Expert’s Summary

Based on our extensive review of VT Markets, ForexFraud is pleased to let our readers know that we trust the broker. Is VT Markets safe for investors? Yes, it is. VT Markets is the brand name for:

- Vantage International Group Limited – Authorised and regulated by the Cayman Islands Monetary Authority (CIMA), Securities Investment Business Law (SIBL) number 1383491.

- Vantage Global Prime Pty Ltd – Regulated by the Australian Securities and Investments Commission (ASIC), AFSL no. 428901.

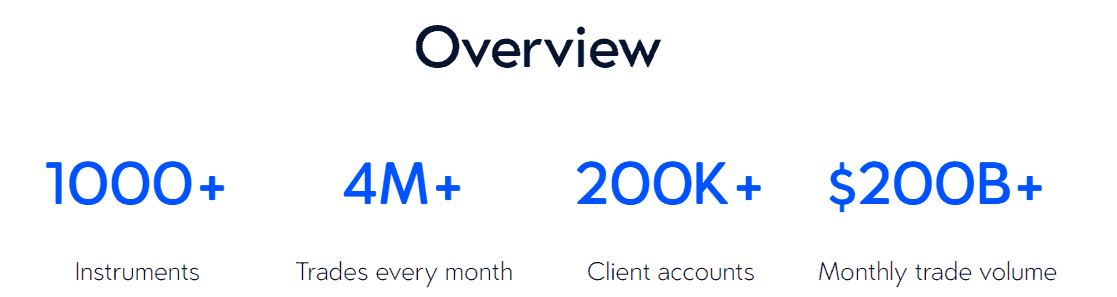

Founded in 2016 and part of the Vantage Group of Companies, VT Markets is a multi-asset broker offering a range of 100+ CFD products. The no-dealing desk broker provides a choice of STP/Raw ECN accounts with zero deposit. The account opening process is quick and straightforward, and this holds good for the demo or live account. You can open a live account for free and access all the features and trading conditions offered by the broker from the globally renowned MetaTrader 4 (MT4) platform, which is accessible on all computers and mobile devices.

Rating Overview

| Overall rating | ⭐⭐⭐⭐ |

| Regulation | ⭐⭐⭐⭐⭐ |

| Fees | ⭐⭐⭐⭐ |

| Range of Markets | ⭐⭐⭐⭐⭐ |

| Platforms | ⭐⭐⭐⭐ |

In terms of the trading conditions, VT Markets offers a True ECN Account with spreads starting from zero pips, while the STP Account comprises low spreads with zero brokerage. The CFD broker also promises lightning-fast trade execution via its Equinix Fibre Optic Network.

Free Demo Account

No Purchase Necessary

As part of this VT Markets brokerage review, we tested the trading conditions on both the Standard STP and Raw ECN demo accounts, and they were spot on. Next, we analysed the trading costs. Although the lowest spread on the Standard STP Account was 1.2 pips or more for all the FX pairs, we found that it is sometimes lower than that stated by the broker on the website – you don’t get to see that very often. VT Markets charges a maximum commission of $6 a round trip, which is reasonable, while the fees are more or less in line with what the other CFD brokers charge.

Coming to the trading platform, VT Markets offers the Standard MT4 terminal. You can access live news, an economic calendar, and all the other features of MT4. For social trading enthusiasts, VT Markets provides access to multiple social trading platforms such as ZuluTrade, Myfxbook AutoTrade and DupliTrade.

You can also, scalp, auto trade or carry out whatever form of trading you choose, with no restrictions. However, if you’re expecting premium analytics or additional plugins such as Autochartist, you could be disappointed. Also, the broker does not offer CFD trading in cryptocurrencies.

Broker Summary

VT Markets is a multi-asset, multi-regulated broker operating out of Sydney, Australia. Established in 2016, the STP/ECN broker is a subsidiary of the Vantage Group of Companies, which includes Vantage International Group (VIG) Limited, Vantage Global Prime Pty and Vantage Global Prime LLP. The regulators governing the parent firm include the Cayman Islands Monetary Authority (CIMA), the Australian Securities and Investments Commission (ASIC) and the Financial Conduct Authority (FCA), making it a reliable broker.

VT Markets offers its clients a choice of two account types: the Standard STP and the Raw ECN. The former comes with a moderate spread and zero brokerage, while the spread on the latter starts at zero pips and $6 per round transaction for a standard lot. You can open a live account in no time. Still, if you would prefer to test the platform before depositing funds, you can switch to a demo account from the ‘Client area’ or even open a separate practice account in a couple of minutes. The product range includes 100+ CFD products across forex, indices, precious metals, energy, soft commodities and shares (US, HK).

Free Demo Account

No Purchase Necessary

When it comes to trading, VT Markets offers the choice of MT4 along with the option of the world’s most popular social trading platforms – ZuluTrade, Myfxbook AutoTrade and DupliTrade. The trading conditions are excellent, with lightning speed order execution via the uniquely optimised fibre-optic network, maximum leverage of 500:1 and ample liquidity.

Get in touch with the broker’s customer support via live chat, email social media platforms, or request a callback. VT Markets has a registered head office in Australia with two regional offices – one in the Cayman Islands and the other in Taipei.

Broker Introduction

VT Markets is the subsidiary of the 2009-incorporated Vantage International Group (VIG) Limited, a CIMA-regulated broker operating under the name of Vantage FX. Founded in 2016, VT Markets operates from Sydney, Australia, and provides retail clients with a superior trading experience by offering a mix of STP and ECN accounts with raw spreads.

VT Markets is also the trading name of Vantage Global Prime Pty, which is authorised and regulated by ASIC. The CFD broker also has Professional Indemnity Insurance in place and maintains client funds in an AA-rated Australian bank.

The ‘No dealing desk’ multi-asset broker offers excellent leverage, promotional offers, and tailored IB rebate programmes. Clients signing up with VT Markets can open an account quickly and have the choice of setting up a demo or live account with access to the world’s number one trading platform, MT4.

If you are a resident of Australia, you would come under the umbrella of the Vantage Global Prime Pty (an ASIC-regulated firm). International clients, on the other hand, would sign up with Vantage International Group (VIG) Limited, a CIMA-regulated firm.

Opening an Account

The process of opening an account with VT Markets starts at the broker’s homepage, where there is the option of opening a live or demo account.

The first stage of the registration process involves providing basic contact information and proof of ID. This needs to be a driver’s license, passport number, or National ID card. Our analysts reported that some of the data fields took a little bit of getting used to at first, but the whole process sped up and took less than four minutes to complete.

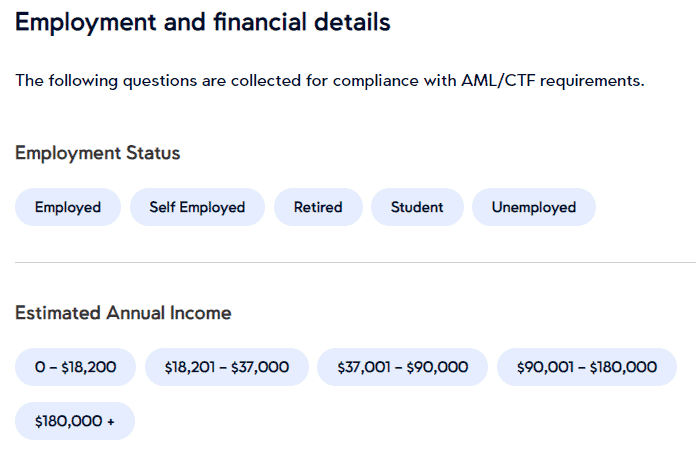

As VT Markets is regulated, new clients are required to disclose their country of domicile and provide basic details relating to trading experience (if any) and educational background. There are also questions relating to the source of funds, average income, net worth, and educational background.

These sections were easy enough to navigate as part of our VT Markets review and formed part of the process of the broker setting up a profile for new users – to ensure compliance with regulatory client care protocols.

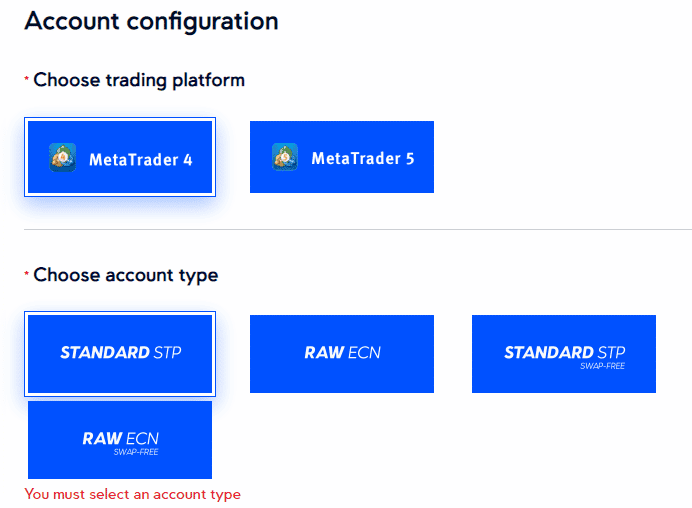

It is also important to know which kind of account and platform you want to sign up to, as the registration process includes a section where those decisions are input.

All new users are then required to verify their email address and after that login details and passwords relating to the new account are sent via email. The time interval between the broker receiving and authorising the account was impressively short, which meant we were able to move on to live trading relatively quickly.

Making a Deposit

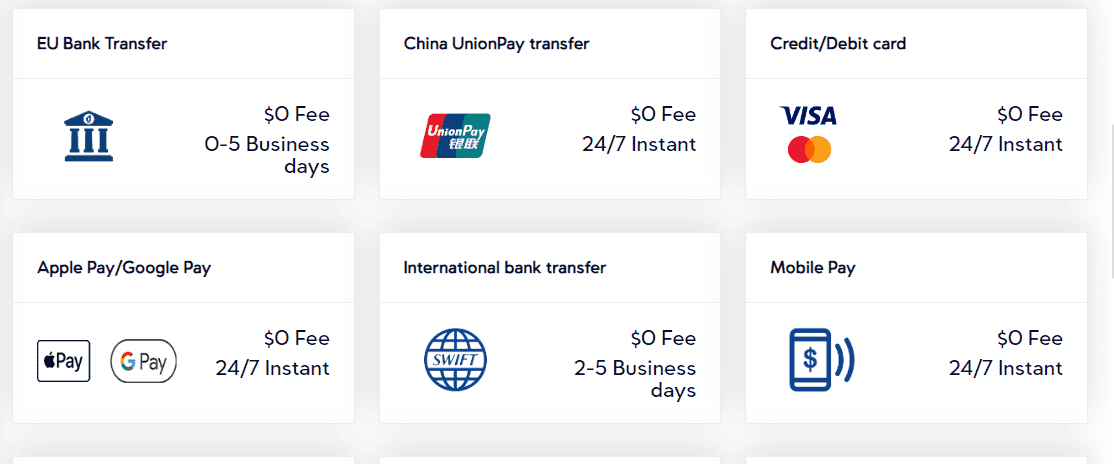

The different ways of adding funds to a VT Markets account are neatly laid out in a simple table, which gives details of how long each method takes. It also states what fees, if any, are charged on deposits, which can be made using debit / credit cards, bank transfers, SWIFT, cryptocurrency, and ePayment agents.

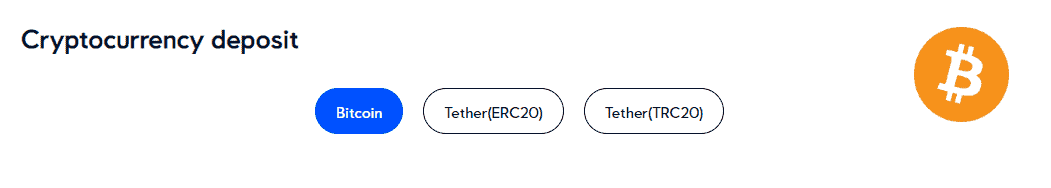

Depositing funds with VT Markets is fast and cost-effective. One of the standout features of the broker is that it allows clients to fund their account using the cryptocurrencies Bitcoin and Tether. Transaction costs in coins can be higher than those of fiat currency, and it is worth checking the T&Cs relating to each coin. But the processing times are low for the sector, with crypto transactions quoted as taking one hour to process.

The minimum deposit amount at VT Markets is $200 (or base currency). This is in line with the peer group and a realistic amount considering the need to be able to collateralise accounts to a level to cope with market volatility.

Placing a Trade

The platforms provided to VT Markets clients are the ever-popular MetaTrader MT4 and MT5. As this software is provided under license by a third-party (MetaTrader) there is a need to complete some additional online paperwork and accepting a Terms of Service agreement.

VT Markets does well to provide a step-by-step guide on how to proceed and we received the login information within seconds of the account being opened. The log-in details to the MT platforms are different to the login details of your VT Markets account, so they need to be stored safely.

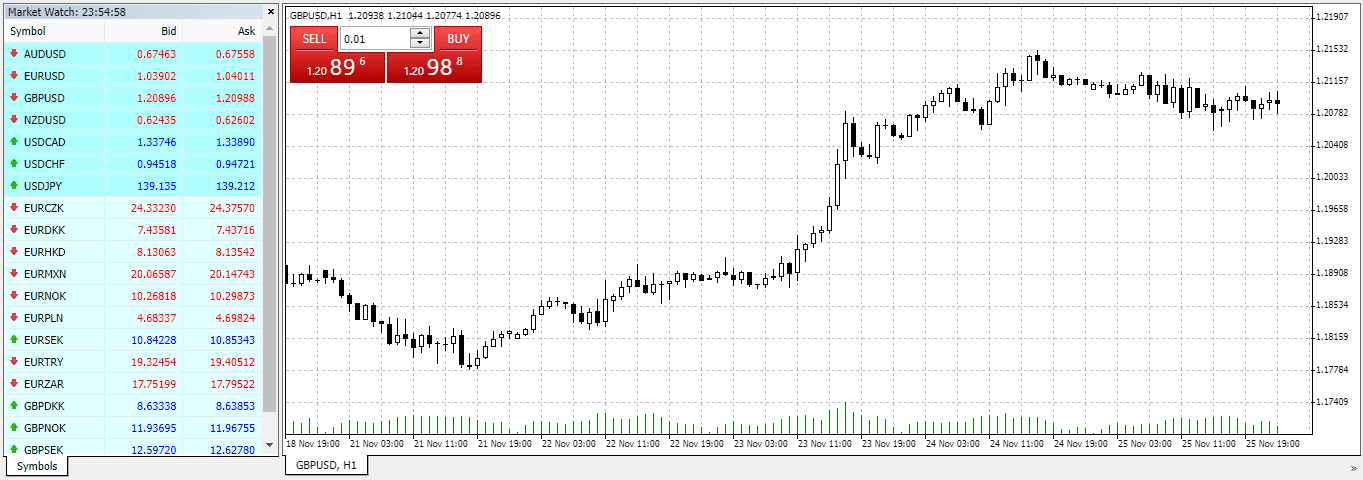

MetaTrader platforms have been operating for decades and are a finely tuned operation. As a result, it was no surprise that opening up the trading dashboard was easy to do and we were able to navigate to the trading monitors to start booking trades.

As an example, MetaTrader MT4 has been developed over the course of 20 years of live trading and is known for its excellent trade execution. It’s robust, easy to use, packed full of trading signal indicators, and has a clean aesthetic.

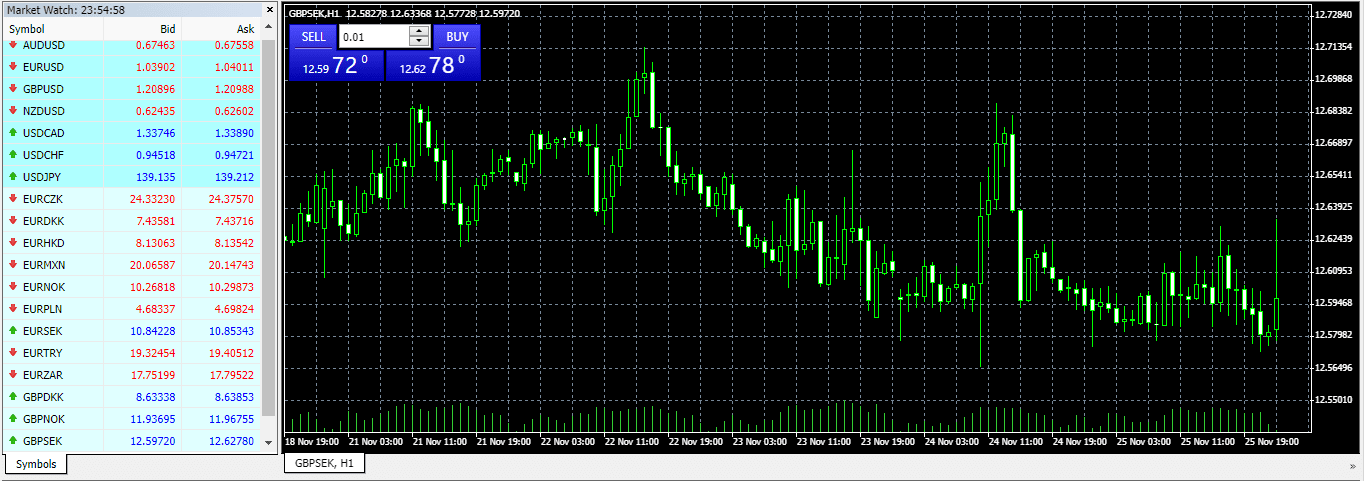

To try it out, we booked test trades in GBPUSD and GBPSEK. These were executed first time and reported accurately in the Portfolio section of the main dashboard.

Contacting Customer Support

The VT Markets customer support team operates 24/5. That covers the core of the trading week and for those looking to carry out research on weekends, the service is also available from 04:00 to 13:00 (MT4 system time, GMT+3) every Sunday.

If you have any questions during non-working hours, you can click the ‘live chat’ icon, leave your contact information and detail the nature of your enquiry and someone from the customer support team will call you back as soon as possible.

Initial contact with the customer service team is via the live chat system. This starts off with a ‘bot’ fielding FAQ-style responses, but there is an option to speak to a human agent. When trialling that part of the service, we found response times to be almost instant and the staff to be informed, professional, and able to resolve our queries at the first time of asking.

It isn’t currently possible to contact VT Markets support via phone. Live chat is the only option for real-time queries. More detailed issues can be addressed using email and it is possible to use Live Chat to request a call from a dedicated account manager.

Spreads and Leverage

The spreads and leverage offered by VT Markets depend on the account types. In this review of VT Markets, we analysed the two account types along with the corresponding spread and leverage.

If you sign up for the Standard STP Account, besides the lightning-fast execution via the Equinix Fibre Optic Network, clients receive greater market depth and price transparency. The CFD broker also has more than 30 liquidity providers offering low spreads through the VT Markets oneZero MT4 bridge. According to VT Markets, the spread for the Standard STP Account starts at 1.3 pips on the EUR/USD pair, and although the broker claims to offer ultra-low spreads, at best, we can say that the spreads are reasonable.

In this VT Markets review, we logged into the Standard STP demo account and found the spread starting from 1.2 pips for FX pairs, which is slightly better than that advertised by the broker on its website.

Free Demo Account

No Purchase Necessary

On the other hand, if you register for the Raw ECN Account, VT Markets pledges to provide institutional-grade liquidity directly from some of the world’s leading banks and institutions. These come without any mark-up in the spread, and the broker promises users the feel of trading in the real interbank forex markets.

If you sign up for the Raw ECN Account, in addition to all the trading conditions offered for the Standard STP Account, your spreads start from zero pips. In this VT Markets brokerage review, we were able to verify that the spread stated by the broker matched the spread on the Raw ECN demo account.

When it comes to leverage, VT Markets offers identical margins for both the Standard STP and the Raw ECN accounts. The max leverage of 500:1 should be more than adequate to control your CFD trades.

Platform & Tools

VT Markets offers all users the standard MT4 platform across all computers and mobile devices. It doesn’t matter which account type you sign up for – all users receive access to CFDs in forex, indices, energy, precious metals, soft commodities and shares. However, there could be a difference in the number of tradable instruments depending on your account type.

In this review of VT Markets, we went through the process of opening a 90-day demo account and tested the MT4 platform for both the Standard STP and the Raw ECN accounts.

To begin with, individuals have the choice of setting up either a demo or live account. To test the platform before opening a live account with the broker, sign up for the demo account.

You get to choose between the Standard STP Account or the Raw ECN Account, base currency, leverage and virtual cash to get you started. If you open a live account, go to the VT Markets ‘Client Area’ and switch to a demo account. Regardless of the account type, signing up for an account with the CFD broker takes just a few minutes.

As mentioned earlier, VT Markets offers only the Standard MT4 platform to all users. If you are expecting additional tools or plugins, you will be disappointed. We were able to access only 82 instruments from the VT Markets Standard STP demo account. These include forex (28), indices + VIX (13), precious metals + metals (3), energy (5), softs (5), and US shares (28). However, on the Raw ECN demo account, we were able to monitor more than 110 securities.

The product offering is much lower than that claimed by the broker on the website. For instance, we were able to access only 28 US stocks from the demo Standard STP platform, unlike the 50 VT Markets stocks that the broker has advertised. We were also unable to find CFDs of shares listed on the Hong Kong exchanges. However, we noticed that the spread was sometimes lower than that stated by the broker on the website. Besides, in this VT Markets brokerage review, we found that orders were executed at lightning speed.

Although VT Markets does not provide additional tools to assist clients with their trading activities, the MT4 platform comprises a whole range of analytical tools and features. Here are the primary trading tools and features that users can access across the web, desktop and mobile applications:

- The platform supports three types of orders – instant, market and pending.

- The instant trading function allows sending one-click orders, while the pending orders comprise limit, stop and trailing.

- Experience powerful charting with three chart types in nine time frames.

- Employ the 30 technical indicators and 24 graphic objects to carry out in-depth chart analysis.

- Multiple order placement windows.

Besides the above, users logging into the desktop application are able to:

- Access the market depth window to view the top bids and offers.

- Place trading alerts.

- Execute trades with the assistance of robots (Expert Advisors).

- Download, rent and purchase technical indicators and trading robots.

- Hire professional freelance developers to build automated strategies for you.

- Log into the MQL4 IDE development environment to create, test and optimise strategies.

Open Your Account Now

Simple Sign Up Process

Commission & Fees

As mentioned earlier, VT Markets offers two account types: the Standard STP and the Raw ECN accounts. Individuals registering for the STP Account have access to low spreads and zero commissions. Investors signing up for the ECN Account are eligible for spreads starting from zero pips and commissions up to $6.00 per standard lot, per round transaction.

When it comes to fees, there are standard charges that clients have to accept. These include:

- Swap – Charges for holding overnight positions that vary on the product type.

- International telegraphic transfers – A minimum fee of 20 units of your account base currency or $20.

VT Markets does not have any other charges, be it for deposits or withdrawals. However, your bank or the payment gateway could levy a fee for the services offered.

Compare with other approved brokers

|  |  |  | |

| Regulation | ASIC, CIMA, FCA | ASIC, MiFID, FSA, FSCA | FCA, CySEC, FSCA, Seychelles FSA, Labuan FSA | FSPR |

| Customer Support | email, phone, live chat | email, phone, live chat | email, phone, live chat | email, phone, live chat |

| Trading Platforms | MT4, MT5, WebTrader, Mobile Apps | MT4, MT5, Mobile App | MT4, MT5, WebTrader | MT4, MT5, WebTrader, Mobile Apps |

| Minimum Deposit | No minimum deposit | $100 | $100 | $200 |

| Leverage | 1:500 Max | 400:1 | Tickmill Ltd 1:500, Tickmill Europe 1:30 (retail) & 1:300 (pro), Tickmill UK 1:30 (retail) | 1:500 |

| Total Markets | 203 | 1260 | 637 | 182 |

| Total Currency Pairs | 39 | 55 | 62 | 72 |

| Total Cryptocurrencies | 16 | 17 | 9 (* CFD Crypto trading is available only to Professional Clients under Tickmill UK.) | 0 |

