Featured Forex Broker

This secure framework acts as a base for some of lowest cost trading in the market with trade execution backed up by some very impressive behind the scenes infrastructure designed to offer the best access to the financial markets. Read the full review of Tickmill

NAGA Markets was founded in 2015 as a regulated brokerage and subsidiary of the social investing network NAGA Group, a global fintech enterprise known for its flagship products SWITEX and SwipeStox. NAGA Group trades on the German Stock Exchange in Frankfurt under the ETR:N4G ticker.

Since its inception, NAGA Markets has offered an extensive portfolio of tradable assets in CFD, forex, ETFs, commodities and indices. The company is headquartered in Limassol, Cyprus but its office footprint is wide-reaching with locations in ten countries, including Mexico, South Africa, India and Indonesia. NAGA Markets also operates internationally although its services are unavailable in certain countries such as Belgium, Japan and North America.

The reputable Cyprus Securities and Exchange Commission (CySEC), a financial regulatory agency with operations that comply with European MiFID laws, regulates NAGA Markets. In terms of platforms, NAGA Markets’ pioneering Social Trading offering is complemented by CFD-focused MT4 and the multi-asset MT5 for a comprehensive trading suite.

NAGA Markets also has a particular focus on cryptocurrencies with CFDs on the major decentralised digital currency bitcoin (BTC) and open-source Ethereum (ETH) among others. NAGA Markets offers CFDs on crypto at large scale in a multitude of variations for a flexible and comprehensive trading experience.

Traders can trade crypto pairs and major currencies including GBP and USD and access to more than 15 cryptos including the forementioned Bitcoin as well as Ripple, Litecoin, Dash and Bitcoin Cash. NAGA Market also has a crypto called Naga Coin (NGC), which aims to blur the lines between financial markets and digital money.

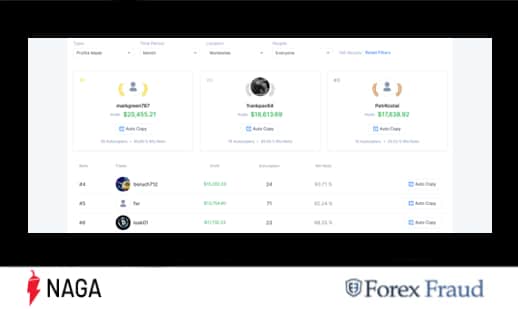

NAGA Markets offers extensive copy trading features with automatic copying enabling users to duplicate the activities of expert traders. Traders can make informed decisions based on statistics including win ratio and total trades. The community-focused initiative means traders who get a transaction copied also receive a copy payment immediately.

NAGA Markets is also one of a select few brokers to provide trades for online game virtual items which makes it a great outlet for traders with interests in traditional transactions and newer forms of mobile gaming.

NAGA Markets has a high rating of 4.7/5 on TrustPilot from more than 300 reviews and a lower 2.434 rating on Fox Peace Army from a smaller 22 sample review size. The vast majority (83%) of reviews on TrustPilot are Excellent with users praising the platform and sleek UI and UX backed up by timely and helpful assistance. Users also enjoy the scale of markets available.

The CySEC seal of approval means NAGA Markets is one of the most reputable brokers in Europe, Asia and Africa. Since being founded in 2015, more than 500,000 accounts have been activated, making it one of the fastest-growing in the world.

Features

Some of the major features of NAGA Markets broker include:

- Founded in 2015

- A subsidiary of renowned NAGA Group

- Offers award-winning social trading platform, NAGA Trader

- Majority of tradable assets are not charged a commission

- Patient and helpful 24/5 customer service by live chat, phone and email

- Excellent educational resources for beginners and experts

- Regulated by Cyprus Securities and Exchange Commission (CySEC)

- ESMA complaint

- Robust licensing, compliance with strict rules

- EU GDPR ensures data protection and privacy

- Supports MT4 and MT5 trading platforms

- Partnership with TradingView

- Extensive social trading and copy trading functionality

- Comprehensive educational tools for beginner and expert traders

- CYBO AI assistant offers 24/7 portfolio management indicators

- 750+ financial instruments available

- Includes 100+ currency pairs

- Extensive cryptocurrency offering with trades in Bitcoin, Ethereum and more

- CFDs on commodities, stocks and indices

- No commission fees on trades

- Offers leverage of 1:200

- Swipestox social trading app available

- Offers negative balance protection

- NAGA Wallets allows for 1200+ tokens to be stored

- Available in over 22 languages

- Fast deposits and withdrawals

- Multiple deposit and withdrawal methods accepted

Spreads and leverage

NAGA Markets costs of trading are at the higher end compared to other brokers with a 1.2 pips spread for the EUR/USD currency pair. However, spreads do vary depending on market conditions and instruments. NAGA Markets offers a maximum leverage of 1:200 and a minimum trade size of 0.01.

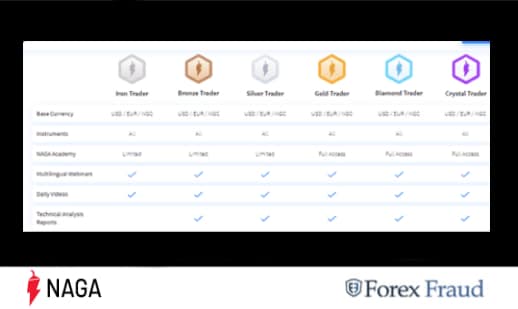

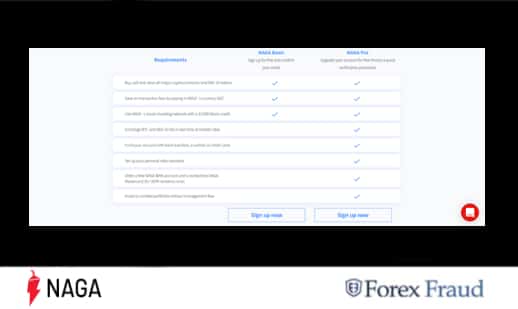

Unlike other brokers who classify the live account, NAGA Markets categorises traders based on set achievement levels starting from a base ‘Iron Trader’ with limited access to NAGA Academy and the absence of technical analysis reports. The top-level ‘Crystal Trader’ offers full access to NAGA Academy in addition to multilingual webinars and daily videos.

Users can become an Iron Trader by registering a live account, getting verification, closing and copying five demo traders and opening a Stocks Account and filling in the profile page. Traders move through the levels, Bronze, Silver, Gold, Diamond and Crystal by completing certain activities. A Crystal Trader, for example, needs to have made 30+ profitable trades and entered a 100,000 euro deposit.

NAGA Markets empowers traders to speculate on price movements on financial markets around the world through an extensive CFD offering. It currently hosts more than 24 indices including British FTSE 100, S&P 500, Japanese Nikkei 225, DAX30, Indian NIFTY 50. There are also a range of CFDs on commodities with users able to trade in Gold, Silver, Crude Oil, Natural Gas and Copper among others. You can also access CFDs on some of the biggest stocks in the world.

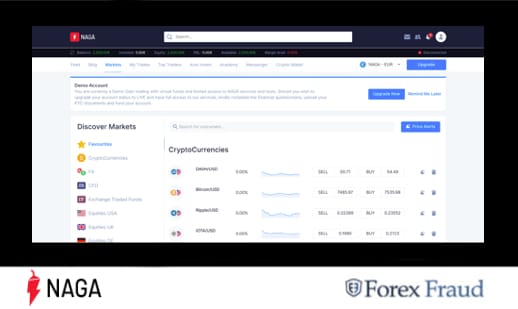

NAGA Markets’ Discover Markets function serves up everything from Exchange Trade Funds, CFDs and FX to Equities in countries such as the Netherlands, Spain, France and the US. There are also Future Index and Commodity Futures available. The 650+ list of stocks on the platform include Google (NASDAQ:GOOGL), Netflix (NASDAQ:NFLX) and Facebook (NASDAQ:FB). NAGA Markets also provides access to 17 ETF CFDs.

