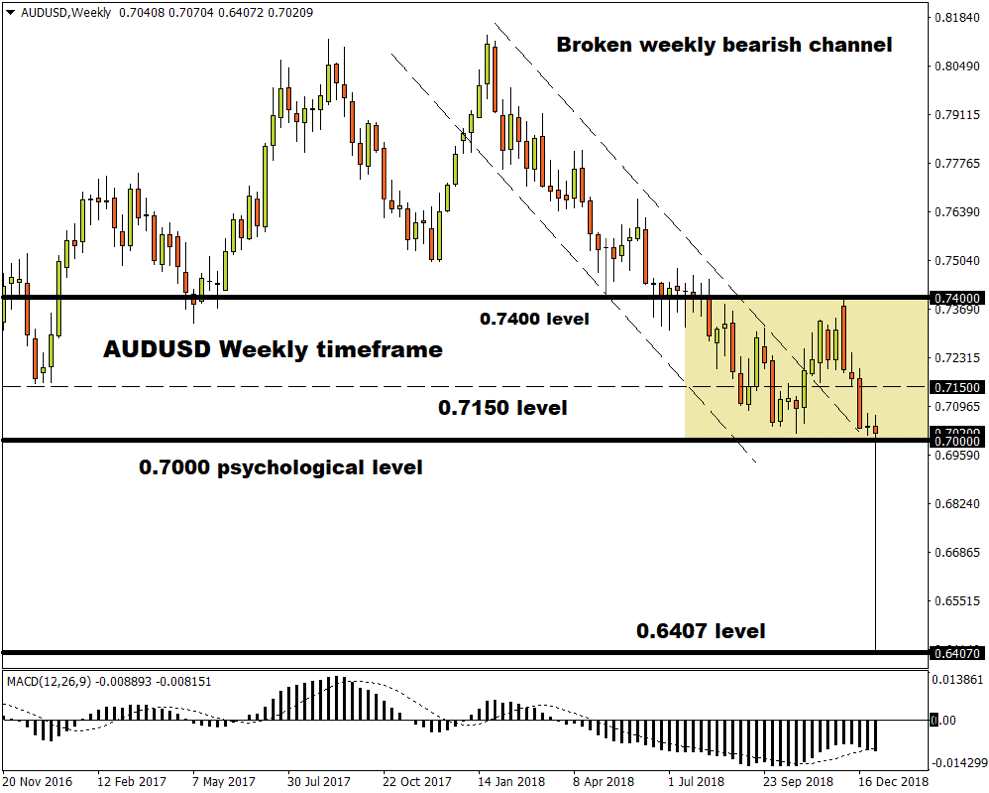

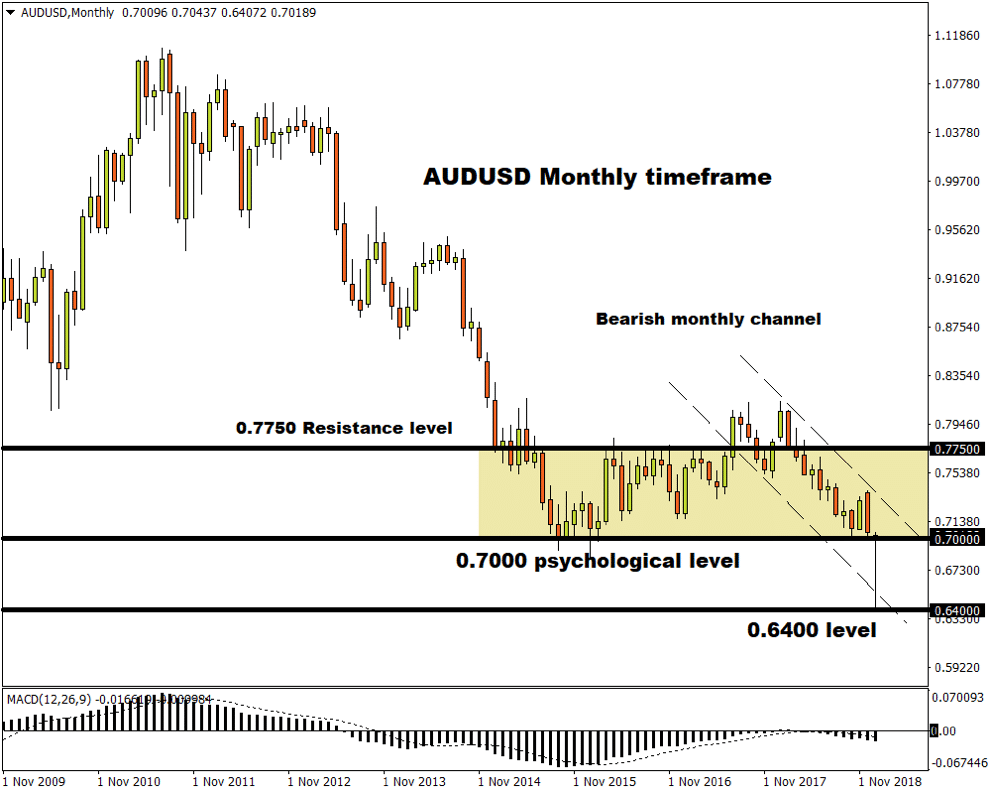

Taking a look at the technical picture, the AUDUSD monthly close narrowly above 0.70 in December 2018 suggests that the market will be encouraged to sell the Aussie early 2019.

A solid monthly and weekly close below the psychological 0.70 level holds the potential to attract investors swarming to attacked the AUDUSD lower.

0.70 will be viewed as a critical level for the AUDUSD and if this level becomes stubborn support, the alternative view is that the pair can rebound towards 0.7150 and even 0.7310 if risk appetite returns.

*Charts updated on Friday 4 January*

Written by Jameel Ahmad, Global Head of Currency Strategy and Market Research at FXTM

For more information, please visit: FXTM

Disclaimer: This written/visual material is comprised of personal opinions and ideas. The content should not be construed as containing any type of investment advice and/or a solicitation for any transactions. It does not imply an obligation to purchase investment services, nor does it guarantee or predict future performance. FXTM, its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness of any information or data made available and assume no liability for any loss arising from any investment based on the same.

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 90% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2025

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #2 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #3 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #4 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #5 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #6 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox