The monthly US jobs report released on Friday was a massive disappointment for Main Street, but it boosted Wall Street. Why? Because the financial markets are taking it as a sign that fiscal and monetary policies will be continued to pump cash into the markets.

The Non-Farm Payrolls numbers missed analyst expectations by some distance. The gain in jobs in April was forecast to be close to one million; however, only 266,000 Americans took up new roles. The overall unemployment rate had been predicted to fall to 5.8% but instead came in at 6.1%. There was more bad news as it was confirmed the numbers for March were being revised downwards from 966,000 to 770,000.

The one million and 5.8% estimations were the average of analyst expectations, with many factoring in even larger gains than that as signs of economic recovery dominated the newswires. The figures mean that the 266,000 additional jobs number needs to be looked into in some detail.

Market Reaction to the April NFP Jobs Numbers

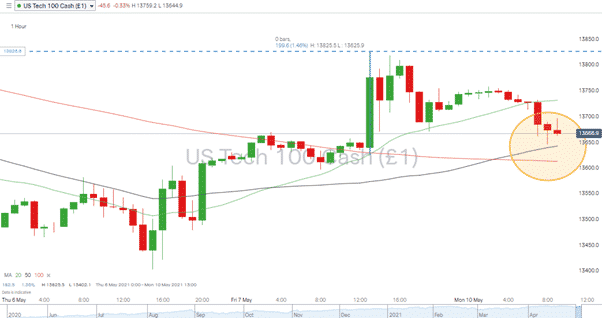

As is often the way, the financial markets reacted positively to the news based on the belief that US Federal Reserve monetary policy will continue to be super-relaxed. All that cheap money has to go somewhere; it was the global stock indices that benefited on Friday. In the hour following the announcement, the Nasdaq 100 index rallied 1.46%, and the S&P 500 increased in value by 0.54%.

Source: IG

The price spike in the Nasdaq, to 13825, was followed by a reversal in futures prices over the weekend and Asian and European trading hours. With price on the hourly charts now sitting on the 50 SMA (but below the 20 SMA and above the 100), there will be a temptation for some investors to buy the dips. Support is being offered around the 13600 level, but it will be interesting to see how the NFP jobs report is interpreted now that analysts have had more time to study the findings.

Source: IG

Does the NFP Jobs Report Point Towards Wage Inflation?

For a large part of the last ten years, the US stock markets have responded to good and bad economic data in essentially the same way – by increasing in value. Good news was – good news, and bad news – would be addressed by the Fed or White House supporting the economy. One feature of the NFP report from Friday might be encouraging some to disassociate themselves from that established mantra.

If the jobs number miss is attributed to a shortage of qualified staff for the existing vacancies, then those US citizens in paid positions will be in a stronger position when negotiating pay rises. Employers will also be more open-minded about upping their budget when hiring. The prospect of global recovery is very real and capturing workers from rivals might be necessary to satisfy orders. Price inflation is increasingly being seen as the factor most likely to derail the equity bull market. The week ahead will offer clues as to how much weight investors are currently giving to the risk.

If you want to know more about this topic, or have been scammed by a fraudulent broker, please contact us at [email protected]

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2025

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #2 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #3 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #4 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #5 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #6 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox