Expert Summary

Pepperstone was founded in 2010 and has built a strong market reputation. The platform supports institutional grade traders as well as beginners. That means there is plenty of scope for those new to trading to benefit from the same high-quality infrastructure that the pro’s use.

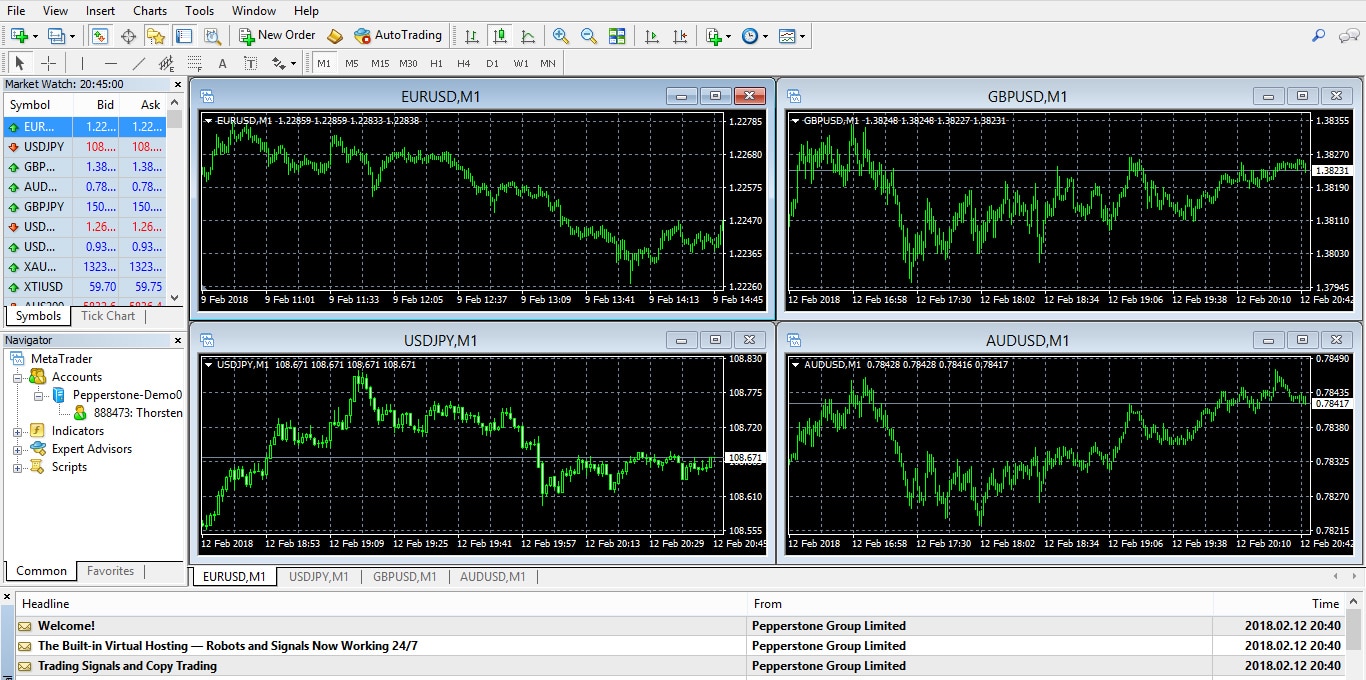

What sets Pepperstone apart from the competition is the range of high-end trading platforms it offers. It’s actually quite difficult to choose between the cTrader, TradingView and MetaTrader MT4 and MT5 trading dashboards. All are best-in-class quality and selection will likely come down to personal preference on aesthetics or functionality.

Rating Overview

| Overall rating | ⭐⭐⭐⭐ |

| Regulation | ⭐⭐⭐⭐⭐ |

| Fees | ⭐⭐⭐⭐ |

| Range of Markets | ⭐⭐⭐⭐⭐ |

| Platforms | ⭐⭐⭐⭐ |

It’s not just the client-facing areas of the site which are first class. The background systems and trading infrastructure use NDD technology to ensure optimal trade execution. Clients can access liquidity pools in a network of 22 banks and the average order execution speed is 30ms. This all helps the bottom line as reliable and fast execution can be the difference between a trade posting a profit or a loss.

There is some reassurance to be gained from the fact that Pepperstone offers 24/5 support. In terms of educational resources, you can find plenty of information on the website, sign-up for webinars or access the live economic calendar.

Pepperstone is also right at the top of the charts regarding the safety of client deposits and maintaining client privacy. You also feel that the firm is on your side because it resists the temptation to charge for cash deposits and withdrawals and there are no trade inactivity fees.

So, it doesn’t matter if you are a beginner or an expert, Pepperstone has something for everyone. First and foremost, it is rated by Forex Fraud as a Trusted Broker. Add to that the cutting-edge trading platforms, high-speed order execution, analytical tools, automated trading, and VPS hosting, and it’s clear to see Pepperstone has it all.

The Demo account available at Pepperstone is a free, no strings opportunity to try out the platform. It’s worth trying it out just to see quite how good it is.

If you decide to go live and trade real funds, it’s worth noting that Pepperstone doesn’t have hidden charges relating to account administration. What you see is what you get.

Free Demo Account

No Purchase NecessaryBroker Introduction

Pepperstone Group Limited is the holding company of Pepperstone, a multi-asset, multi-regulated CFD broker which operates globally and is headquartered in Melbourne.

The broker also operates out of the United Kingdom under the brand name Pepperstone Limited and in the Middle East as Pepperstone Financial Services (DIFC) Limited. The regulators include the Australian Securities and Investment Commission (ASIC), the Financial Conduct Authority (FCA), and the Dubai Financial Services Authority (DFSA) and also CMA, BaFIN, CySEC and SCB licenses.

Clients can access the 150+ CFD instruments. There are more than 70 currency markets to trade. The firm’s reputation as a forex specialist has been built on, and it now offers markets in commodities, cryptocurrencies, indices and shares from three platforms – MT4, MT5, TradingView and cTrader.

Clients can choose to open an Edge Standard or Edge Razor account. There is also an Islamic account which is swap-free and Shariah-compliant.

The minimum required deposit for these accounts is USD 200 or the equivalent. They all permit trading strategies such as scalping, hedging and systematic trading.

The Active Traders account is aimed at institutional investors and big-ticket retail traders. This account also features custom account managers, VPS hosting, advanced reporting and custom trading solutions. The users of such accounts can trade through APIs and third-party trading platforms.

There are 13 equity Index CFD markets; also available are the Precious Metals and Energy sectors. The metals include gold, platinum, palladium and silver with the minimum trade size set to $0.10 per pip. Oil and gas have spreads starting from 1.2, and margin requirements of AUD 0.81-AUD 1 per minimum trade size. No commissions are charged on commodities and leverage on these products can again extend to 1:500 for professional clients and 1:30 for retails clients.

Spreads & Leverage

Pepperstone is a global broker and the T&Cs associated with the different accounts depend on your country of residence. The good news is that Pepperstone’s aims to be one of the lowest-costs brokers in the market.

The minimum spread on the Standard Account starts at 0.6 pips while the Razor Account spread starts from an impossible to beat 0.0 pips. The average spread doesn’t move far from 0.8 (0.75 average at EUR/USD), which shows tight spreads are consistently offered.

According to the site, the attractive spreads are made possible by the Edge technology and accessing deep liquidity pools (as is claimed) does convert to lower-cost trading.

Retail clients residing in the UK and Europe receive max leverage of 1:30, while professional clients and those coming under the other two regulators can trade using lower margins.

You can register with Pepperstone for either of the two account types – Standard or Razor. The former is a low spread account with zero commissions, and the latter comes with a transaction charge of AUD$7 per lot. The minimum deposit for both of the account types is set at AUD$200.

The Crypto markets covered include over 20 crypto CFDs, among which Bitcoin, Ethereum, Dash and Litecoin. All are traded as CFDs and the maximum available leverage is 1:2 (retail client) or 1:10 for pro clients. The volatility and quirks of the crypto markets mean spreads tend to be wider than for other asset groups. The Pepperstone pricing follows the broad trend but is in line with the peer group.

Platform & Tools

Pepperstone is currently a participant in the Equinix Financial exchange, a state-of-the-art network of execution venues and trading servers. It allows the brokerage unfettered access to a wide range of low-latency networks, as well as to some impressive VPS hosting options, that complement MT4s EAs wonderfully.

Pepperstone offers no fewer than 11 trading platforms. Some of them are industry staples, such as desktop MT4, MT5, TradingView and cTrader while several others are in mobile App and web trader format.

The ever-popular MT4 platform comes packed full of charting and analysis tools. MT5 is a second-generation format of MT4, so while being a bit same but different, it does offer clients some extra features.

The cTrader platform offers the same degree of charting tools and optionality to trade algorithmic models. It just has a distinctly different aesthetic.

Commissions & Fees

Pepperstone takes a refreshing approach to fees. Not only are the trading spreads tight, but the firm is also the trader’s friend by not charging any of the following:

- No fees on cash deposits

- No fees on cash withdrawals

- No account administration fees

- No trading inactivity fees

- Free Demo account with no set expiry date

Also on offer are MAM/PAMM accounts. They are designed specifically for money managers, who handle multiple trading accounts and trade block orders through a single, master account. Such accounts support all order types and periodic client report management. EAs are supported by the MAM/PAMM suite as well.

Education

The whole ethos of Pepperstone is based around supporting traders to develop the skills required to be successful. The educational materials on offer cater to entry-level traders and the more experienced.

Their offering ranges from ‘how to trade’ style videos to research notes on different trading strategies. A beneficial resource is the hour-long webinars run by the Pepperstone analysts, where they discuss current market conditions and how to trade them.

Compare Pepperstone with other approved brokers

|  |  |  | |

| Regulation | FCA, CySEC, DFSA, BaFIN, SCB, CMA & ASIC | ASIC, MiFID, FSA, FSCA | FCA, CySEC, FSCA, Seychelles FSA, Labuan FSA | FSPR |

| Customer Support | email, phone, live chat | email, phone, live chat | email, phone, live chat | email, phone, live chat |

| Trading Platforms | MT4, MT5, cTrader, TradingView | MT4, MT5, Mobile App | MT4, MT5, WebTrader | MT4, MT5, WebTrader, Mobile Apps |

| Minimum Deposit | $200 | $100 | $100 | $200 |

| Leverage | 1:30 | 400:1 | Tickmill Ltd 1:500, Tickmill Europe 1:30 (retail) & 1:300 (pro), Tickmill UK 1:30 (retail) | 1:500 |

| Total Markets | 1200 | 1260 | 637 | 182 |

| Total Currency Pairs | 62 | 55 | 62 | 72 |

| Total Cryptocurrencies | 18 | 17 | 9 (* CFD Crypto trading is available only to Professional Clients under Tickmill UK.) | 0 |

Opening an Account

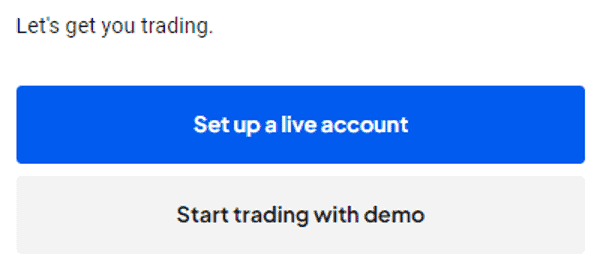

Opening an account at Pepperstone is impressively straightforward. New clients jump straight into the onboarding process by providing basic details such as their email address and phone number. Then, there is an option to either set up a Demo account, which is activated almost immediately, or to go through the process of setting up a live trading account.

This approach results in new users being able to complete the data input part of the process required for a live account in as little as five minutes.

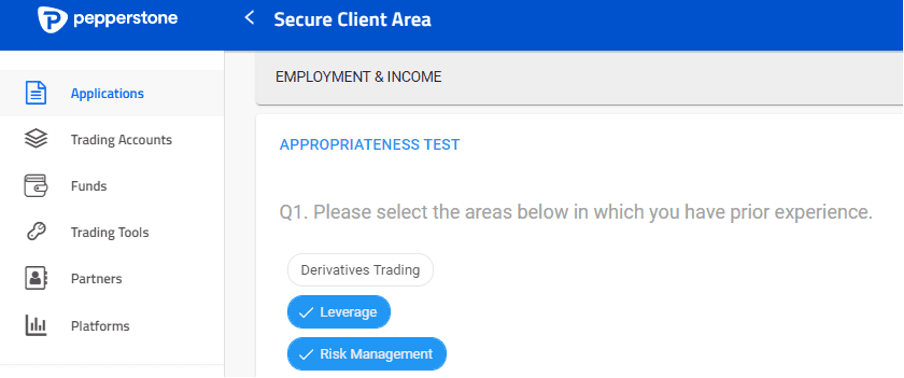

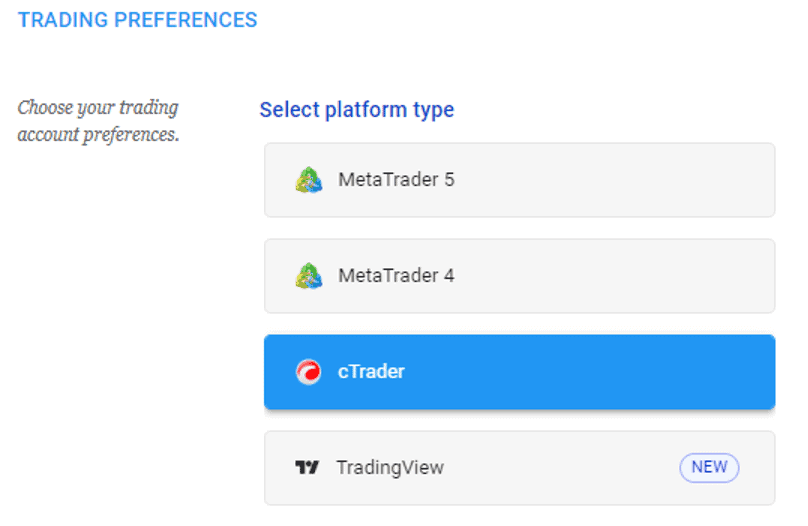

Industry-standard questions on source of funds, trading experience and educational background form the main part of the account opening requirements. New users also select which trading platform type they would like to use, with Pepperstone offering four well-regarded platforms.

There aren’t necessarily any right or wrong answers to the questions asked by the broker. From a user perspective, they act as a good way of re-evaluating investment aims. At the same time, the broker builds a profile of its new client, which helps it comply with its duty-of-care protocols.

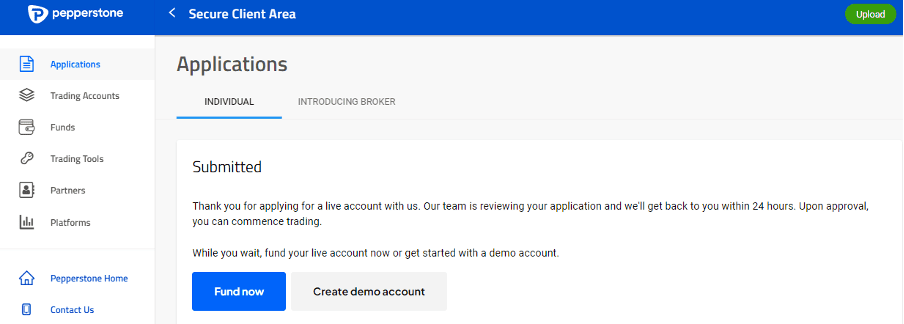

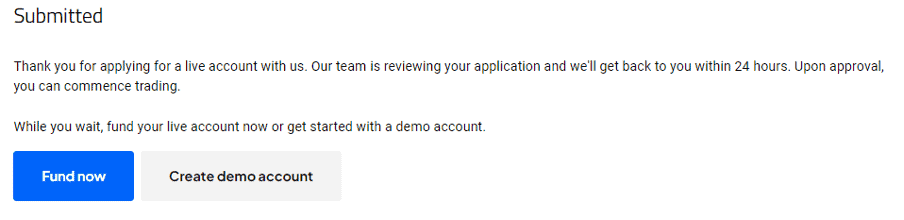

As with other brokers, Pepperstone requires up to 24 hours to verify the account. During this time, clients can practice trading using a Demo account and send funds to the account.

