Tickmill continues to grow from strength to strength by offering traders exceptional trading conditions.

The firm’s status as a trusted broker continues to be developed and the Tickmill Group of companies are now regulated by five different and well-regarded authorities, including the FCA, and CySEC. In fact, Tickmill complies with regulations to a degree that is well above market average and is a profitable and viable company.

Rating Overview

| Overall rating | ⭐⭐⭐⭐ |

| Regulation | ⭐⭐⭐⭐⭐ |

| Fees | ⭐⭐⭐⭐ |

| Range of Markets | ⭐⭐⭐⭐⭐ |

| Platforms | ⭐⭐⭐⭐ |

One detail which offers an example of high-grade client protection, and which could be overlooked, is that Negative Balance Protection (NBP) applies on ECN trading. NBP protection means traders can’t lose more than their initial stake and most brokers don’t offer it on ECN trades because they are executed in the heart of the market.

This secure framework acts as a base for some of lowest cost trading in the market with trade execution backed up by some very impressive behind the scenes infrastructure designed to offer the best access to the financial markets.

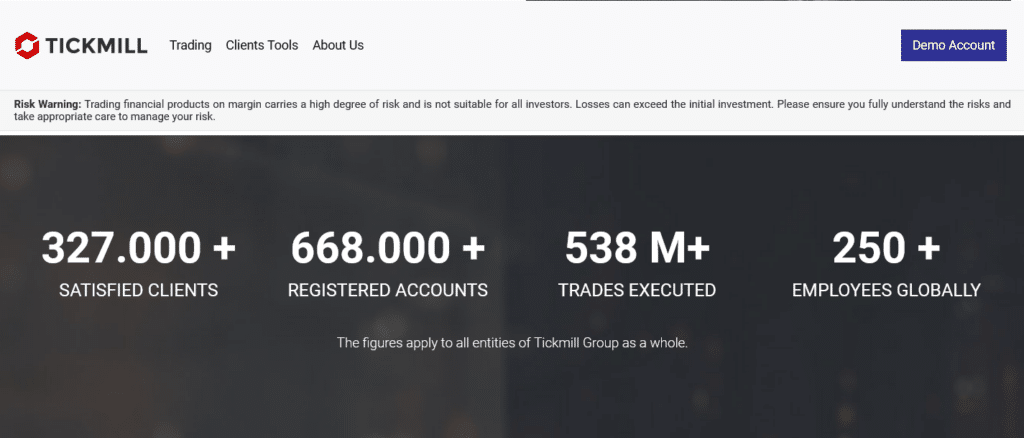

A record number of new clients have taken the decision to sign up to the platform. It now has more than 668,000 registered accounts and depending on their location these clients can take advantage of promotional offer and bonus sign up deals.

There is also the impressive collection of industry awards to consider. In 2023 Tickmill won the #1 Broker for Commissions and Fees’ award at the Annual Forex Broker Review for the third consecutive time and Best Forex Spreads MEA at the Ultimate Fintech Awards MEA 2023. A quick scan of online feedback from the trading community also gives a glimpse of the strength of Tickmill’s fan base. This is backed up by review site Trustpilot recording that 82% of reviews mark Tickmill as ‘Excellent’ or ‘Good’.

The complimentary research and analysis services are a real plus point for Tickmill. Trading tools like Signal Centre, combining AI-driven and human analysis, Ssentiment monitor Acuity and Autochartist can be used to develop and enhance trading ideas. Copy trading is also available for clients of Tickmill Ltd through its latest addition Tickmill Social Trading and the existing Pelican Trading.

Free Demo Account

No Purchase NecessaryThe Tickmill Trading Experience

Tickmill trading platforms are set up to provide reliable, low-cost, super-fast trading, in a wide range of popular markets. Trying out the trading platform using a Tickmill demo account is a risk-free way to find out just how good the trading experience can be..

In terms of dashboard functionality, it’s to Tickmill’s credit that the range of extra Tickmill support services complement, rather than get in the way of the trading experience. Research and learning materials are plentiful and set out in their own area of the site. Webinars in different languages, seminars, video tutorials are available tailored to explaining the basics and preparing clients for trading. Tickmill’s YouTube channel is also a valuable source of trading information with past webinars and videos by its expert analysts freely available. The revamped Tickmill blog with asset-driven navigation provides expert daily analysis, market sentiment and the latest calendar events for Tickmill’s most traded assets. The Bright Minds Podcast features guests from different fields and it presents a new way to look at trading and finance.

Free Demo Account

No Purchase NecessaryBroker Summary

The Tickmill Group of companies includes Tickmill UK Ltd, Tickmill Europe Ltd, and Tickmill Ltd, Tickmill Asia Ltd and Tickmill South Africa (Pty) Ltd.

Tickmill currently operates in more than 200 countries and has more than 668,000 registered clients and more than 250 employees. Reports show that it has executed more than 538m in trades.

There is a focus on quality as well as quantity. With the average trade execution speed at 0.2 seconds, lots of trading tools and a variety of educational materials, the award-winning ECN broker meets most of the requirements of traders, beginners and professionals alike.

Broker Introduction

The best way to find out more and explore the reasons for the firm’s popularity is to try out a risk-free Tickmill demo account.

Once you have completed the brief registration process, you will be able to use your Tickmill sign in at any time. The only requirement is that you supply your email address and phone number, and then you are ready to step into the markets and develop your trading skills.

You can set your balance of virtual funds and leverage terms at a level that suits you. Although you will be ‘paper trading’, you will benefit from all the high-tech mechanisms of the actual Tickmill MT4 or MT5 platform.

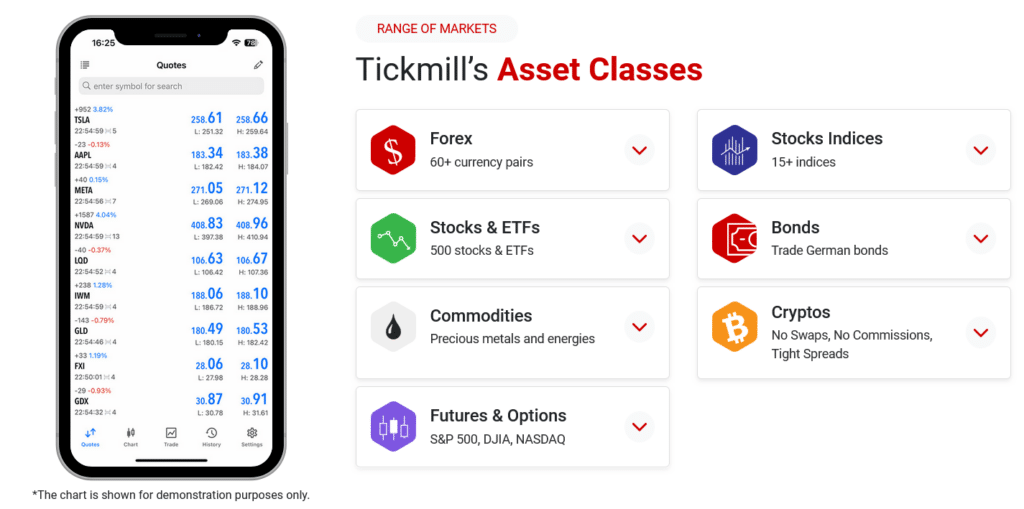

Once set up it’s possible to trade a wide range of CFD asset groups. Markets supported include, forex, stocks and ETFs, stock indices, cryptocurrencies, commodities and bonds depending on the platform.

Tickmill UK Ltd offers Features and Options trading through the CQG platform, TradingView and AgenaTrader. Get direct market access through major globally regulated Futures exchanges including the CME, CBOT, NYMEX, COMEX, EUREX, ICE Futures Europe and the Small Exchange.

Spreads & Leverage

Making a consistent profit from the markets isn’t easy. Part of the recipe for success is setting up with a broker that helps you tilt the balance in your favour. One way to improve your trading bottom line is by selecting a platform that offers low-cost access to the markets.

Tickmill fees are low. Bid-offer spreads start from as low as 0.0 pips, and there are also near-zero commissions. Numbers such as these are just hard to beat, and Tickmill unsurprising scores highly in this category.

If you’re looking to take advantage of such welcoming T&Cs, it’s also possible to apply leverage to your trading. This isn’t for everyone as it comes with additional risks. Tickmill account types score additional bonus points by allowing clients to choose their own leverage terms instead of setting them at predetermined default levels.

In line with standard practice, the maximum Tickmill leverage terms on offer to clients will be determined by the regulatory body of the country in which you live. UK and EU retail clients will find leverage capped at 1:30, which is still a considerable level, while clients of Tickmill Ltd Tickmill entities are able to scale up to 1:500.

Platform & Tools

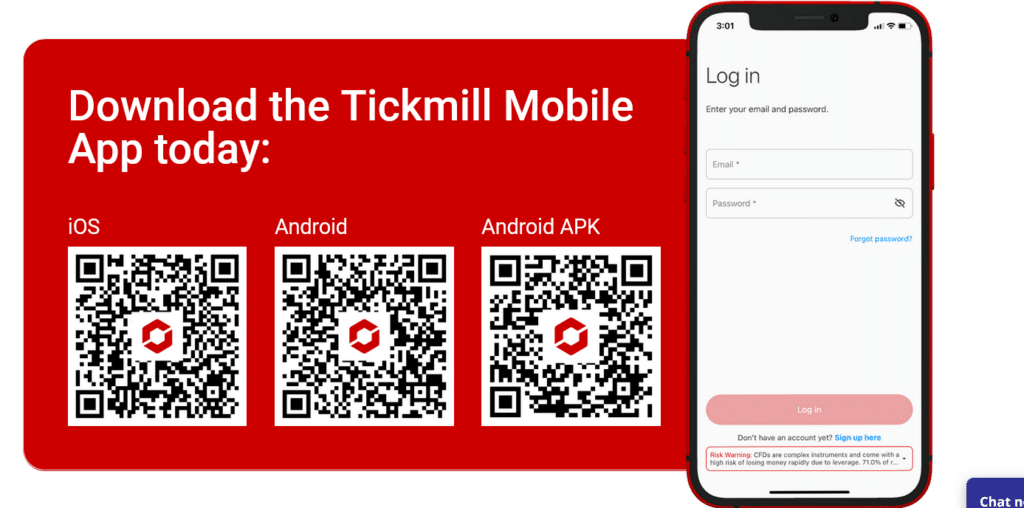

By offering traders the choice of MetaTrader’s MT4 and MT5 platforms Tickmill provides access to the most popular retail forex platforms in the world. MT4 been used by millions of traders for many years and is very much the benchmark by which other platforms are measured. MT5 is the second-generation version of the platform and introduces a range of innovative features and markets.

Both are available in desktop, Web Trader and app format for Android and iOS mobile devices. MetaTrader platforms are the gold standard in online trading. They are fully customisable and provide trading environments packed full of technical indicators, custom scripts and the CopyTrading possibilities associated with Expert Advisors (EAs).

Whichever approach you take, you will have access to analytical tools and trade indicators that are considered to be among the best in the industry. To add a cherry on top of the cake, Tickmill clients also gain access to Signal Centre, Acuity Trading and Autochartist.

Hedging and scalping strategies are allowed, which demonstrates that the platform is based on a high-quality IT infrastructure. The operator also allows the use of all EAs and trading algos – this is the green light for expert users of MT4/MT5, who can take full advantage of the power of the best trading platform in the world.

Despite its relative youth, Tickmill has already picked up a number of prestigious forex awards. Awards won in 2021 include:

- #1 Broker for Commissions and Fees – ForexBrokers.com Annual Forex Broker Review

- Best Partner Program Africa – Finance Magnates Africa Summit 2023

- Best Forex Spreads MEA – Ultimate Fintech Awards MEA 2023

Commissions & Fees

The brokerage offers a free-to-use, risk-free demo account, which gives traders a taste of what’s on offer. When stepping up to trading with real cash there are three varieties of trading account. Each is accessed through the same Tickmill login portal but offer slightly different T&Cs.

- Classic Account – This is the most accessible account. It is an entry-level account aimed at those looking to get into the game cheaply, and without having to pay commissions. The Tickmill minimum deposit for this account is 100 base currency (EUR, USD, GBP, PLN and CHF are all accepted for Tickmill Europe Ltd and Tickmill UK while Tickmill Ltd accepts USD, EUR, GBP and ZAR). . The maximum available leverage for Tickmill Ltd is 1:500, for Tickmill Europe Ltd, maximum leverage for retail clients is 1:30 and 1:300 for professional clients and for Tickmill UK 1:30 for retail clients. Spreads start from 1.6 pips and trade execution is of the NDD variety.

- Pro Account – This is quite an improvement in regard to spreads. While it does feature a commission of 2 per side per lot, its spreads start from 0 pips. The maximum available leverage is 1:500 on this account for Tickmill Ltd and Tickmill UK while for Tickmill Europe Ltd is 1:300.

- VIP Account – The minimum balance for this account is $50,000. Spreads start from 0 pips on this account and the maximum available leverage is 1:500 for Tickmill Ltd, 1:30 (retail) and 1:300 (professionals) for Tickmill Europe Ltd and 1:30 for Tickmill UK. Commissions are ultra-low and start from just 1 per side, per lot.

Scalping is allowed and there are no time limitations for keeping the positions open.

All of the three types of account are available in a swap-free format which is fully Sharia law-compliant. Those who want to set up such an account have to open a regular account, as described above, after which they have to request the conversion of this account into an Islamic one.

Trading conditions offered by the Islamic account are the same as those available through the above-mentioned regular accounts.

There are three base currencies to choose from and negative balance protection rules apply. Deposits can be made through an impressive range of accepted methods, such as Bank Transfer, Crypto Payments, Visa, Mastercard, Skrill, Neteller, SticPay, FasaPay, UnionPay, WebMoney for Tickmill Ltd.

Tickmill Europe Ltd accepts Bank Transfer, Visa, Mastercard, Skrill, Neteller, Dotpay, PayPal and Trustly.

Tickmill UK Ltd accepts Bank Transfer, Visa, Mastercard, Skrill, Neteller, Dotpay, Sofort, and PayPal.

There are no commissions charged on most deposits and withdrawals. One exception is Bank Wire, where charges may be applied to small transactions but can be avoided if you make a deposit larger than US$5,000.

Compare Tickmill Group with other approved brokers

|  |  |  | |

| Regulation | FCA, CySEC, FSCA, Seychelles FSA, Labuan FSA | ASIC, MiFID, FSA, FSCA | FCA (FRN 509909), ASIC, FMA, and FSCA | FCA, CySEC, ASIC, Seychelles FSAS, |

| Customer Support | email, phone, live chat | email, phone, live chat | email, whatsapp, live chat | |

| Trading Platforms | MT4, MT5, WebTrader | MT4, MT5, Mobile App | desktop and mobile via brokers own platform | desktop and mobile via brokers own platform |

| Minimum Deposit | $100 | $100 | 100GBP/AUD/EUR/USD | $50 (varying by Country) |

| Leverage | Tickmill Ltd 1:500, Tickmill Europe 1:30 (retail) & 1:300 (pro), Tickmill UK 1:30 (retail) | 400:1 | 1:30 | From 1:2 to 1:30 |

| Total Markets | 637 | 1260 | 2800+ | 2368 |

| Total Currency Pairs | 62 | 55 | 65 CFD Forex pairs | 49 |

| Total Cryptocurrencies | 9 (* CFD Crypto trading is available only to Professional Clients under Tickmill UK.) | 17 | 19 | 37 |

Education

Tickmill offers a great range of materials to help traders build up their knowledge and therefore trade safely. There are webinars, tutorials, seminars, eBooks, infographics, glossaries, articles and insights.

Webinars and live sessions are hosted in various languages and past sessions are available on its YouTube channel. The Tickmill blog provides asset-driven navigation on Tickmill’s most-traded assets along with expert articles, market sentiment and technical analysis widgets.

Tickmill video resources also cover a wide range of topics from beginner level education to some which are designed to support more experienced traders. The videos are available for free to all clients.

There are also dedicated sections to technical and fundamental analysis. All of this ‘how-to’-style material is backed up by other services, such as Autochartist, which help traders identify actual trading opportunities. Tickmill’s Bright Minds podcast features guests from different fields who offer a new way to look at the world of trading and finance.

Opening an Account

The first page of the registration process at Tickmill includes a neat overview of the process and a summary of the documentation required to complete the process. This is a handy guide that enables new users to get all the required documentation in place and during our test that helped us keep the onboarding time down.

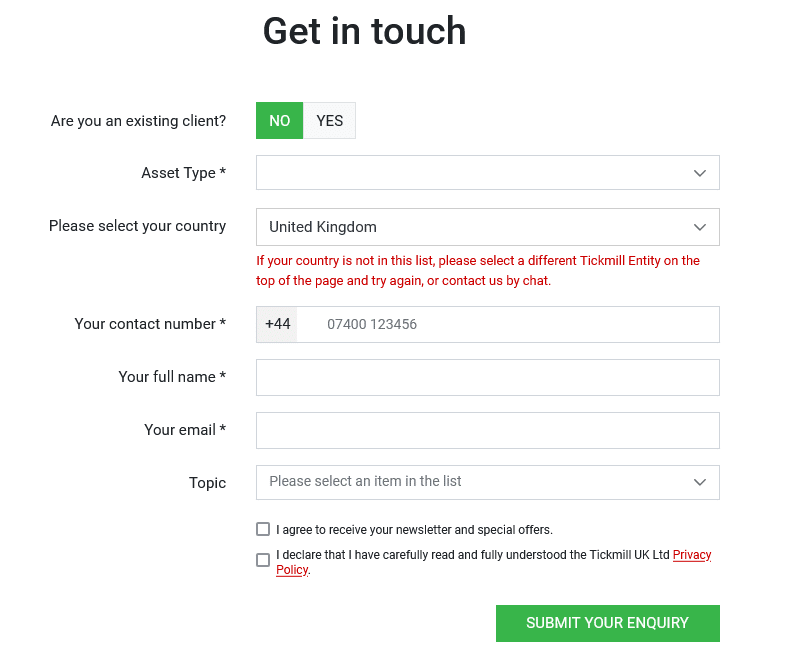

There are also ‘Contact Us’ details clearly laid out so that those opening accounts can contact the team via LiveChat, phone or email if they require additional support.

After entering basic contact details Tickmill gets straight down to guiding new users to the entities they can register with according to their country of residence. Leverage terms vary according to entity.

Online security is a hot topic and to ensure applicants are legitimate a verification email is sent to the prospective user which must be opened and responded to within 48 hours. The minimum password criteria are also advanced in nature with it needing to be a minimum of 12 characters long.

In line with KYC (Know Your Client) protocols Tickmill requires users to share information on investment objectives, trading experience, educational background and source of income. This helps the firm inform clients of the best type of account for their trading style and meets the requirements set out by the broker’s regulator.

The ‘Trading Knowledge And Experience’ section asks relatively advanced questions, such as “Over the past 12 months, how often have you traded Derivatives?”. There aren’t necessarily any right or wrong answers to these questions, they just help the broker build a profile of their clients and implement duty of care protocols. It is though an indication that Tickmill is a good fit for intermediate and advanced level traders.

Personal documents such as a copy of a driving licence and a utility bill then need to be uploaded but having those already on hand meant this part of the process took moments to complete. Then with the final checks completed, and in approximately a total time of 10 minutes, our testers were able to then proceed to the Tickmill trading platform.

We were notified that it could take up to 24 hours for the KYC documents to be verified and not being able to proceed whilst the paperwork was being checked meant we switched to setting up a Demo account to be able to explore the functionality of the Tickmill platform.

Making a Deposit

Whilst the checks are being run it is still possible to make further progress in terms of getting closer to starting trading. Users can enter the Secure Client Area and download the trading platform and check out the funding options. Once accounts have been approved then payments to Tickmill can be made using bank transfer, credit cards and debit cards. The minimum initial balance is $50 or equivalent.

Those who find themselves frustrated by the 1-3 working days taken for accounts to be verified should note that the card payment processing times are faster than those of bank transfers which can take 0-3 working days to complete. If you are planning to use cards to deposit funds, also note the need to upload a scanned image of your credit card before it will be accepted.

Placing a Trade

The platforms provided by Tickmill is the ever-popular MetaTrader MT4 and MT5. As the software is operated by a third-party, downloading it requires agreeing to licence agreements, but this part of the process is relatively straightforward and involves simply reading and clicking on agreements.

Once completed the log-in details for the MT4 platform, which are different from those used to access the Tickmill site itself, are sent via email. This email was sent instantly so there was no delay in getting access to MT4 to try out trading. The MT4 platform can be downloaded in a format suitable for Windows, Mac, Android and iOS devices.

During the time period when the account is being verified it is possible to access the Demo account version of the MT4 platform and carry out some test trades. This allows new users to get familiar with the mechanics of the platform and to try out trading ideas.

