Featured Forex Broker

This secure framework acts as a base for some of lowest cost trading in the market with trade execution backed up by some very impressive behind the scenes infrastructure designed to offer the best access to the financial markets. Read the full review of Tickmill

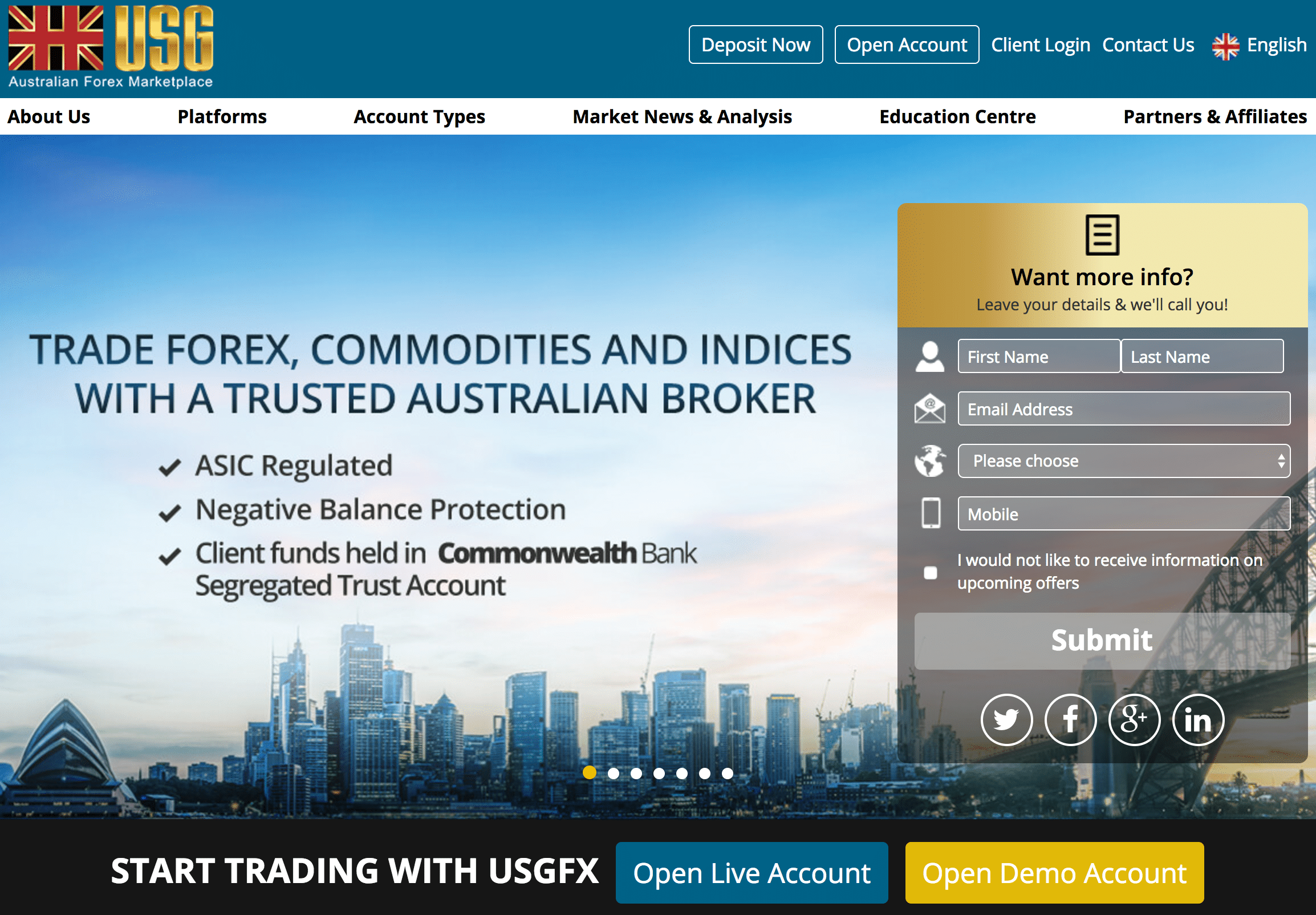

One of the foremost foreign exchange brokers in the Pacific Rim is Union Standard Group, or USGFX for short, of Australia. The company opened its doors for business more than a decade back and remains committed to “becoming the most trusted and respected forex broker in the world.” The firm has grown quickly, establishing regional offices in Auckland, Hong Kong, and Shanghai. Regulatory oversight is assured by the Australian Securities and Investment Commission (ASIC), an agency that is every bit as strict as the FCA in the UK or the CFTC in the U.S. It has distinguished itself from the pack by building a state-of-the-art telecommunications network with direct Interbank server connections in London, New York, and Hong Kong. USGFX is licensed in both Australia and New Zealand and offers not only traditional forex trading, but also the ability to trade CFD derivatives in indices and commodities, as one more added attraction.

As per strict regulatory guidelines, USGFX segregates client deposits at a major local bank, the Commonwealth Bank of Australia, and does not allow these funds to be combined with daily operating capital. Setting up an account is quite easy with this firm. In addition to a free demo account, there are three account types, each designed with the average trader in mind, and another two higher level accounts for corporate and professional clients. The minimum deposit is $100 for the standard accounts, and each account comes with a free personal account manager to ensure an enjoyable trading experience. Major credit cards and bank wires are preferred when making a deposit, but there are also several alternate payment options supported. Competitive contests and promotional bonus arrangements abound, but do check the website for the latest details and implied commitments. Spreads are highly competitive, and leverage can vary from 100:1, all the way up to 500:1.