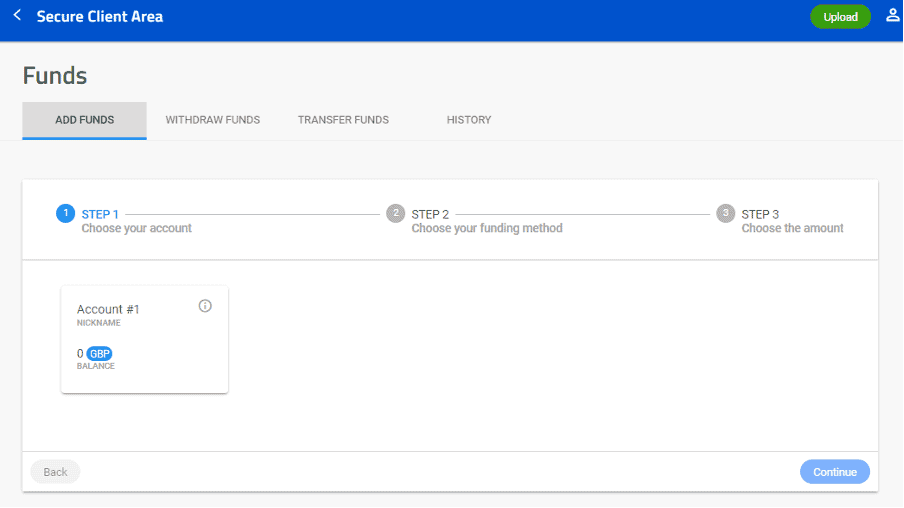

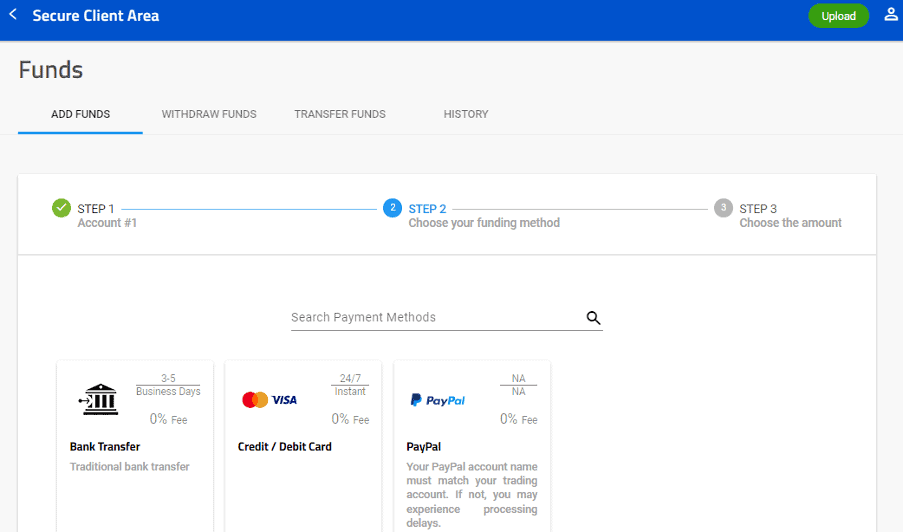

Making a Deposit

Adding funds to a Pepperstone account is broken down into three easy-to-follow steps. The first involves selecting the account type and base currency.

The second step involves deciding which payment agent to use. There are nine to choose from, including Visa, Mastercard, POLi, Bank transfer, BPay, PayPal, Neteller, Skrill and Union Pay. The fastest payment method is credit/debit cards, which are almost instant, whereas bank transfers can take three to five working days.

Pepperstone is one of the most cost-effective brokers in the market. Demonstrating this, the user interface includes a monitor that allows clients to check how much of their deposit will hit their new trading account and how much might be lost to banking fees. Pepperstone doesn’t charge fees on deposits or withdrawals, but some third-party methods do incur costs, so it’s worth checking the small print.

The recommended minimum deposit to trade with Pepperstone is $200 or equivalent. That’s enough for clients to trade in small sizes and get used to trading without their account incurring margin calls. It is, however, possible to deposit less than that amount.

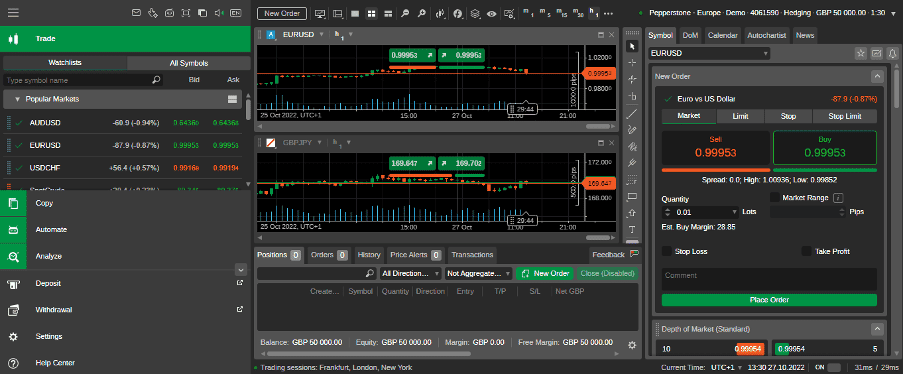

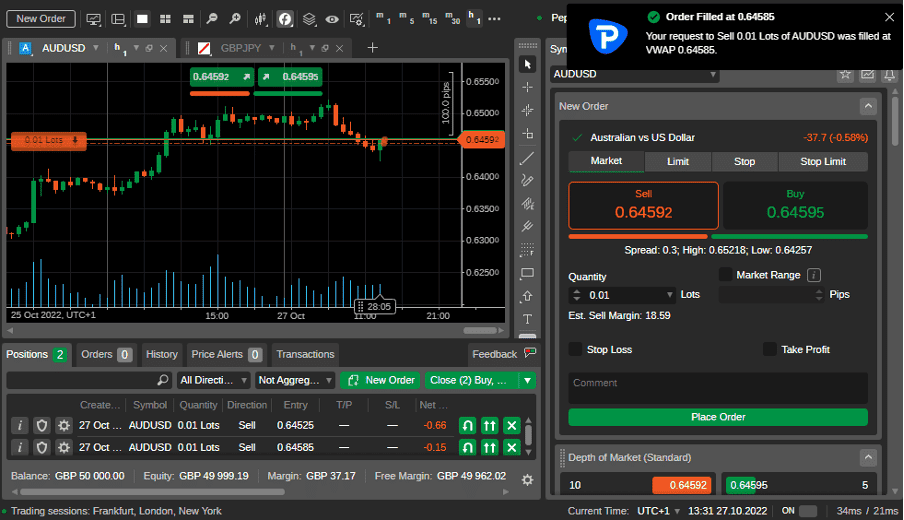

Placing a Trade

With four trading platforms on offer, there is a trading dashboard to suit all sorts of traders, from complete novices to experienced investors. The functionality and research tools that come with each platform vary, but the process of placing a trade follows the same general principles.

During our testing, we opted for the cTrader platform as its easy-to-use aesthetics are ideal for beginners. There is an option to download cTrader or access it using the WebTrader dashboard.

The decision by Pepperstone to offer MT4, MT5, cTrader and TradingView platforms is to be celebrated. As they are all supplied by third-party providers, there is a need for an additional user profile to be set up, but this was done instantly, with the new details being sent to our email address.

Our test trade in AUDUSD took seconds to book. After accessing the market and checking the current market price levels, it was a case of clicking ‘Sell’ and then hitting ‘Place Order’. Quality of trade execution is a big selling point for Pepperstone, so we weren’t surprised to see our orders filled and confirmation provided almost instantly.

Contacting Customer Support

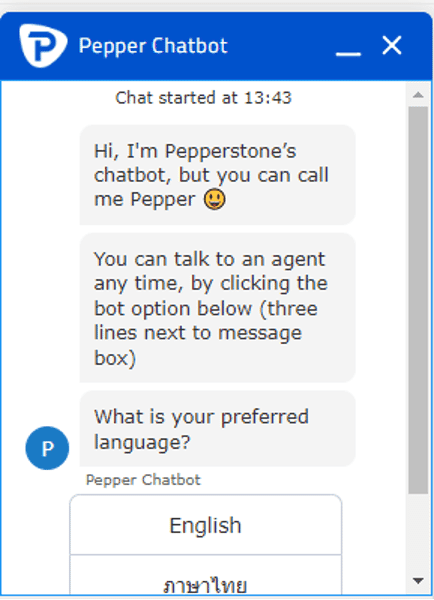

Pepperstone customer support can be contacted 24/7 via phone, live chat and email. The around-the-clock service will be a really attractive option for some, and the inclusion of all three of the main ways of raising issues is another positive for the service.