Platform

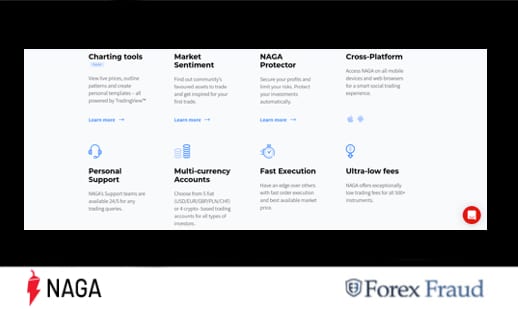

Traders can access in excess of 700 markets across crypto, forex and virtual in-game items via NAGA Markets’ registered social trading platform, NAGA Trader. The platform can be accessed on the web or on mobile via free iOS and Android apps. NAGA Trader has been hailed as a leading trading instrument with various awards including a Best of Show award at the Finovate Europe Event. Since its launch, NAGA Trader has also picked up the Red Herring Europe 2017 Award and Best Social Trading Platform 2017 award.

The simple and intuitive user interface is complemented by an up-to-date news feed and messenger. The comprehensive UX enables users to share analysis and keep tabs on the activity of other traders and their views on markets, as well as publish, share, like and comment on posts. This social trading aspect is enhanced by the ability to trade instruments directly from chat.

Copy trading functionality is extensive. Users can apply filters to be served with tailored recommendations for copy trading and access an automated trading assistant, CYBO. The AI-powered advisor uses complex algorithms to assess markets and identify excellent trading signals. The ‘Auto Invest’ section provides an overview of portfolios based on whether they are Conservative, Moderate or Growth and based over either the short-term, mid-term or long-term.

NAGA Markets supports the MetaTrader 4 platform which has been the market standard for over a decade. The secure, advanced tech and cutting edge features offer traders complete control over important daily tasks such as monitoring developments in the market and executing trades in a simple and intuitive manner. The platform combines excellent performance with unparalleled security thanks to the 128-bit keys encryption.

MT4 is perfect for beginners and expert traders alike as it is easy to get an account set up within minutes while the low memory and CPU footprint ensures smooth operation throughout the working day. MT4 also brings advanced functionality such as coding related MQL4 integrated development and algorithmic trading for a complete, bespoke, highly advanced experience.

Both the MT4 and MT5 trading platforms are available via the web, desktop applications and on mobile. In addition to Windows, NAGA Markets MT4 and MT5 are compatible with Mac and Linux operating systems.

NAGA Markets; partnership with TradingView enhances the offering even further by enabling you to access a number of different charting tools that allow for the tracking of live prices and list patterns as well as the creation of custom templates. Traders can also use platform add-ons including off the shelf EAs which can automate trades and strategies and provide a range of technical analysis indicators.

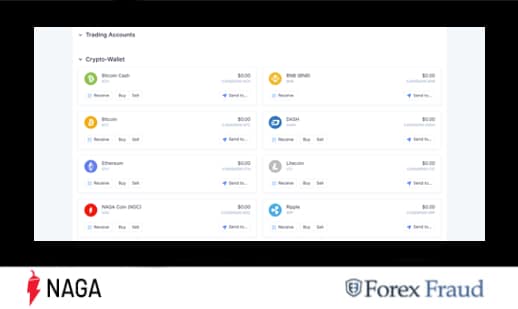

Finally, the NAGA Markets website has a clean, modern UI with ten tabs at the top of the page. These tabs include a ‘Blog’ section with a cycle of the latest news, a personalised ‘Feed’ complete with top wins and real-time trades being made and a ‘Markets’ section allowing users to discover markets and search for instruments. Traders also have easy access to ‘My Trades’, ‘Top Traders’, ‘Auto Invest’, ‘Academy’, ‘Messenger’ and ‘Crypto-Wallet’.

The Crypto-Wallet section allows traders to Buy NAGA Coin or Bitcoin with crypto or EUR/USD instantly via a banner at the top of the page. There is also an overview of trading accounts and a Crypto-Wallet drop-down box with some of the most popular cryptocurrencies. Traders can use receive, buy, sell and send to functions for currencies including DASH (DASH), Litecoin (LTC) and Ripple (XRP). Crypto trading and exchange is comprehensive on this platform.

Deposits and withdrawals

First and foremost, the stringent regulation of the Cyprus Securities and Exchange Commission (CySEC) under license number 204/13 ensures deposits and any money will be safe with them. You can open an account by navigating to the NAGA Markets website via desktop or mobile. You can start a new trading account by making a minimum deposit of $500.

NAGA Markets charges a standard 0.20% and 0.10% commission on CFDs and ETFs CFDs, respectively, but there are not any commission charges for other assets. When making a deposit via MasterCard or Visa, traders will not be charged for sums of $30,000 per month or less. Alternative methods of funding are not charged either when the deposit is anywhere between $1,000 and $5,000.

NAGA Markets accepts 13 payment methods in total. These are VISA, VISA Electron, MasterCard, Maestro, NETELLER, SKRILL, GiroPay, clarinet, EPS, Transfers 24, DONER & REUSCHEL, Eurobank and KB. All of these methods require a minimum deposit of 30 EUR/USB/GBP/PLN depending on the currency selected. There are no charges for any of the 13 methods.

Withdrawals are a quick and easy process on NAGA Markets. The standard charge for withdrawals is 10 EUR/USD for all transactions below the $30,000 threshold and this is across all of the accepted methods. Inactive accounts are also privy to a 50 EUR fee. Traders can withdraw using any of the 13 payment methods listed previously.

Beginners and customer support

NAGA Markets is well suited to first-time traders as it provides a plethora of educational-based materials through its NAGA Trading Academy. Beginners can tap into a range of guides, videos, courses and webinars to get up and running. Novices without trading experience can also complete basic courses and get help from a dedicated account manager.

Beginners are also aided by NAGA Markets’ focus on social and copy trading which allows users to find mentors with just a few clicks. The social trading aspect makes the first foray into trading less daunting as costly mistakes can be avoided. Auto-copying is a central tenet of the NAGA platform as it allows users to replicate the activities of well-know investors and expert traders with just a single click of a button.

Customer support is extensive. NAGA Markets customer service is available through three primary channels; live chat, email and phone. It is available 24 hours a day during the working week (Mon-Fri) and users can expect a reply via phone and live chat within minutes. Emails will be replied to within 24 hours. User reviews on TrustPilot suggest support can reply in less than a minute via live chat.

NAGA Markets has offices across four continents which allows traders in South Africa, Cyprus, Mexico, Peru, India, Indonesia, Vietnam, Thailand and New Zealand to access customer service via a local phone number. Traders located elsewhere can reach NAGA markets using the global support line.

NAGA Markets Trading Conclusion

NAGA Markets is a pioneer in Social Trading. Its intuitive software is built from the ground up for a modern trading experience with gestures, customised settings, filters and copy trading functionality offering a truly customised approach. NAGA Markets offers the industry-standard MT4 alongside its own proprietary social trading, widening its appeal to traders across the globe. The tradable assets in CFDs and crypto mean this broker’s offerings are plentiful compared to others on the market.

NAGA Markets is also a fairly priced broker with its 1.2 pips for the EUR/USD matching the industry average exactly. The low withdrawal fees and absence of commission charges also make this broker an excellent entry point for CFD trading, cryptocurrency trading and exchange and Social and Copy trading.

Customer service is also excellent with several channels available 24 hours a day during the week and when backed up by stringent CySEC regulation and compliance, you can expect a hassle-free and safe experience that will match other industry leaders. The registration process is also simple.

Please be advised that certain products and/or multiplier levels may not be available for traders from EEA countries due to legal restrictions.

Safest Forex Brokers 2025

-

-

-

-

-

4.8-

-

-

-

-

4.9-

-

-

-

-

5-

-

-

-

-

4.9-

-

-

-

-

5-

-

-

-

-

5Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox

Stay up to date with the latest Forex scam alerts

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox

Stay up to date with the latest Forex scam alerts