Our test trade in GBPUSD took seconds to book. The reliable MT4 trade execution GUI flags up any instances of trade orders being bounced due to market price moving, but during out testing all the virtual trades were executed as planned and the position reported accurately in the Portfolio section of the platform.

Contacting Customer Support

Tickmill customer support can be contacted by phone, LiveChat and email. Our testers found the LiveChat experience to be wholly rewarding. After confirming our account details a genuine member of staff, rather than a bot, immediately started engaging with us on our chosen topic.

In this instance we asked for an update on the current turnaround time for new account documents to be processed and got an answer to our question within minutes. The representative advised that our account had been approved within less than one hour, rather than 1-3 working days, so maybe following this course of action will work for other eager new users as well.

Using the email ‘contact us’ address was similarly straightforward. Tickmill include reference to [email protected] on their main site and our question on where to locate research materials on the site was answered overnight, within 24 hours. Again, completely to our satisfaction. The response shared a link to the best page for us to use and an invitation to follow up with the representative if there was anything else we needed help with.

During testing our team of researchers found the Tickmill customer support team to be easily contactable, efficient and professional. All our questions being answered well within any timelines we would consider appropriate.

Final Thoughts

*Only available to clients of Tickmill Ltd.

Asset prices go up and asset prices go down. No matter how experienced a trader you are, ‘market risk’ is unavoidable. The important thing is that traders exploit those things that they can control, and broker selection is high up on that list.

Choosing a trusted and reliable broker which is well regulated and has been operating for many years is a good first step. Tickmill is firmly in that category, and also offers a lot of other neat and innovative features. Tickmill Ltd even intermittently offers a $30 bonus scheme to help novice traders try trading with real funds, but in small size, and that $30 is provided by the broker.

As the regulatory framework that Tickmill has put in place is well above average, it’s worth concluding this review with confirmation that the behind-the-scenes infrastructure makes it a safe and reliable broker.

The online broker sector is a competitive one and Tickmill stands out for giving traders everything they need, and nothing they don’t.

Broker Details

Tickmill is a multi-asset, multi-regulated broker. The group companies include Tickmill UK Ltd, regulated by the Financial Conduct Authority (FCA) and the Dubai Financial Services Authority as a Representative Office; Tickmill Europe Ltd, regulated by the Cyprus Securities and Exchange Commission (CySEC); Tickmill Ltd, regulated by the Seychelles Financial Services Authority (FSA), Tickmill Asia Ltd, regulated by the Financial Services Authority of Labuan Malaysia and Tickmill South Africa (Pty) Ltd, regulated by the Financial Sector Conduct Authority (FSCA).

Coming under the legislative framework of MiFID II, the broker is authorised to provide services across countries in the European Economic Area (EEA) and beyond. If you are a retail client residing in Europe or the UK, you automatically come under the protection of the Investor Compensation Fund (ICF) or the Financial Services Compensation Scheme (FSCS).

Free Demo Account

No Purchase NecessaryFAQ

How can I open a demo account with Tickmill?

Demo accounts, in desktop and mobile app format, are free to use.

Is Tickmill a regulated broker?

Yes. As Tickmill is a global broker, the regulatory protection that applies to clients will depend on where they live. Regulators that Tickmill is authorised by include the Financial Conduct Authority (FCA), the Cyprus Securities and Exchange Commission (CySEC), the Seychelles Financial Services Authority (FSA) and the Labuan Financial Services Authority (Labuan FSA).

What bonus terms does Tickmill offer?

These change from time to time, but one offer that Tickmill Ltd has is the $30 Welcome Account, where the broker credits your account with $30 and lets you keep any profits.

How do I withdraw money from Tickmill?

To comply with regulations, Tickmill requests clients to return funds to the account that made the initial deposit. The good news is that unlike a lot of other brokers, Tickmill does not apply charges on these transactions.

Please be advised that certain products and/or multiplier levels may not be available for traders from EEA countries due to legal restrictions.

Safest Forex Brokers 2025

-

-

-

-

-

4.8-

-

-

-

-

4.9-

-

-

-

-

5-

-

-

-

-

4.9-

-

-

-

-

5-

-

-

-

-

5Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox

Stay up to date with the latest Forex scam alerts

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox

Stay up to date with the latest Forex scam alerts