After bearing up under an onslaught of new regulations and guidelines from our friends in the global regulatory community, the retail foreign exchange industry has adapted well, as we started a new year. By the look of fraud and regulatory headlines over the first quarter of this year, however, one would have thought that everyone had decided to take a long winter’s nap. Yes, there were the normal blacklisting of bad boys, especially binary brokers, and a few warnings about not too ethical money managers, but other than that, most compliance folks and fraudsters seemed to be in hibernation.

Read all forex market news.

Do not let complacency cloud your judgment. April has come alive with ample stories of prosecutions, major scams, and frontline companies changing their tunes when it comes to letting anyone benefit from their brand awareness. And do not assume that conmen have taken a long-term vacation to some far off location. They have been busy at work polishing and revamping their favourite tools and schemes of their trade for this summer’s full-out attack on unwary consumers.

While researching this article, I encountered no less than two mal-bots, attempting to gain my private login information. One attempt was blocked by my security software, which notified me that the site I was trying to access was infected by mal-ware and should be avoided. The second attempt was the old fake Microsoft alert, warning me that a serious virus had infected my PC and that I should immediately go to the suggested hyperlink or call the indicated phone number. Microsoft does not engage in this type of activity. The website given would have loaded a mal-bot, while the phone number would have connected me with a crooked call desk in God knows where. Risk never sleeps!

If you peruse the global headlines in the fraud and scam arena for April, you will take note of a serious uplift in activity on all fronts. As most every fund manager, at least the legitimate types in our industry and other investment mediums, will tell you, your first consideration before taking any position in our financial markets, wherever you might be, is to be fully aware of the risks at hand. We have spoken from time to time about different forms of market risk for a reason – To be forewarned is to be forearmed, and awareness is the first step towards preventing the consequences of fraud and/or risk!

What have been a few of the more notable storylines over the month of April?

We have assembled a brief synopsis of a few of the more interesting items that appeared in industry rags over the past month. These tidbits range from actions taken by the CFTC, the SEC, ESMA, and the FCA to Russia’s continuing problem with its self-inflicted plague of fraud. Binary option and Crypto fraud are ever-present, but on the positive side, there have been healthy returns realised by one of the major players on the brokerage front. Let’s start with a review of recent regulatory actions of note:

The FCA and ESMA broadcast capital requirement impacts of new rules

If you were familiar with the regulatory changes that were made in the U.S. market after the financial crisis, then you could almost see this one coming in Europe. A few years back, the CFTC lowered permissible leverage limits, which caused an outcry from the brokerage establishment. These changes were but the first shoe to drop. The second one had to do with increased capital requirements, the second assault, so to speak, which drove the remaining brokers from the region that perceived greater opportunities on the global scene, excluding the United States.

It may be “Déjà vu” all over again, because now the FCA and ESMA have recently put capital requirements front and center in their latest communiqués. The press releases are cloaked in obtuse phrases, suggesting that firms may want to check their capital adequacy calculations under the new rules of conduct. One reporter tried to explain the missive as follows: “One of the key elements of the new regulatory framework devised by the ESMA is related to protecting clients from adverse market moves. All firms trading as principal will need to carefully consider how the provision of negative balance protection impacts the risks they are exposed to and the capital and liquidity they need to hold.” Suggesting is one thing, but regulators usually want to see proof at some point.

CFTC and SEC step up prosecution activity in the U.S. market

The CFTC and SEC have been busy behind the scenes, but, occasionally, their actions are highlighted in the press. The CFTC has been attacking binary option schemes for some time, since the only legal way to trade them in the U.S. region is via regulated exchanges. This fact has not deterred the criminal element of our society, which allegedly includes one Blake Kantor, who established a company known as Blue Bit Banc or Blue Bit Analytics, Ltd. (BBB).

Richard P. Donoghue, United States Attorney for the Eastern District of New York stated: “As alleged, Kantor used a computer program to generate manipulated data to cheat hundreds of investors out of their hard-earned savings. To cover-up his fraudulent scheme, Kantor then lied to the FBI and ordered the alteration of documents that would assist agents in identifying his victims.” Kantor could get 20 years in prison for defrauding 713 victims out of $2.1 million.

The SEC, on the other hand, has taken a very dim view of ICO offerings. Centra Tech Inc. raised $32 million in its 2017 Initial Coin Offering. The SEC is alleging that the evidence demonstrates fraudulent intent on behalf of Gentra’s co-founders, Raymond Trapani, Sohrab “Sam” Sharma, and Robert Farkas. Robert A. Cohen, Chief of the SEC Enforcement Division’s Cyber Unit, stated that, “We allege that the Centra co-founders went to great lengths to create the false impression that they had developed a viable, cutting-edge technology. Investors should exercise caution about investments in digital assets, especially when they are marketed with claims that seem too good to be true.”

In another separate action, the SEC has added the widow of deceased Steve Karroum, the former CEO of FX and Beyond, as a defendant in its fraud case. Karroum raise $4 million from 18 investors, but, in his pure “Bernie MaDoff style”, never invested a dime of the funds in his proposed forex scheme, one that he claimed would never have a losing trade. The SEC has been kind enough to not assess huge fines and penalties on Karroum’s widow, but the SEC still wants disgorgement of nearly $1 million in proceeds from his estate and Mrs. Karroum. Be careful whom you marry these days.

Russia continues to deal with persistent fraud risk within its own borders

Forex pyramid schemes are an ever-present danger in Russia, despite the fact that current law requires dealer licenses in order to offer services to Russian residents. Two men, ages 29 and 33, have been sentenced to spend over three years in a “colony” for their 32 million Ruble fraud. Per statements from prosecutors, “The administrators of an online trading website offered investors to put their money into managed accounts for trading on the Forex markets. The clients were promised that they would receive percentage of the profits generated from this trading. Given that the promised returns were very high, the offer appeared rather attractive.” Sound familiar?

Google reacts to bad press by blocking binary option solicitation ads

Online giant, Google, has changed its policy regarding binary option apps: “We do not allow apps that provide users with the ability to trade binary options.” As Leaprate reported last year, “After coming under a lot of heat from regulators around the world, and in particular ASIC in Australia and Canada’s various provincial regulators, Google took action against a series of financial related apps offering either unlicensed services, or apps which were suspect of promoting deceptive behavior. Much of that “action” involved taking down a large number of Binary Options trading apps associated with unlicensed and unregulated “offshore” brokers. “ The ban now is all-inclusive.

Expat cross-border payment fraud heats up in anticipation of summer travel

It is as predictable as rain that cross-border payment fraud heats up as the summer months come near. Whether you are a traveler or an expat that lives far from your homeland, you had best be prepared for scammers in this arena. This oft-seen advice is invaluable: “The majority of reputable currency brokers will allow new clients to try before they buy by setting up a demo account and playing for a while. Basically, the best way to ensure you’re safe from forex scammers is to simply use one of the major players such as banks or the online household names in the sector. ‘Guilty until proved innocent‘ is the watch-phrase for expats looking to exchange currency.”

Leucadia and FXCM refuse to assume a low profile from a news perspective

Seems like only yesterday that FXCM went through a re-branding to include Leucadia, its controlling owner, in its logo. The news now is that Leucadia is also re-branding. Per its release: “The proposed name change is intended to reflect that we now will be a diversified financial services company, rather than one that is more broadly focused, and Jefferies is by far our largest business and our engine of opportunity. We will continue to use the wonderful Leucadia name in our asset management and merchant banking activities where its brand recognition adds tremendous value.” What’s in a name?

GAIN Capital has a stellar first quarter – Can the tide be changing for forex?

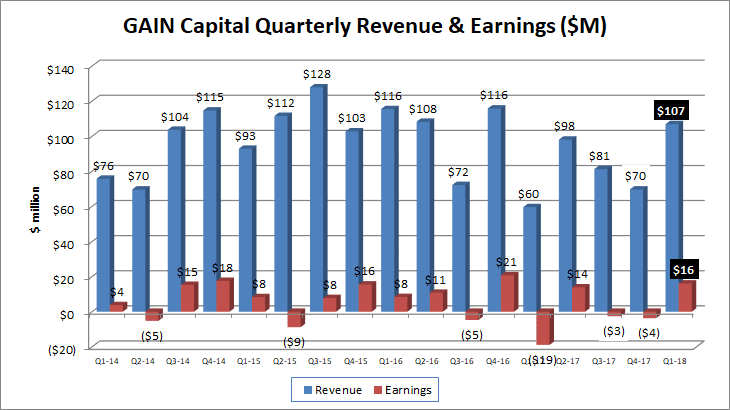

On a positive news front, GAIN Capital just reported improved earnings (See below):

The company reported, “Q1 Revenue at GAIN Capital came it at $106.9 million, up 53% over Q4-2017 and the company’s first $100M+ revenue quarter since 2016. Net profits of $16.2 million in Q1 compares nicely to an $11 million loss the company suffered in all of 2017.” Hopefully, this is a harbinger of good things to come for other brokers in the forex industry. Trading volumes have been in decline for quite some time, but, perhaps, a ray of sunshine has finally come upon us.

Concluding Remarks

Risk never sleeps, and, as a retail forex trader, it is strongly advised that you never take your eye off market risk, whether it be in the form of financially driven risk factors or the risk posed by fraudulent scam artists. Regulators seem to have come out of their respective hibernation caves and are back at protecting the public at large.

Stay skeptical and cautious!

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2025

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #2 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #3 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #4 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #5 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #6 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox