Stock Market Returns After Trump

Wednesday morning saw Donald Trump depart the White House. After a lunch-time changing of the guard, his successor, the incoming president Joe Biden, saw US stock markets post all-time closing highs.

One of Trump’s campaign cornerstones was that he’d be the best candidate to oversee the stock markets. So, it was a cruel irony that it wasn’t his legs under the desk in the Oval Office when the stock market records were posted. Trump can, however, still point to an impressive track record.

The Dow Jones Industrial Average increased in value by 56% during Trump’s presidency, the eighth-best return for any single term presidency. In the years since 1897, the average four-year return was 29.9%.

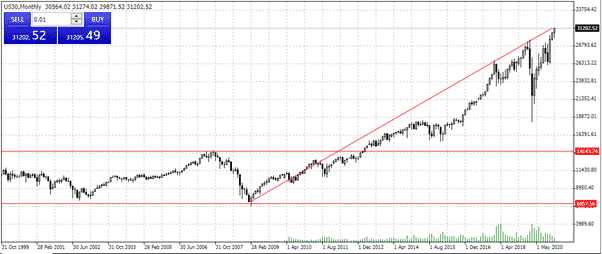

DJIA 20yr price chart – The Obama and Trump Years

Source: FXTM

Factor in the stock market gains made during the Obama years (72% first term and 46% second term) and the numbers really start to stack up.

Does outperformance over the last 12 years point to prudent guidance from the White House, a paradigm-shift in equity valuations, or a stock market bubble?

What Does Biden Mean for The Stock Markets?

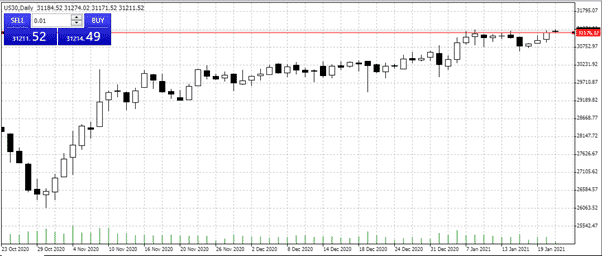

Wednesday’s rally in US equities saw the major indices all make gains and post all-time highs.

DJIA climbed 0.8%, the S&P 500 added 1.4%, the Nasdaq Composite gained 2%, and the Russell 2000 increased 0.4%.

Source: FXTM

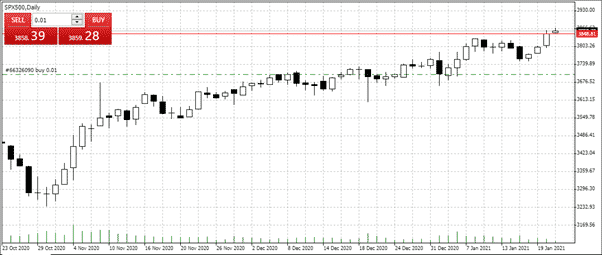

SPX500 Daily – All-time high closing

Source: FXTM

Markets love certainty, and Joe Biden’s administration looks decidedly stable, if not dull, compared to Donald Trump’s.

Another driver of price rises was the earnings reports for Q4. During 2020, Netflix was the member of the FAANG group of stocks which looked most likely to have its membership of that exclusive club rescinded. Challengers such as Disney+ and Covid related logistical problems meant making blockbuster standard material became more difficult.

Netflix earnings for Q4 took the share price 16.9% higher and cemented the firm’s position within that group of sweetheart stocks.

Investor excitement spilt over to other tech-names. Alphabet jumped 5.4%, Amazon climbed 4.6%, and Microsoft gained 3.7%.

Any Risks to the Tech Rally?

Recent history shows that missing out on US stock rallies can be a painful experience, shorting the US markets doubly so. But going long also comes with risks.

From a technical perspective, it has been possible to throw on positions if stop losses have been wide enough. Dips which haven’t broken the upward momentum patterns have been happy hunting grounds for many.

The largest risk factor may be more fundamental. For some time, politicians in the US and abroad have eyed up the abnormal profits being made by the tech stocks. Without a consensus among different governments, these profits are hard to pin down effectively enough to be taxed.

With Covid-19 blowing massive holes in fiscal budgets, it could be that political consensus is found to the extent that Google, Facebook, Netflix and their peers will face additional costs.

Ursula von der Leyen, president of the EU’s executive arm, offered an early warning sign. She is confident that the new US president will be an “ally” in stepping up the rules on how tech firms operate.

If you want to know more about this topic or have been scammed by a fraudulent broker, please contact us at [email protected]

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2025

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #2 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #3 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #4 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #5 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #6 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox