With a raft of corporate and economic data due to hit the markets this week, price moves over the last week across various asset groups have been relatively quiet. The additional price volatility forecast could trigger moves in certain asset groups, particularly the cryptos, which appear to be struggling to maintain their record highs.

| Instrument | 19th April | 26th April | Hourly | Daily | % Change | |

| GBP/USD | 1.3870 | 1.3924 | Strong Buy | Strong Buy | 0.39% | |

| EUR/USD | 1.2008 | 1.2096 | Neutral | Strong Buy | 0.73% | |

| FTSE 100 | 7,031 | 6,926 | Strong Buy | Strong Buy | -1.49% | |

| S&P 500 | 4,180 | 4,180 | Strong Buy | Strong Buy | 0.00% | |

| Gold | 1,786 | 1,778 | Neutral | Strong Buy | -0.45% | |

| Silver | 2,603 | 2,597 | Strong Buy | Strong Buy | -0.23% | |

| Crude Oil WTI | 63.19 | 61.45 | Strong Sell | Strong Buy | -2.75% | |

| Bitcoin | 57,385 | 52,727 | Buy | Sell | -8.12% |

The calm before the storm?

The General Market This Week

Crude’s +2% slump over the week can be balanced against it experiencing a multi-month surge in price. Metals and equity indices all lost ground despite technical indicators pointing towards upwards price movement. Concerns about the scale of the Covid outbreaks in India and Japan weighing on gold in particular, with the Asian subcontinent being a significant retail market for the metal.

Bitcoin

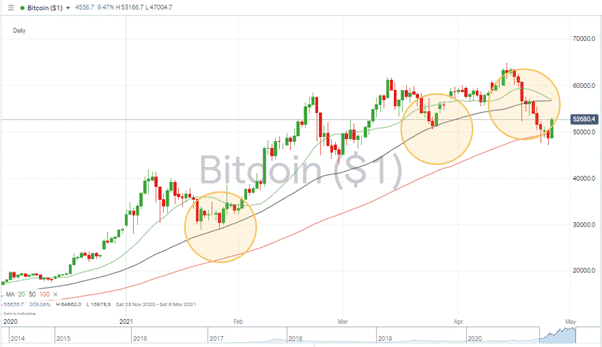

Bitcoin’s slide to $52,000 involved three days of trade printing below the psychologically important $50k level. It does appear to have found support at the 100 Daily SMA, but the 50 SMA, which provided support for more than 12 months, will now come into play as a resistance level.

Bitcoin Daily Price Chart – New SMA Support?

Source: IG

What Does Bitcoin’s Price Slide Tell Us About the Broader Market?

A certain degree of crypto buying pressure can be attributed to speculative investors. Buying something just because it’s going up might not be out of the traditional playbook, but many have made impressive returns by doing so.

With global central banks and governments operating loose monetary and fiscal policies, that money has to go somewhere, and crypto has been that place since the start of the year.

The US Federal Reserve will give its six-weekly update to the markets on Wednesday. While there is unlikely to be any change in interest rates, any hint of a shift in tone would catch the markets off-guard. Equities and forex would be vulnerable to a price shock, but cryptos could also see prices move south. If the extra volatility associated with Bitcoin, Ethereum and Dogecoin cause prices to break the 110 Daily SMA, the path of least resistance would appear to be downwards.

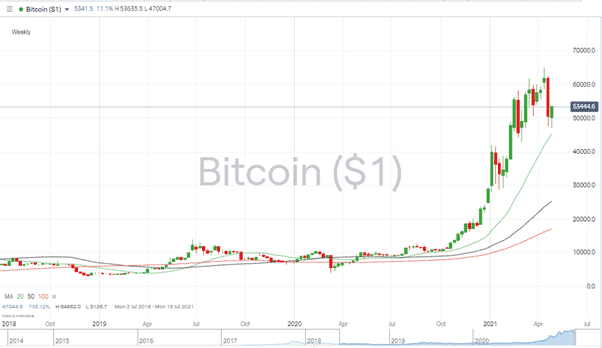

Bitcoin Weekly Price Chart – 20 SMA

Source: IG

The Bitcoin Weekly 20 SMA currently sits at 45,350.

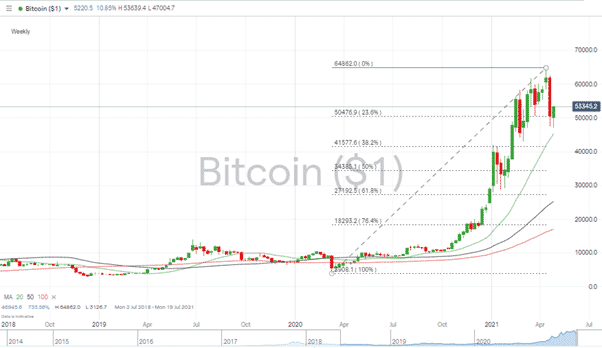

Bitcoin Weekly Price Chart – Fibs Coming into Play

Source: IG

Bitcoin’s 38.2% Fibonacci retracement is below that level. At $41,577, it opens the door to a test of the ‘big number’ support at $40k. Nothing can be discounted, especially not a price surge in the other direction. However, Bitcoin is the market to watch this week.

If you want to know more about this topic, or have been scammed by a fraudulent broker, please contact us at [email protected]

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2024

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex & CFD Broker |

Best Trading Conditions

Visit broker

|

||

| #2 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #3 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #4 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #5 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #6 |

|

Global CFD & FX Broker |

ALL-INCLUSIVE TRADING PLATFORM

Visit broker

|

||

| #7 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #8 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox