Free Demo Account

No Purchase NecessaryExpert’s Summary

Although it’s relatively young in the markets, Moneta Markets seems like a good choice for both beginner and expert forex and CFDs traders.

Moneta Markets is a financial services provider that offers 1000+ of the most liquid Currencies, Indices, Commodities, Share CFDs, ETFs and more. Moneta Markets’ stock trading offering is also popular with traders. Most competing CFDs brokers offer about the same number of tradable instruments. Regarding leverage, this broker offers up to 1000:1. Moneta Markets’ CFD offering is higher than that of most leading CFDs brokers.

Rating Overview

| Overall rating | ⭐⭐⭐⭐⭐ |

| Regulation | ⭐⭐⭐⭐⭐ |

| Fees | ⭐⭐⭐⭐ |

| Range of Markets | ⭐⭐⭐⭐⭐ |

| Platforms | ⭐⭐⭐⭐ |

When researching our Moneta Markets brokerage review, we found that it hasn’t disclosed much about its pricing. However, we have established that it is an STP and therefore charges either a spread or a commission. The spreads are floating, starting from as low as 0 pips. Commissions mostly apply to share CFDs and start from as low as 0.1%. Rollover fees also apply to some assets.

Regarding non-trading costs, this broker claims not to charge any deposit and withdrawal fees. However, a fee may apply on the side of the financial institutions facilitating the transaction. From the pricing data that we have managed to gather, Moneta Markets can be considered to be a low-cost broker.

This broker offers a proprietary trading platform equipped with a myriad of features for a seamless CFDs trading experience. It is made with the retail CFDs trader in mind and comes with advanced trading features. A demo test shows that it has superior CFDs trading features than MetaTrader 4 (MT4) and cTrader. These two trading platforms are the most popular in the industry. However, traders can also use MetaTrader 4 and 5 at Moneta Markets.

Moneta Markets offers 24/7 customer services via phone, live chat and email. It takes a few minutes to connect with the agents through phone and live chat. The agents seem friendly and well informed.

Broker Summary

Moneta Markets has been on the market now for more than 5 years, and offers a great range of instruments for retail traders at user-friendly entry points.

Open Your Account Now

Simple Sign Up Process

Traders who use Moneta Markets get access to 1000+ of the most liquid Currencies, Indices, Commodities, Share CFDs, ETFs and more. Moneta Markets offers a proprietary WebTrader and mobile apps for both Android and iOS. The WebTrader is easily customisable and is fully equipped with features that enable a seamless CFDs trading experience.

These include over 45 technical indicators, six different chart types, trend line indicators and a suite of drawing tools. Also available is an AI-powered Market Buzz, live trading signals, and in-depth crowd insights. The platform also offers the Stop Loss and Take Profit features to help traders manage risk.

Moneta Markets offers native trading mobile apps that have all the features of the WebTrader. This means that you can trade while on the go. The apps are available on both Google Play and the App Store. Moneta Markets does not offer a desktop app. When compared to MT4, the Moneta Markets proprietary platform seems superior.

Regarding pricing, this broker is an STP and therefore charges a mark-up on spreads and a commission on some assets. The spreads can be from as low as 0 pips, and there can be a commission of as low as 0.1% on share CFDs. Rollover fees may also apply to some assets. Moneta Markets does not charge any withdrawal and deposit fees, but a fee may apply on the side of the financial institutions handling the transactions.

Moneta Markets has an award-winning customer services department that is available 24/5. You can contact the agents through phone, email and live chat. This broker is not available in the US, Canada, Russia, Lebanon, North Korea, Yemen, Tunisia, and a few other countries.

Broker Introduction

Moneta Markets is a CFD broker founded in 2019. It caters for retail investors and offers 1000+ of the most liquid Currencies, Indices, Commodities, Share CFDs, ETFs and more. Traders will appreciate Moneta Markets’ stock trading offering.

The broker has some of the lowest trading costs in the industry. However, there is little data regarding pricing on its website. This is perhaps because the broker is quite new in the markets. Regarding leverage, the broker offers up to 1000:1.

Moneta Markets offers third-party trading platforms such as MT4 and MT5. It also provides its proprietary trading platforms for web and mobile devices. Traders can access the WebTrader on Moneta Markets’ website for free. The mobile apps are also available for free on Google Play and the App Store. Moneta Markets offers a wide range of trading tools, some from third-party providers.

Its resource centre seems quite comprehensive, with materials ranging from beginners’ to experienced traders’ education. The materials are offered in video tutorials, e-books, blogs and well-structured courses. There is also an easily accessible and highly intuitive demo account for beginner traders to practice before going live with a Moneta Markets brokerage account.

Moneta Markets offers deposit bonuses of up to 50% for deposits worth $500 or more. There is also a feature on the website that allows clients to earn by referring other clients to sign up. This broker is regulated by the Financial Sector Conduct Authority (“FSCA”) of South Africa and segregates clients’ funds through the National Australia Bank.

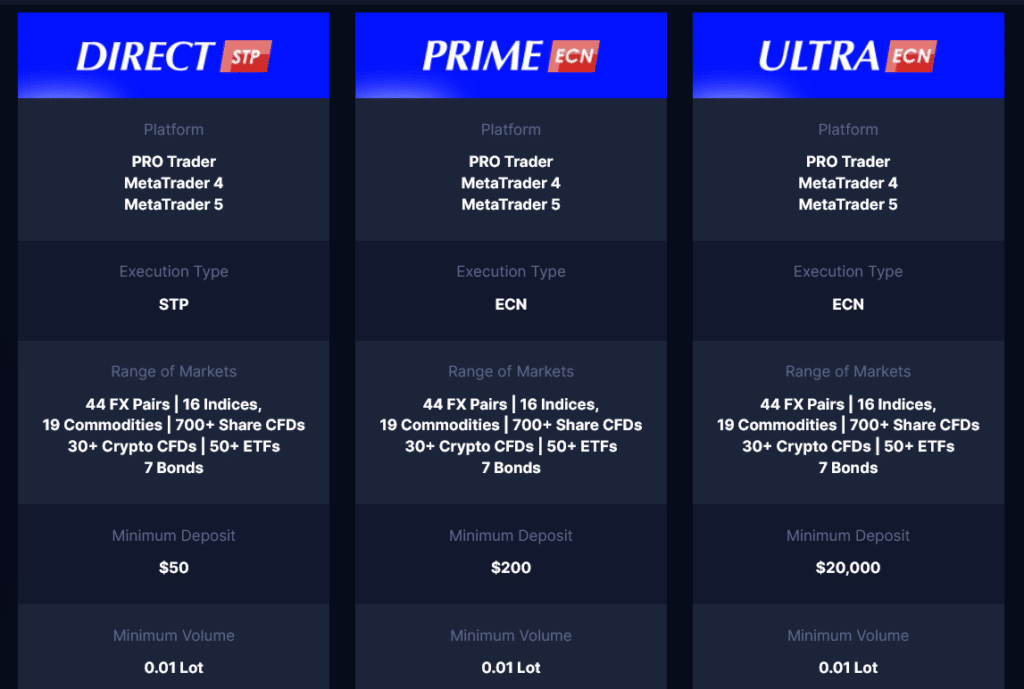

You need a minimum deposit of $50 to trade with Moneta Markets. The broker doesn’t charge any deposit fees. You can contact Moneta Markets through email, phone and live chat 24/5, Monday through Friday.

Spreads & Leverage

Moneta Markets hasn’t published any information about its spreads on its website. However, it claims to be an STP broker and therefore charges a mark-up on spreads and a commission depending on the asset. STP brokers relay orders direct to the liquidity providers for processing and fulfilment.

Consequently, trade execution time is shortened – this reduces slippage/re-quotes and ensures that the trader gets the best pricing.

Excellent Spreads and Leverage

Sign Up Today

A demo test on Moneta Markets shows that it offers floating spreads of as low as 0 pips. Moreover, all instruments apart from share CFDs are commission-free. As illustrated on the demo, share CFDs attract a commission of up to 0.1%.

Moneta Markets’ crypto spreads are similar to what most CFDs brokers offer. For BTC, it is $50. The margin for BTC is 5:1. Other assets are provided at a margin of up to 500:1. Moneta Markets scores average in terms of pricing when compared to other leading CFDs brokers.

Platforms & Tools

When compiling this review of Moneta Markets, we found that it offers a proprietary, fully customisable WebTrader and native mobile apps for both Android and iOS. Moneta Markets’ WebTrader is highly intuitive and easy to use for both beginner and expert traders. In addition, the broker also offers access to the popular Meta Trader 4 and 5 platform.

It comes with a myriad of technical indicators and chart types to help users carry out trading research easily. The platform offers 45+ built-in technical indicators and six different chart types. Also available is a trend line and a suite of drawing tools to help clients effectively conduct technical analysis.

Other features include an order module positioned next to trading charts and a real-time calculator that shows clients their trading volume in both pips and dollar value. Also available are streaming Market Buzz, live trading signals, in-depth crowd insights, and a regularly updated news portal.

Market Buzz is an AI tool that filters through the news to identify those items that are driving the global markets. It filters through the noise to ensure that traders only get quality signals. Moneta Markets’ Trading Calculators, on the other hand, help traders identify key price levels and therefore manage their capital efficiently. Regarding risk management, the Moneta Markets trading platform offers both the Stop Loss and Take Profit features.

The risk management tools allow clients to monitor the amount of capital at risk in pips, price and dollar amount. Consequently, they can try different risk levels and determine what fits their risk appetite. The Moneta Markets WebTrader has an in-built client portal for account opening and easy deposits and withdrawals. The platform is compatible with both mobile and web browsers.

Moneta Markets’ native mobile apps include all the features found in the WebTrader. The apps are compatible with both iOS and Android devices and can be downloaded on Google Play and the App Store.

The platform has more superior technical analysis features than MT4 and cTrader. Moneta Markets recently won the ‘Most Advanced Web-Based CFDs trading Platform’ in CV Magazine’s Corporate Excellence Awards.

Commissions & Fees

The fees and commissions charged by this CFDs broker differ depending on the type of instrument. As mentioned above in this review of Moneta Markets, the broker only charges commissions on share CFDs. Other CFDs are offered on tight floating spreads of as low as 0 pips. The broker hasn’t published the commission criteria on its website.

However, a demo test indicates a commission of 0.1% of the value of the underlying share CFDs. Moreover, this broker charges swap fees depending on the underlying asset. For instance, the swap rate for XAU/AUD as of 23rd July 2020 is at -4.16 for buy positions and -0.19 points for sell positions. Likewise, the swap rate per lot for the buy position on the EUR/AUD pair is -5.19 points, while that of the sell position is 0.15 points.

Moneta Markets claims not to charge any fees on deposits through debit/credit cards, Neteller, PayPal, Skrill, FasaPay, JCB and bitcoin. International bank wire transfers may attract a fee on the side of the banks facilitating the transactions. As mentioned earlier, Moneta Markets works with the National Australia Bank.

This broker hasn’t disclosed if it charges any withdrawal fees. We engaged Moneta Markets’ customer service agents, and they confirmed that most withdrawal methods are free. However, there may be a fee for withdrawals through Skrill. We rate Moneta Markets average in terms of trading commissions and fees.

Create Your Account Now

Free Withdrawals on Most Transactions

Education

This review of Moneta Markets found that the trading education section is comprehensive and easy to navigate through. The educational materials range from beginner to expert-level traders. Some of the materials are available before registration, but most are only available to traders who have made a deposit.

Beginner and expert-level trading courses, video tutorials, e-books, blogs and a regularly updated news portal are available. The structured courses cater for both beginners and advanced traders. Traders must deposit at least $500 to access the broker’s ‘Market Masters’ video course, which features 100+ advanced trading tutorials.

The video tutorials that are available to unregistered users provide lessons on how to make the most out of the Moneta Markets WebTrader. They are easy to understand for complete beginners. The blog offers an in-depth analysis of market events and trading tips to help traders to capitalise on them. There is also an in-depth and well-arranged FAQs page.

Before they sign up for a Moneta Markets brokerage account, traders can practice their skills through the highly intuitive demo account. This platform back tests on historical market data and therefore simulates a real market experience. Moreover, it comes with nearly all of the features found in the live platform and therefore fully prepares the user for live trading. Traders can access the demo account on the WebTrader and also on the Android and iOS mobile apps.

Moneta Markets has also launched a live TV channel that offers daily financial news. Traders can access it on the broker’s website or YouTube channel.

Compare Moneta Markets with other approved brokers

|  |  |  | |

| Regulation | FSCA | ASIC, MiFID, FSA, FSCA | FCA, CySEC, FSCA, Seychelles FSA, Labuan FSA | FSPR |

| Customer Support | email, phone, live chat | email, phone, live chat | email, phone, live chat | email, phone, live chat |

| Trading Platforms | MT4, MT5, ProTrader, AppTrader, CopyTrader | MT4, MT5, Mobile App | MT4, MT5, WebTrader | MT4, MT5, WebTrader, Mobile Apps |

| Minimum Deposit | $50 | $100 | $100 | $200 |

| Leverage | 1000:1 | 400:1 | Tickmill Ltd 1:500, Tickmill Europe 1:30 (retail) & 1:300 (pro), Tickmill UK 1:30 (retail) | 1:500 |

| Total Markets | 1000+ | 1260 | 637 | 182 |

| Total Currency Pairs | 45+ | 55 | 62 | 72 |

| Total Cryptocurrencies | 17 | 9 (* CFD Crypto trading is available only to Professional Clients under Tickmill UK.) | 0 |

Opening an Account

The homepage of Moneta Markets offers those looking to open an account a clear breakdown of the basic T&Cs. It is also the starting point for those looking to sign up for Standard, Demo or Pro Trader accounts.

The onboarding process for a live account is one of the most straightforward in the market, and the claim that it takes less than five minutes to complete was found to be correct during our testing. Those looking to set up a Demo account need to click on that option from the homepage, and they can complete that process in a matter of seconds.

New live account clients are required to disclose their country of domicile and provide basic details such as their email address and phone number. The ‘More About You’ section includes an industry-standard range of questions designed to enable the broker to establish a user profile.

Topics covered include employment status, source of funds, annual income, and trading knowledge and experience. The next step involves selecting which of the MetaTrader platforms you want to use, MT4 or MT5, and whether you want an ECN or STP account.

There is a handy guide in the right-hand sidebar that keeps new clients up to date with how their application is progressing, and once ID documentation has been uploaded, there is a short delay while the broker attends to verification protocols.

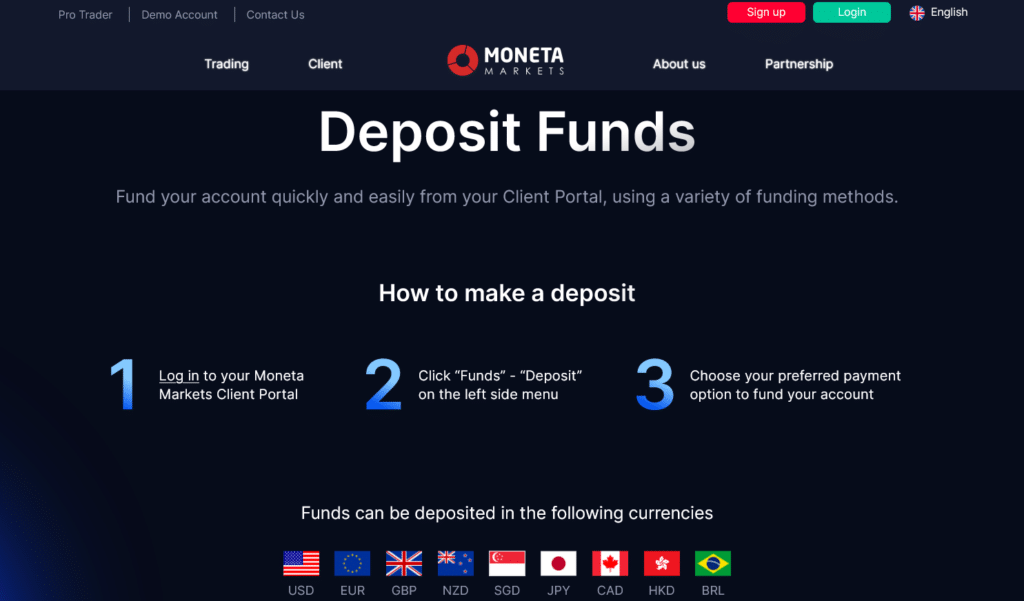

Making a Deposit

The ways of adding funds to a Moneta Markets account are fast and cost-effective. Credit/debit card and Fasapay transfers are instant and commission free. The ability to use cryptocurrencies to fund accounts is a standout feature of Moneta Markets’ offering, but clients should note that transfers using coins take up to one hour to process.

The range of base currencies to choose from is greater than at most other brokers, which helps minimise any costs associated with currency conversions. Some of the base currencies such as Hong Kong and Canadian dollars, and Brazilian real, aren’t offered by many other high-profile brokers.

The recommended minimum deposit to trade with Moneta Markets is $50 or equivalent. The standard advice given to beginners is to start off trading in a small size, and the way that Moneta Markets facilitates that with such a low minimum deposit level represents a great first step into trading.

An additional security feature of the Moneta Markets funding process is that all funds deposited into a trading account must be under the same name as the account holder. Third-party payments aren’t permitted, which also means that funds can only be returned to the source from which they originally came.

Placing a Trade

The platforms provided by Moneta Markets are the ever-popular MetaTrader 4 and MetaTrader 5 trading dashboards. As this software is provided under licence by a third party, a separate agreement needs to be completed. The first step involves selecting which of the two platforms you want to use and reading and clicking on Terms of Service agreements.

After registering, you’ll be sent the login details to the MetaTrader platform, which will be different from those used to access the Moneta Markets site. During our testing, these were sent immediately, and we were able to access the MetaTrader trading platform and book trades within a matter of seconds.

Given the need for Moneta Markets staff to verify and approve new applications for live accounts, it’s good news that those onboarding can access a Demo account during that time delay. The functionality and market data price feeds are identical, which means that it is an ideal way to get more familiar with the mechanics of how the platform works and to try out trading strategies.

The intuitive functionality of the MetaTrader platforms meant that it took a matter of seconds for us to book our test trades in EURUSD and USDJPY. The reliable MT4 trade execution is followed by our new positions being immediately reported in the portfolio section of the platform.

Contacting Customer Support

Moneta Markets customer support can be contacted 24/5 via phone, live chat and email. The around-the-clock service means that traders can have issues resolved immediately, and in our testing we found the Moneta Markets staff to be informed and helpful.

The Trustpilot score of 4.4 out of 5.0 points towards the customer experience at Moneta Markets being positive, and our telephone testing found this to be the case. Queries pitched at beginner, intermediate and advanced levels were all dealt with professionally, with every query being resolved during the first call.

Email queries on subjects that required more analysis were resolved within 24 hours – again to our complete satisfaction.

Customer Service

When writing this review of Moneta Markets, we discovered that it recently won the ‘Best Customer Support Award’ in the CFD broker category by CV Magazine’s Corporate Excellence Awards. The broker provides 24/5 multilingual customer service.