USGFX is both a market maker, as well as an STP/ECN shop, the latter business model being associated with the upper scale VIP and Pro-ECN account classes. The Metatrader4 series of trading platforms, the most popular one on the market, is standard, including mobile and multi-terminal applications. For times when a web-based solution is a necessity to access your MT4 account, a Webtrader option is also supported. The firm’s widespread use of optic fiber and high-speed technology enables the platforms to have one-click, nearly instantaneous order execution. Slippage and requotes are rare, if ever. Automated and social trading are also supported. Market commentary, extensive support materials, and a broad-based learning center round out this complete package, together with 24-hour customer service. Unfortunately, U.S. clients are not accepted.

Unique Features of Trading with USGFX

Why trade with USGFX.com? The firm lists these reasons:

- Founded in 2005 by industry professionals that wanted to focus on long-term client relationships;

- Headquartered in Sydney with satellite offices in Auckland, Hong Kong, and Shanghai;

- Operating licenses in both Australia and New Zealand;

- Regulated by the Australian Securities and Investment Commission;

- High speed server connections to Interbank servers in New York, London, and Hong Kong provide for quick order execution and minimal slippage and requotes;

- Free demo account for practice trading;

- Four account classifications: Micro, and Standard for retail forex traders, and VIP and Pro-ECN for professional and corporate traders;

- Minimum deposit is $100 USD for basic trading accounts ($50,000 for upper tiered accounts);

- Accounts may be maintained in USD, AUD, EUR, or GBP;

- Client deposits reside at the Commonwealth Bank of Australia in segregated accounts in compliance with strict regulatory standards;

- Negative Balance Protection;

- Withdrawal requests handled promptly within 24 hours;

- Tight competitive spreads for major pairs;

- Leverage varies by account class from 100:1 to as high as 500:1;

- Top level market commentary, technical analysis, and support materials;

- Company provides a structured forex education course – The TradersClub Coaching Program, in addition to other guides, webinars, and seminars;

- MT4 & MT5 trading with the world’s most popular platform, supplemented with Webtrader for web-based only approach;

- Social trading is available through either ZuluTrade or Myfxbook;

- Dedicated personal account manager and professional support staff available on a 24-hour basis.

Platform

USGFX utilizes the Metatrader4 series of platform protocols for standard trading, as well as for mobile, and multi-terminal applications. The staff also supplements this set up with Webtrader, another popular service that is web-based and does not require a download to access your MT4 account. Expert Advisors are supported for automated trading, and links to ZuluTrade or Myfxbook provide social trading options. Scalping is also permitted, but only for the VIP and Pro-ECN account classes. The latest in available encryption technology is used to prevent hackers from compromising any transmission or storage of sensitive data or personal identity information.

Deposits and Withdrawals

USGFX accepts traditional bank wires, credit cards, and several alternative payment processing service provider mechanisms, including Webmoney, OK Pay, Perfect Money, Fasapay, Skrill, and Neteller. Cash deposits are unacceptable, due to international anti-money laundering standards. Withdrawal requests are processed within 24 hours, as long as your internationally mandated identity documentation is on file, up to date, and in order. The website provides ample details on what specific items are required.

Beginner Support

A dedicated personal account manager is part of the standard package with USGFX. Service representatives are well trained and available on a 24-hour basis via live chat, phone or email. Regional offices are also located throughout Asia, including Sydney, Auckland, Hong Kong, and Shanghai. USGFX has also invested heavily in its learning center that offers a variety of guides, ebooks, webinars, seminars, and a TradersClub Coaching Program. The firm also provides top-level market commentary, fundamental and technical analyses, and a revolving economic calendar.

Spreads and Leverage

Spreads and leverage at USGFX vary by account type, but spreads generally are tight and competitive, ranging from close to one pip to just over two pips for selected major pairs. Variable spread pricing is the rule, but the tightest spreads exist under the STP/ECN model. Leverage can be as low as 100:1 and as high as 500:1.

Conclusion

USGFX is one of the leading firms in Asia, if not the entire global market. Clients benefit from top-of-line regulatory oversight and over a decade of operating proficiency. The popularity of this firm has spread quickly, and it has expanded to meet the challenge, leading first with its technology and following with topnotch customer service and support. Customer deposit safety is never an issue. Spreads and leverage are more than competitive, and their product offering includes CFDs, when and if you require or would prefer that diversification possibility. The management team is committed to winning you over and forging a long-term relationship, which is easy to do when the firm holds fast to its principles of trust, transparency and respect.

Please be advised that certain products and/or multiplier levels may not be available for traders from EEA countries due to legal restrictions.

Safest Forex Brokers 2025

-

-

-

-

-

4.8-

-

-

-

-

4.9-

-

-

-

-

5-

-

-

-

-

4.9-

-

-

-

-

5-

-

-

-

-

5Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox

Stay up to date with the latest Forex scam alerts

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox

Stay up to date with the latest Forex scam alerts