The trading cost at VT Markets in terms of commission and fees is among the lowest in the industry. Combined with the cutting-edge MT4 platform, the dark liquidity pool, high-speed order execution and price transparency, you couldn’t have asked for healthier trading conditions at a low cost.

Education

VT Markets provides only one daily news article to all its users. There are no other learning, training or educational materials for beginners to get an insight into the markets, and the broker doesn’t provide any trading tools or strategies to prepare novices to analyse the markets. The lack of educational content could easily count as one of the drawbacks of the CFD broker.

Customer Services

VT Markets provides customer support via live chat and email. If you would like to speak with the broker, you can request a callback. Finally, to keep yourself updated on the latest company events or market news, you can get in touch with the CFD broker via its social media platforms – Facebook, LinkedIn, Twitter and YouTube.

In this review of VT Markets, we reached out to the live helpdesk team on several occasions and found the members to be friendly, though it’s challenging to get them to give you information. This is because VT Markets prefers prospective clients to speak with an account manager and clarify all the information they need, which is not bad at all.

Free Demo Account

No Purchase Necessary

Final Thoughts

As we conclude our review of VT Markets, we are happy to let our readers know that we are delighted with the services offered by the award-winning STP/ECN broker. VT Markets is among the top brokers when it comes to offering low client trading costs, and the conditions are among the best in the industry. With the multiple regulators, segregated client funds in the AA-rated National Australia Bank (NAB), multiple liquidity providers, and automated, copy and social trading, there are a great many options.

There are a couple of drawbacks though. Firstly, VT Markets does not offer cryptocurrencies trading, and secondly, the limit on the analytical tools is to the standard MT4 offerings.

If you are seriously considering signing up with a CFD broker, then make sure that you check out VT Markets before you sign on the dotted line with another broker.

Exclusive Bonus For Forexfraud Visitors

Time

FAQs

How do I open a demo account with VT Markets?

To open a demo account with VT Markets, go to the website (https://www.vtmarkets.com), click the white ‘DEMO ACCOUNT’ button on the top-right corner of the homepage, fill out your personal information, and click the blue ‘NEXT STEP’ button. Next, choose your account type (Standard STP or Raw ECN), choose your base currency from the five available options, select your account balance, and click the blue ‘GET YOUR DEMO ACCOUNT’ button.

Is VT Markets a regulated broker?

Yes, VT Markets is a multi-regulated broker. The firm comes under the regulations of the Cayman Islands Monetary Authority (CIMA), Securities Investment Business Law (SIBL) number 1383491, and the Australian Securities and Investments Commission (ASIC), AFSL number 428901.

How can I change leverage with VT Markets?

VT Markets offers maximum leverage of 500:1. However, depending on the equity in your account, you can also increase your leverage. Remember that higher leverage leads to greater risk. To change your leverage, send a request via the VT Markets secure client portal.

How do I withdraw money from VT Markets?

You can withdraw funds from VT Markets via bank wire, cards or eWallets. The CFD broker processes all fund withdrawals through the original funding source. For instance, if you have deposited funds via a debit/credit card, the withdrawal request will be processed to the same card as long as the amount of funds sent back does not exceed the original amount deposited through it. VT Markets transfers the profits that are more than the deposited amount to the nominated bank account.

Please be advised that certain products and/or multiplier levels may not be available for traders from EEA countries due to legal restrictions.

Safest Forex Brokers 2025

-

-

-

-

-

4.8-

-

-

-

-

4.9-

-

-

-

-

5-

-

-

-

-

4.9-

-

-

-

-

5-

-

-

-

-

5Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox

Stay up to date with the latest Forex scam alerts

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox

Stay up to date with the latest Forex scam alerts