Traders can reach the agents through email, phone and live chat. Calls and live chats get a response within minutes, while emails may take up to 12 hours. The services are available in English, French, German, Portuguese, Chinese, Spanish, Indonesian, Italian, Arabic, Malaysian, Vietnamese, Thai, Japanese and Korean.

Excellent Customer Service

Great Help and Support

The customer support agents are friendly and quite well-informed. They also seem to have all the necessary tools in place to ensure that clients get help in one place. Moneta Markets is headquartered in the Cayman Islands.

The broker has made disclosures on its physical offices and is therefore traceable in case of serious disputes. Traders in the UK can contact the broker on +44 113 320 4819, while international traders can contact it through +61 2 8330 1233.

The broker can also be reached at [email protected], though this is not recommended for urgent enquiries.

Final Thoughts

This broker seems like a good choice for both beginner and experienced CFDs traders. It offers a highly supportive trading environment, and its WebTrader is more equipped than popular options such as MT4. Moneta Markets offers a highly intuitive WebTrader and mobile apps for both iOS and Android. The apps are available on Google Play and the App Store and are free to download.

This broker is relatively new in the market, and therefore there is scant information regarding its pricing. However, we have carried out a demo test and established that it adopts the STP trading model. Consequently, it charges either a commission or a floating spread depending on the asset.

The spreads are floating, starting from as low as 0 pips, while the commissions only apply to share CFDs and start from 0.1%. Moneta Markets has a proprietary trading platform that comes in WebTrader and mobile versions. The platform is highly customisable and is equipped with tools for technical and fundamental analysis.

Our Moneta Markets brokerage review found that you need as little as $50 to get started with this broker. Deposits can be made through wire transfer, debit/credit cards, most e-wallets, and bitcoin. Moneta Markets has an award-winning customer service department that is reachable 24/5. The agents are reachable via email, phone and live chat.

Contact Details

Phone: +44 (113) 3204819

Email: [email protected]

FAQs

How do I open a demo account with Moneta Markets?

Visit Moneta Markets’ website and click the registration tab. Select the demo account to register a practice account. You can also register for demo trading through its mobile apps.

Is Moneta Markets a regulated broker?

Yes! Moneta Markets is regulated by the Financial Sector Conduct Authority (“FSCA”) of South Africa. Its parent company is monitored by Tier-1 regulators the FCA and ASIC.

What are the deposit options for Moneta Markets?

Moneta Markets accepts deposits through Wire Transfer, Mastercard, Visa, UnionPay, Skrill, PayPal, Neteller, FasaPay and bitcoin. The minimum you can deposit is $50.

How do I withdraw money from Moneta Markets?

Moneta Markets allows seamless withdrawals. Simply fill in a request form and wait for up to 24 hours for your funds to be processed. You can only withdraw through the method you used to deposit.

Moneta Markets PTY LTD soliciting Business from UAE through a Non-Exclusive Introducing Broker Agreement Regulated by SCA , Sterling Financial Services LLC ,Cat 5 ,No 305029.

Moneta Markets is a trading name of Moneta Markets South Africa (Pty) Ltd, an authorised Financial Service Provider (“FSP”) registered and regulated by the Financial Sector Conduct Authority (“FSCA”) of South Africa under license number 47490 and located at 1 Hood Avenue, Rosebank, Johannesburg, Gauteng 2196, South Africa.

Moneta Markets is a trading name of Moneta Markets Ltd, registered under Saint Lucia Registry of International Business Companies with registration number 2023-00068.

Please be advised that certain products and/or multiplier levels may not be available for traders from EEA countries due to legal restrictions.

Safest Forex Brokers 2025

-

-

-

-

-

4.8-

-

-

-

-

4.9-

-

-

-

-

5-

-

-

-

-

4.9-

-

-

-

-

5-

-

-

-

-

5Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox

Stay up to date with the latest Forex scam alerts

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox

Stay up to date with the latest Forex scam alerts