During our testing, we found the client-facing Pepperstone staff to be informed and helpful. Our testers found the live chat experience to be wholly rewarding. After confirming our account details, a genuine member of staff, rather than a bot, immediately started engaging with us on our chosen topic.

Live chat systems can be as frustrating as they are helpful, so Pepperstone does well to be transparent to users about their first interaction being with a ‘bot’, but highlighting that it’s possible to select to speak with a real agent by simply clicking a button. This fast-tracks problem-solving, and the option to use a variety of languages was also welcomed.

The testing of the phone support desk was made easier by an agent contacting us within 20 minutes of completing the onboarding process. The agent was courteous and professional. They were able to answer three different questions relating to the platform and followed up by emailing their contact details should any further assistance be required.

Final Thoughts

The Pepperstone platform is in places institutional-grade, but this impressive service isn’t just for the professionals. From a beginner’s point of view, the decision to offer a range of high-quality trading platforms means it’s possible to try out different systems to find the best fit. The news and research are also very trade orientated – the ideas shared by the Pepperstone analysts are thought-provoking, plus they outline possible trade entry points.

Client safety is a priority and the decision to gain regulatory licenses from both the FCA, ASIC, CySEC and DFSA marks Pepperstone out as safe to use.

Broker Details

- Pepperstone Australia is licensed by the Australian Securities and Investments Commission (ASIC)

- Pepperstone UK is authorised and regulated by the UK Financial Conduct Authority (FCA)

- Pepperstone EU is authorised and regulated by the Cyprus Securities and Exchange Commission (CySEC)

- Pepperstone AE is authorised and regulated by the Dubai Financial Services (DFSA) Authority

- Pepperstone Markets is authorised and regulated by the Securities Commission of the Bahamas (SCB)

- Pepperstone GmbH is authorised and regulated by the Federal Financial Supervisory Authority of Germany (BaFin)

- Pepperstone Markets Kenya Limited is authorised and licensed by the Capital Markets Authority (CMA)

Not many brokers go to the trouble of obtaining so many licenses; however, by doing so, Pepperstone demonstrates a determination to provide safe trading. The licences require the meeting of strict capital requirements and implementing and complying with stringent internal procedures relating to client money protection, risk management, anti-money laundering, conduct, training, accounting and audits.

Contacts

Melbourne

Level 16, Tower One

727 Collins Street

Melbourne VIC 3008 AUSTRALIA

T: 1300 033 375

London

70 Gracechurch St

London EC3V 0XL

UNITED KINGDOM

Toll Free Number: +44 (800) 0465473

Dubai

Al Fattan Currency House

Tower 2, Level 15 – Office 1502A

DIFC Dubai, United Arab Emirates

T +971 (0) 4 573 4100

Cyprus

Franklin Roosevelt 142, Limassol 3011, CYPRUS

T +35725030573

Germany

Neubrückstrasse 1

40213 Düsseldorf

T +49 (0)211 81999940

Nairobi

The Oval Ring Road Westlands PO Box 2905-00606 Nairobi Kenya

T +254 2038 93547

Nassau

Sea Sky Lane, B201 Sandyport, Nassau, New Providence, The Bahamas

Open Your Pepperstone Account

Five Star Forexfraud BrokerRead all forex broker reviews.

Please be advised that certain products and/or multiplier levels may not be available for traders from EEA countries due to legal restrictions.

Safest Forex Brokers 2025

-

-

-

-

-

4.8-

-

-

-

-

4.9-

-

-

-

-

5-

-

-

-

-

4.9-

-

-

-

-

5-

-

-

-

-

5Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox

Stay up to date with the latest Forex scam alerts

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox

Stay up to date with the latest Forex scam alerts