Featured Forex Broker

This secure framework acts as a base for some of lowest cost trading in the market with trade execution backed up by some very impressive behind the scenes infrastructure designed to offer the best access to the financial markets. Read the full review of Tickmill

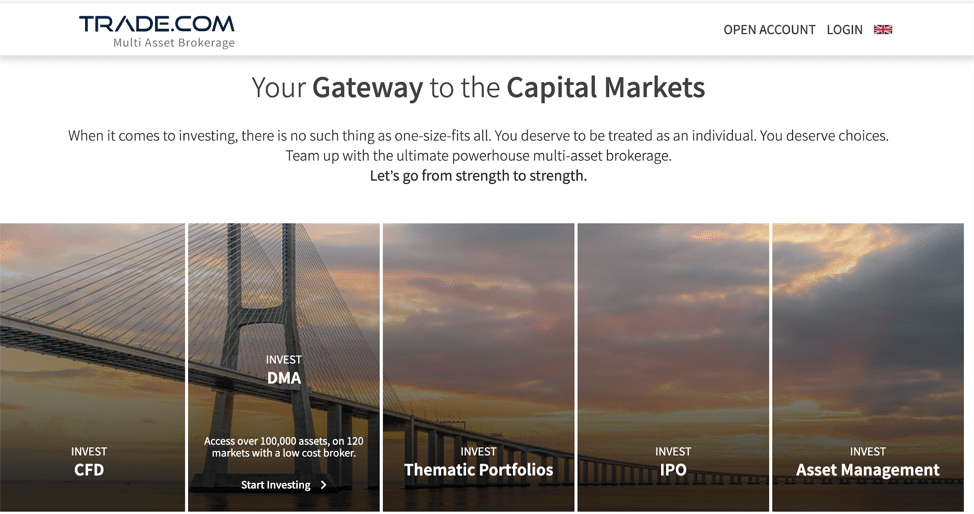

The forex brokerage industry has been consolidating over the past few years for a variety of reasons. As a result, there is safety when dealing with a well-capitalised firm that is part of a larger conglomerate operation. TRADE.com offers this protection, as well as offering one of the largest selections of investment assets in the industry. It offers over 2100 assets to trade with. Additionally, it also offers a whole host of other trading vehicles, which include IPOs, Thematic portfolios, Asset Management and Spread Betting. This brings tax-free gains to residents of the UK and Ireland and also Direct Market Access, which comes with excellent trading conditions and over 100,000 global securities.

TRADE.COM is a trade name operated by Trade Capital Markets (TCM) Ltd (ex. Leadcapital Markets Limited) and Livemarkets Limited. Trade Capital Markets (TCM) Ltd is authorised and regulated in Cyprus by the Cyprus Securities and Exchange Commission (license number 227/14). It is authorised in South Africa by the Financial Sector Conduct Authority (FSP number 47857) and regulated in the United Kingdom by the Financial Conduct Authority (Firm Reference Number 738538).

The array of supported currency pairings includes majors, minors, and a few exotics but if you want to dabble in another market, especially one that is in your region of the world, then you will surely find it among the other over than 2,000 companies to choose from for stocks, core 26 global indices, commodities or bonds. There are five account types, each dependent on your deposit balance. These accounts include escalating benefits, but all come with a dedicated account manager, training support, and a free demo account with $10,000 in virtual cash to hone your trading strategies before putting any real capital at risk.

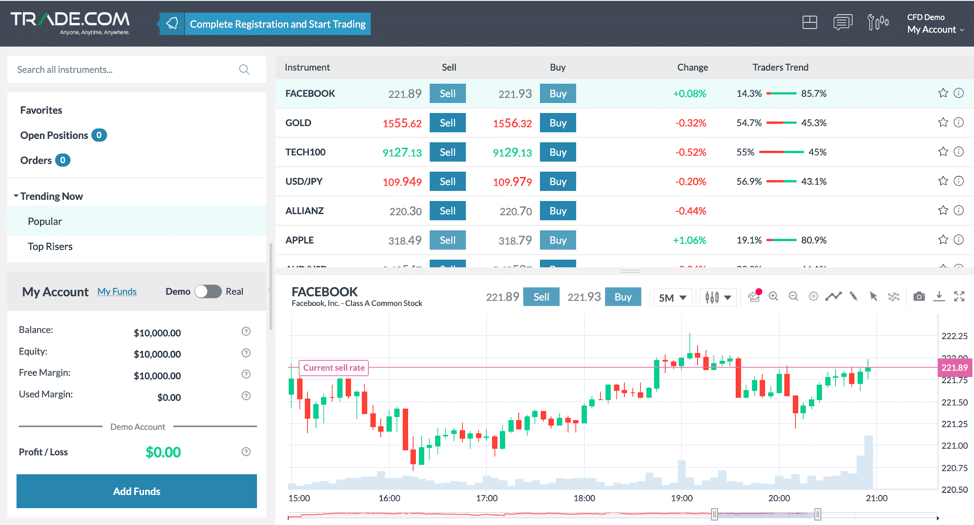

You may want to consider upgrading from the basic account in order to receive premium support. If you are already familiar with MetaTrader4, then you are set to go, unless you wish to try TRADE.com’s Webtrader platform, which an excellent in-house platform that is arguably more feature-packed than MT4. It comes with alerts, technical and fundamental analysis. No downloads are required for this platform, and mobile trading is also supported. Each asset choice has its own spread and leverage characteristics, all detailed on the website. It is worth mentioning here that the WebTrader comes with TradingView advanced charting package and community, which has some amazing functionality for traders. Well worth looking at.

Deposit safety is assured due to the firm’s broad regulatory compliance regimen. Client account balances are segregated from operating capital in major international banks for safety and peace of mind, while national investor protection programs kick in if there is ever an issue of corporate liquidity. Abundant resource materials complete the package, along with the management team’s stated goal to provide the best in support, education, and choice, all under one roof. There is no need to shop elsewhere.

Features

Why trade with TRADE.com? The firm lists these reasons:

- Founded in 2014, with headquarters in Nicosia, Cyprus

- com is a subsidiary of Trade Capital Markets Ltd

- Regulatory oversight provided by CySEC, but the firm operates with companies that also comply with the FCA, the MiFID (EU), and several other regulatory bodies

- Client deposit safety is ensured by top-tier bank segregation and by the Cyprus Investor Compensation Program

- Minimum deposit = $100

- Five account categories: (Micro — $100, Silver — $2,500, Gold — $10,000, Platinum — $50,000, Exclusive — $100,000). Trading Central and premium support apply to the latter two categories

- All accounts include a dedicated account manager and a free demo account with $10,000 in virtual cash

- MetaTrader4, WebTrader, and mobile support platforms supported

- Asset choices are around 2,100, including currency pairs (55), Stocks (more than 2,000 companies), indices (26), commodities (19), and bonds (5)

- Spreads and leverage are competitive, but differ according to asset and pricing mode selected

- Account opening will provide access to a wide range of training and support materials, designed for all levels of trader from basic to advanced

- Website can be read in seven languages

- Customer service can be reached via live chat, email, or telephone (toll-free direct lines provided in 30 separate countries)

Platform

TRADE.com elected to go with the very popular Metatrader4, downloadable, platform protocols. However, if you prefer an online version that requires no downloads and makes mobile trading easier, then check out the firm’s fully online, WebTrader, platform version. The benefits of both trading platforms are listed in detail on the website. For security purposes, TRADE.com also employs the latest in 128-bit technology to encrypt all trading activity data and any personal information submitted to the firm for identity verification. TRADE.com also offers a brand new WebTrader. Announced on 4th April 2018. It offers over 2,100 assets, trending tools, immediate access to live chat and much, much more. It now also offers a host of other technologies for its other products, which include a platform for DMA, Asset Management, IPO, Spread Betting and Thematics.

Deposits and withdrawals

Credit cards and banking wire transfers are the predominant methods for moving funds, but the firm also supports a number of other more local payment alternatives, including Skrill, Neteller, and Safeguard. Check the website for more options. Withdrawal requests are handled quickly, but it is recommended to allow for time for the requirements of payment intermediaries. Make sure to have your internationally mandated identity documents on file and in order, or you might encounter a delay when asking for a withdrawal. Client deposits are also safe due to segregation from operating capital in top-tier bank accounts. The Cyprus Investor Compensation Program provides further protection of up to 20,000 euros.

Beginners’ and customer support

Support reps are eager to serve you during all market hours, ‘24×5’, each and every week — live chat, email and direct phone are the access methods. You can also get in touch with TRADE.com Via Whatsapp.

As well as making the website readable in seven different languages, there are also extensive support materials for all levels of trader. Topics vary as to analysis and strategy development — from basic to advanced — while daily market commentary prepares you for each day’s market action.

Trade.com conclusion

TRADE.com has already made its mark on the international scene of global forex brokers with its extensive asset offerings, excellent support, and competitive pricing. Regulatory compliance is also extensive — further evidence that this firm is devoted to gaining your trust and keeping it. The management team is committed to providing a very high level of service, as stated on its website, “our goal is to provide first class education, timely and actionable information on events that are affecting global markets and access to a wide range of trading products, making TRADE.com one of the few one-stop trading sites in the industry”. As a multi-asset brokerage firm, TRADE.com is definitely worthy of your consideration.

Please be advised that certain products and/or multiplier levels may not be available for traders from EEA countries due to legal restrictions.

Safest Forex Brokers 2025

-

-

-

-

-

4.8-

-

-

-

-

4.9-

-

-

-

-

5-

-

-

-

-

4.9-

-

-

-

-

5-

-

-

-

-

5Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox

Stay up to date with the latest Forex scam alerts

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox

Stay up to date with the latest Forex scam alerts